- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Is Constellation Energy's Maryland Clean Energy Bet Shifting the Investment Case for CEG?

Reviewed by Sasha Jovanovic

- Constellation Energy recently announced a comprehensive proposal to invest in up to 5,800 megawatts of new power generation and battery storage projects in Maryland, with nearly 70% targeting clean, emissions-free energy resources.

- This initiative aims to address surging power demand, particularly from data centers and technology companies, and positions Maryland to raise its clean energy share from just over half to around 70% once projects are operational.

- We will examine how Constellation Energy’s planned multibillion-dollar clean energy investment could reshape its growth outlook and risk profile.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Constellation Energy Investment Narrative Recap

To be a shareholder in Constellation Energy, you need to believe in the accelerating demand for carbon-free, reliable energy to power data centers and technology infrastructure, underpinned by supportive policy for nuclear and renewables. While the company’s announcement of a multibillion-dollar clean energy initiative signals commitment to future growth, this does not materially change the near-term risk that project delays or infrastructure bottlenecks could push back revenue from new capacity additions.

Among recent company announcements, the proposal to double output at the Calvert Cliffs nuclear site by adding up to 2,000 megawatts directly ties into the biggest catalyst: rising demand from large corporate customers seeking long-duration, clean energy contracts. This increases the company’s ability to capture premium contract opportunities and build higher-margin recurring revenues, but also amplifies execution risks linked to regulatory review and capital requirements.

But even as growth bets increase, investors should pay close attention to...

Read the full narrative on Constellation Energy (it's free!)

Constellation Energy's narrative projects $26.7 billion in revenue and $3.6 billion in earnings by 2028. This requires 2.5% yearly revenue growth and a $0.6 billion earnings increase from the current $3.0 billion.

Uncover how Constellation Energy's forecasts yield a $404.07 fair value, a 13% upside to its current price.

Exploring Other Perspectives

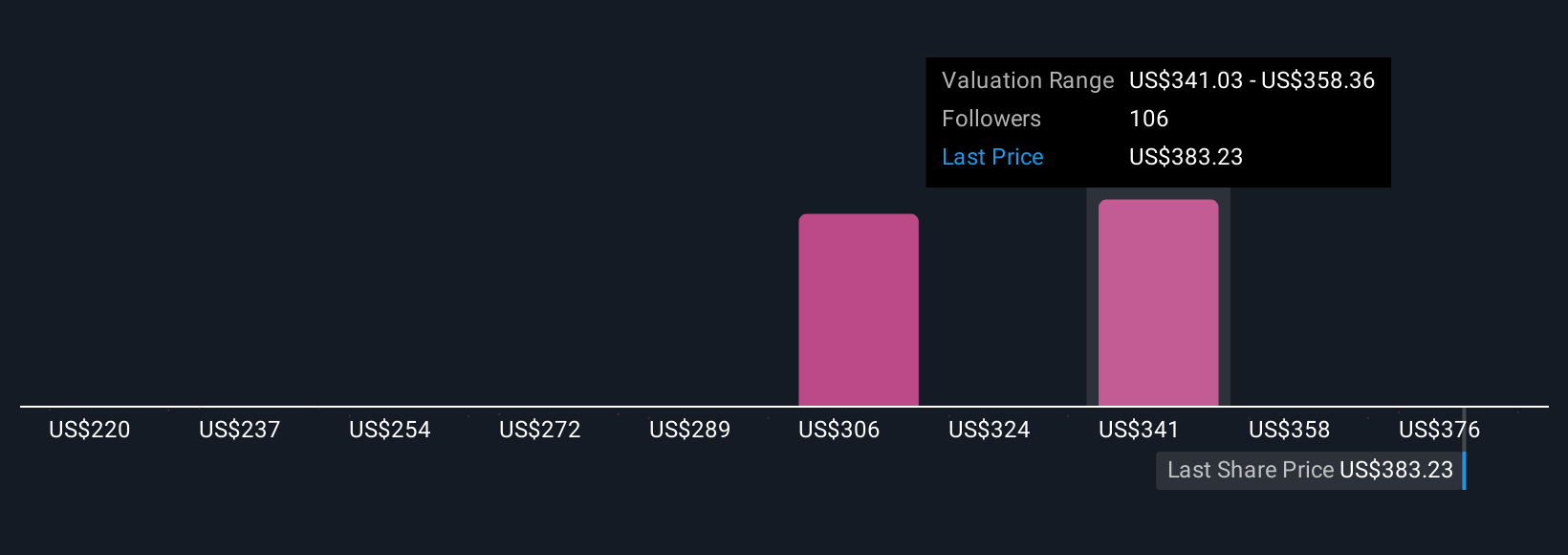

Fair value estimates from 14 members of the Simply Wall St Community for Constellation Energy span from US$225 to nearly US$494 per share. With the company planning substantial long-term investments in nuclear and storage, these wide-ranging views show just how much opinions can differ on future profit potential and timing of new projects.

Explore 14 other fair value estimates on Constellation Energy - why the stock might be worth 37% less than the current price!

Build Your Own Constellation Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellation Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Constellation Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellation Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives