- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 28% in that time.

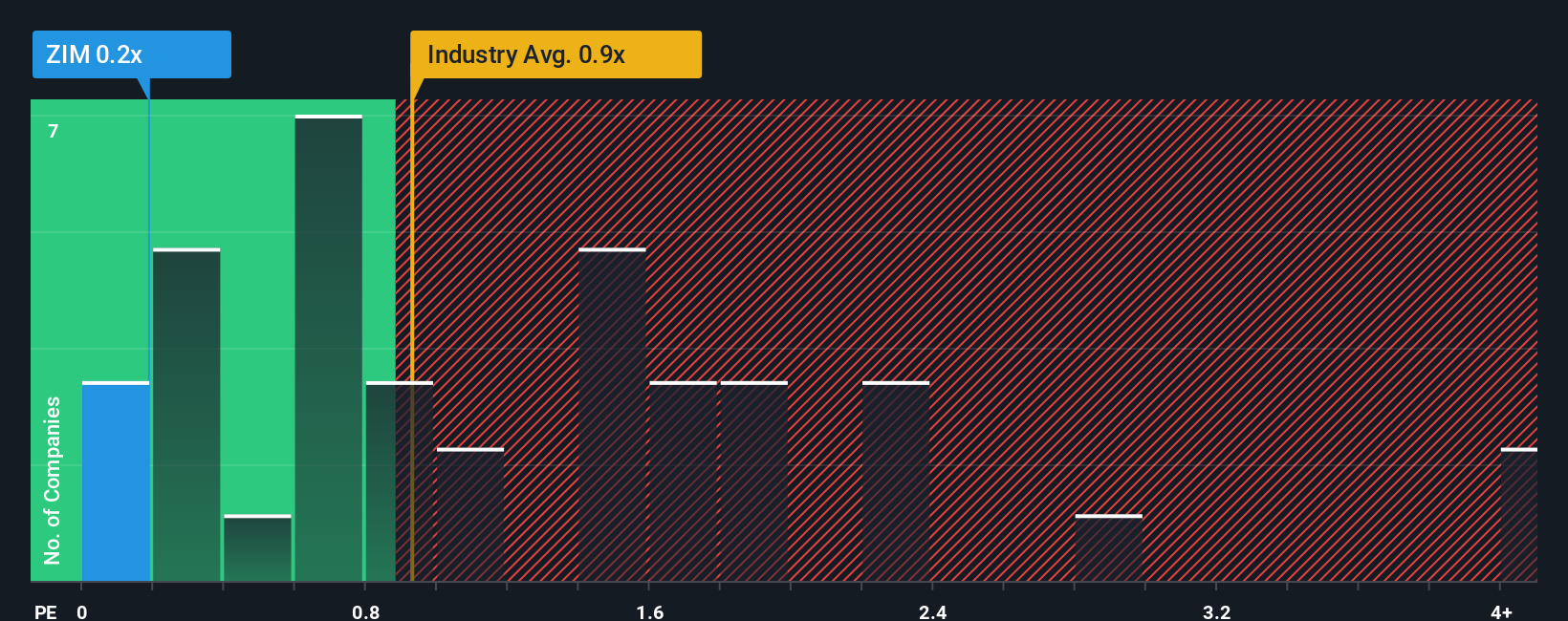

After such a large drop in price, given about half the companies operating in the United States' Shipping industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider ZIM Integrated Shipping Services as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for ZIM Integrated Shipping Services

What Does ZIM Integrated Shipping Services' P/S Mean For Shareholders?

ZIM Integrated Shipping Services certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ZIM Integrated Shipping Services.Is There Any Revenue Growth Forecasted For ZIM Integrated Shipping Services?

There's an inherent assumption that a company should underperform the industry for P/S ratios like ZIM Integrated Shipping Services' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 44% last year. Still, revenue has fallen 38% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company are not good at all, suggesting revenue should decline by 25% over the next year. The industry is also set to see revenue decline 7.3% but the stock is shaping up to perform materially worse.

In light of this, it's understandable that ZIM Integrated Shipping Services' P/S sits below the majority of other companies. However, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

The Key Takeaway

ZIM Integrated Shipping Services' recently weak share price has pulled its P/S back below other Shipping companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that ZIM Integrated Shipping Services' P/S is about what we expect, seeing as the P/S and revenue growth forecasts are lower than that of an already struggling industry. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. However, we're still cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for ZIM Integrated Shipping Services (1 is a bit unpleasant!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives