- United States

- /

- Water Utilities

- /

- NasdaqGS:ARTN.A

Artesian Resources (ARTNA) Margin Improvement Reinforces Bullish Sentiment Despite Slower Growth Forecast

Reviewed by Simply Wall St

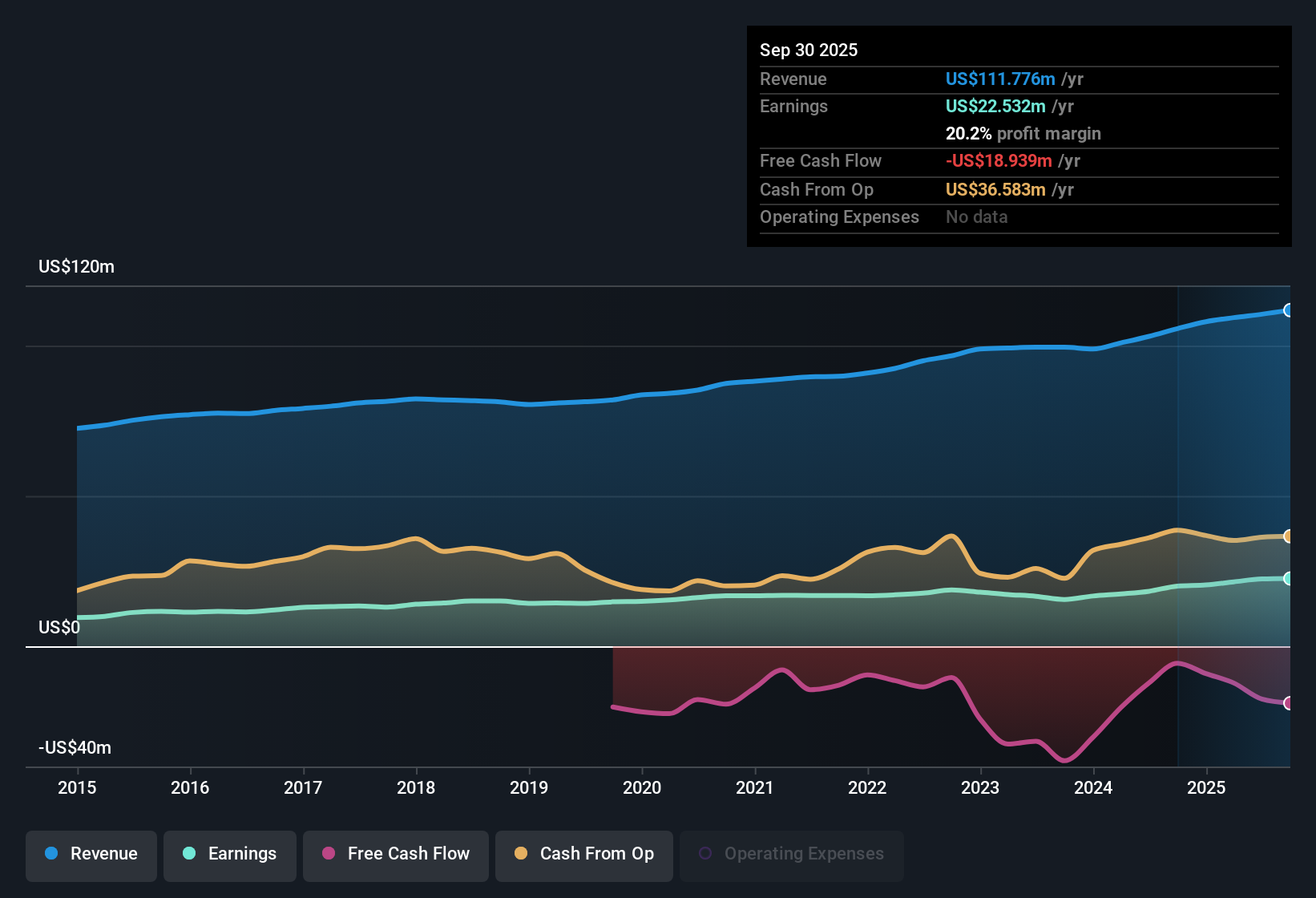

Artesian Resources (ARTNA) delivered a net profit margin of 20.2%, up from 19% last year, and posted 12.5% earnings growth over the past year, which is more than double its five-year annualized average of 5.3%. With a price-to-earnings ratio of 14.7x, well below both peer and global industry averages, and a share price of $32.23 trading just under an estimated fair value of $33.27, the valuation looks appealing. While recent results highlight stable profit growth and margin improvement, forecasts of slower annual revenue growth at 3.9% versus the broader US market rate may influence expectations for future expansion.

See our full analysis for Artesian Resources.Now it’s time to see how these headline numbers stack up against the key narratives shaping investor sentiment. The next section compares results with what the market and community believe about Artesian Resources.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Five-Year Trend

- Artesian Resources posted a net profit margin of 20.2%, significantly above its five-year annualized earnings growth of 5.3% and last year’s 19% margin.

- The improved margin strongly supports the bullish case that the company’s stable profit profile sets it apart from peers.

- Current margin strength highlights quality earnings even as the broader sector faces margin pressure.

- Bulls argue this profitability trend makes Artesian an attractive play for investors seeking resilience and predictability.

Revenue Growth Lags Broader US Market

- Projected annual revenue growth is 3.9%, far slower than the 10.4% annual rate for the broader US market.

- This revenue outlook creates tension with the bullish narrative, since lower growth may limit future upside even as margins and profit quality remain solid.

- The company’s stable sector profile means revenue expansion is more constrained compared to higher-growth industries.

- Optimistic investors might overlook that long-term compounding could be capped unless growth accelerates.

Discount Valuation Versus Peers and Industry

- The price-to-earnings ratio of 14.7x is well below the peer average of 30.9x and the global water utilities industry average of 16.7x, with a current share price of $32.23 just under the DCF fair value of $33.27.

- Despite stable profits and quality earnings, the market is not awarding Artesian a sector-leading multiple, indicating that investors may need stronger growth signals to drive a re-rating.

- The share price’s close alignment with fair value makes the stock a clear value play rather than a momentum story.

- This situation will appeal most to value-focused investors who prioritize margin and profit consistency over aggressive top-line expansion.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Artesian Resources's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Artesian Resources’ slower revenue growth compared to the broader US market could limit potential upside, even as margins and profits remain stable.

If you’re seeking stronger expansion, use stable growth stocks screener (2090 results) to focus on companies delivering reliable growth and performance, especially when momentum is crucial for your strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARTN.A

Artesian Resources

Provides water, wastewater, and other services in Delaware, Maryland, and Pennsylvania.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success