- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Constellation Energy (CEG): Assessing Valuation After Mixed Q3 Earnings and Raised Infrastructure Spending

Reviewed by Simply Wall St

Constellation Energy (CEG) grabbed investor attention after releasing third-quarter earnings that missed profit expectations but delivered better-than-anticipated revenue. Higher costs from grid upgrades and maintenance led management to trim its full-year adjusted earnings outlook.

See our latest analysis for Constellation Energy.

After a brisk rally earlier this year, Constellation Energy’s momentum has cooled in recent weeks as mixed third-quarter results and news of major infrastructure investments gave investors pause. Even so, the company’s share price has delivered a robust 47.7% return year-to-date, and its three-year total shareholder return stands out at 290.7%. This reflects powerful long-run growth, despite some recent volatility as the market digests near-term profit headwinds and the coming Calpine merger.

If you’re watching how the utilities landscape is evolving, now’s a good moment to see what’s happening among other fast-growing, high-insider-ownership stocks. Discover fast growing stocks with high insider ownership

With shares already up nearly 48% this year and profits under pressure from higher investment and costs, investors must consider whether Constellation Energy remains undervalued or if the market has priced in all future upside.

Most Popular Narrative: 11.3% Undervalued

With Constellation Energy's narrative fair value estimated at $404, which is above its last close price of $358.39, the latest analysis suggests investors see more upside grounded in improving fundamentals and future opportunities.

Long-term, higher-margin contracts driven by demand for carbon-free power and new energy solutions are improving revenue growth and diversifying earnings. Federal support and strategic investments in nuclear energy are enhancing cash flow stability, capacity, and overall financial strength.

What’s really powering this valuation? It’s not just industry buzz; the financial forecast is built on a bold mix of robust top-line growth, margin expansion, and ambitious earnings targets. Curious which key numbers and blockbuster trends have analysts raising the fair value? Explore the narrative for the inside story.

Result: Fair Value of $404 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory challenges or delays in securing major new contracts could still undermine Constellation Energy's positive long-term outlook.

Find out about the key risks to this Constellation Energy narrative.

Another View: Price Ratios Paint a Different Picture

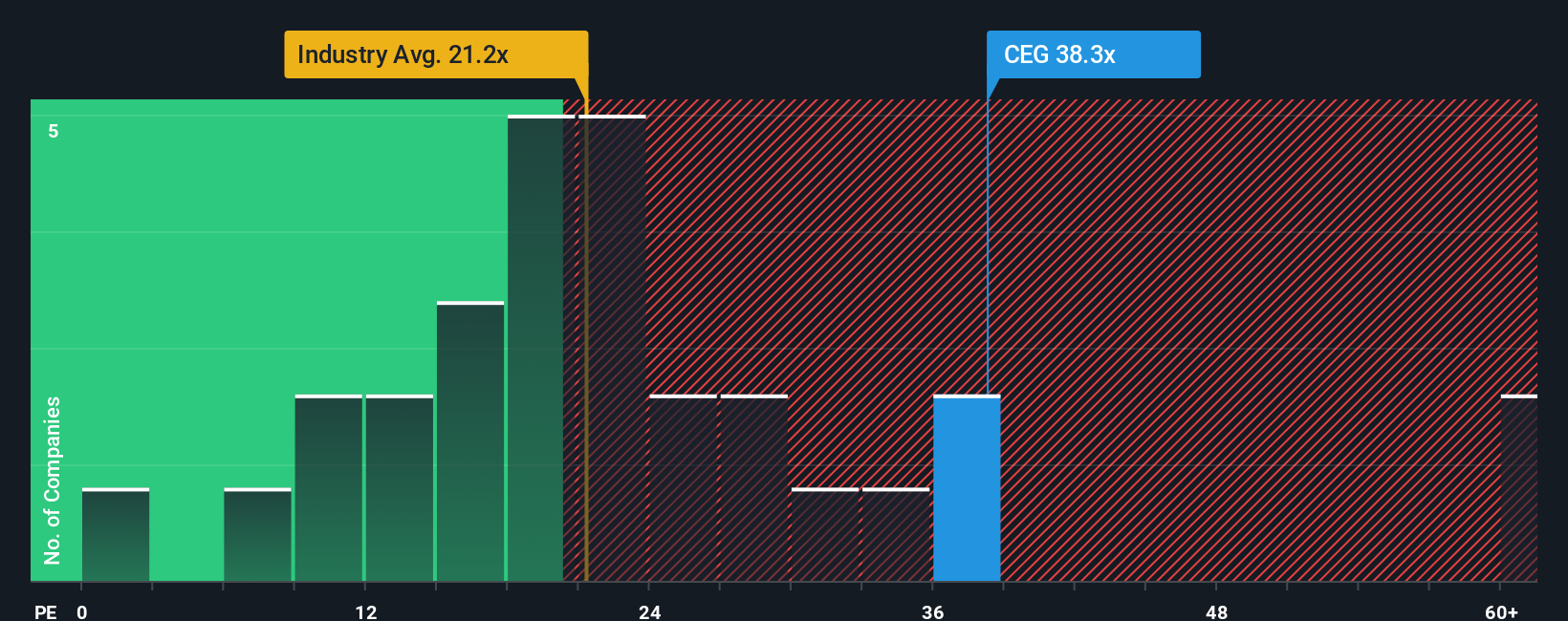

While the fair value narrative and discounted cash flow analysis show upside, looking at Constellation Energy’s price-to-earnings ratio tells a different story. At 40.9x earnings, the stock is much pricier than both the US electric utility industry average of 20.5x and its peer group at 21.7x. Even compared to its own fair ratio of 39.6x, Constellation trades at a premium. This suggests investors are paying up for future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Constellation Energy Narrative

If you think there’s more to the story or want to dig into the facts yourself, crafting your own perspective takes just a few minutes, so why not Do it your way.

A great starting point for your Constellation Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize your next opportunity and outpace the crowd. These screening tools can help you pinpoint untapped value, high-yield potential, and tomorrow’s leaders now.

- Strengthen your portfolio strategy by targeting reliable income with these 16 dividend stocks with yields > 3% for companies offering strong yields above 3%.

- Fuel your growth potential by zeroing in on these 25 AI penny stocks making waves in artificial intelligence innovation and disruption.

- Catch tomorrow’s bargains before they become headlines. Scan these 877 undervalued stocks based on cash flows to uncover stocks trading below their true worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives