- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

American Electric Power (AEP): Assessing Valuation After Earnings Beat and Ambitious $72 Billion Growth Plan

Reviewed by Simply Wall St

American Electric Power Company (AEP) delivered a strong third quarter, topping revenue forecasts and capturing market attention with a newly expanded $72 billion capital spending plan. The company also raised its long-term earnings growth outlook.

See our latest analysis for American Electric Power Company.

Riding the momentum from its ambitious capital plan and rising demand from data centers, American Electric Power's share price showed notable strength, up 5.44% over the past month and boasting a 30.8% year-to-date share price return. Factoring in dividends, the total shareholder return sits at an impressive 28.2% for the past year and nearly 59% for five years, highlighting steady long-term outperformance as confidence builds around growth and consistent payouts.

If AEP’s surge has you thinking more broadly about market leaders, now’s the perfect time to expand your search and discover fast growing stocks with high insider ownership

With AEP’s growth outlook and expanded capital spending now in the spotlight, the key question is whether shares still offer value at these levels or if the market is already factoring in the company’s ambitious new targets.

Most Popular Narrative: 10% Undervalued

American Electric Power Company's most popular narrative sees fair value at $120.41 per share, sitting just above the recent close. This sets an optimistic mood for growth, driven by ambitious expansion and regulatory momentum.

Analysts have raised price targets for American Electric, citing an ambitious multi-year capital expenditure plan of approximately $70 billion, supported by significant contracted load and supportive tariff mechanisms.

Want to know the secret sauce behind this high valuation? The narrative’s math leans on dramatic expansion plans, aggressive earnings targets, and market-beating revenue growth. Curious about the bold numbers baked into the future? Unlock the details hidden in the narrative’s full breakdown.

Result: Fair Value of $120.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including potential regulatory setbacks and ongoing supply chain challenges. Both of these factors could disrupt AEP's ambitious growth trajectory.

Find out about the key risks to this American Electric Power Company narrative.

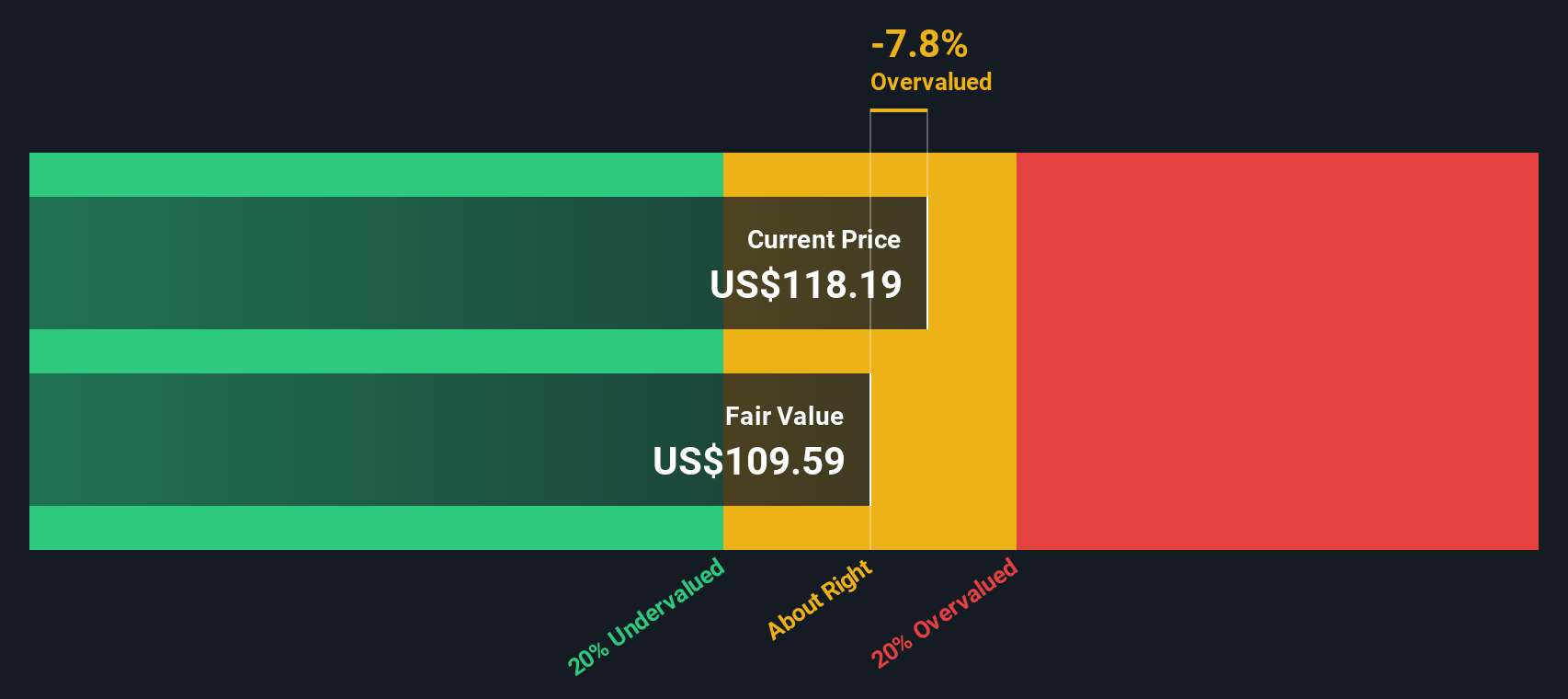

Another View: DCF Model Perspective

Looking through the lens of our SWS DCF model, American Electric Power Company’s current share price of $120.26 is trading above our estimated fair value of $109.95. This method presents a more cautious stance and suggests the market price may already reflect most of the growth story. Which view will prove closer to reality—optimism or restraint?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Electric Power Company Narrative

If you’d rather crunch the numbers yourself or want to bring a fresh perspective, you can craft your own narrative in just minutes. This approach allows you to shape your outlook around the facts that matter most to you. Do it your way

A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Set yourself apart from the crowd and uncover opportunities you won’t want to miss with these targeted, data-driven screeners designed for today’s smart investor.

- Tap into tomorrow’s AI giants by browsing these 26 AI penny stocks, which are positioned to power everything from automation to analytics and beyond.

- Boost your income stream as you evaluate companies known for reliable, high-yield payouts through these 22 dividend stocks with yields > 3%.

- Catch the next wave of market standouts that may be trading below their true value with the help of these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives