- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

How Earnings Forecasts and Revenue Outlook May Reshape the Investment Case for ZIM (ZIM)

Reviewed by Sasha Jovanovic

- ZIM Integrated Shipping Services recently saw its shares fall behind the broader market, as investors focused on the company's upcoming November 20, 2025, earnings report and the outlook for a significant decrease in earnings and revenue from the previous year.

- While analysts have modestly raised consensus EPS estimates, ZIM's forward P/E ratio remains well below industry norms and the broad analyst view remains cautious, reflecting concerns over the company's near-term earnings power.

- With earnings expectations weighing on sentiment, we'll assess how forecasts for a significant earnings and revenue decline reshape ZIM's investment rationale.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

ZIM Integrated Shipping Services Investment Narrative Recap

For investors considering ZIM Integrated Shipping Services, the central thesis rests on the company's ability to navigate shipping market cycles and leverage its investments in fleet efficiency and trade diversification to offset cyclical downturns. The recent share price drop following downbeat earnings forecasts does little to alter the most immediate catalyst, which continues to be the November 20, 2025, earnings report and the clarity it may offer on future cash flow and margin pressures; near-term, the greatest risk is further earnings and revenue contraction amid challenging freight market conditions.

Among ZIM's recent announcements, the Q2 2025 dividend declaration stands out, with the company distributing just 30% of net income amid falling profits and a shrinking payout. This move underscores management's response to profit volatility, and signals that future returns for shareholders may be shaped as much by disciplined capital allocation as by any sector-wide improvements, especially with the upcoming earnings release poised to influence sentiment around the stock's resilience.

However, the most important detail investors should know is that despite ZIM's focus on operational flexibility, fleet renewal, and trade network expansion, the effect of industry-wide overcapacity on freight rates and margins could prove more enduring than many expect...

Read the full narrative on ZIM Integrated Shipping Services (it's free!)

ZIM Integrated Shipping Services is projected to have $4.9 billion in revenue and $61.6 million in earnings by 2028. This reflects an anticipated annual revenue decline of 16.8% and a decrease in earnings of $1.94 billion from current earnings of $2.0 billion.

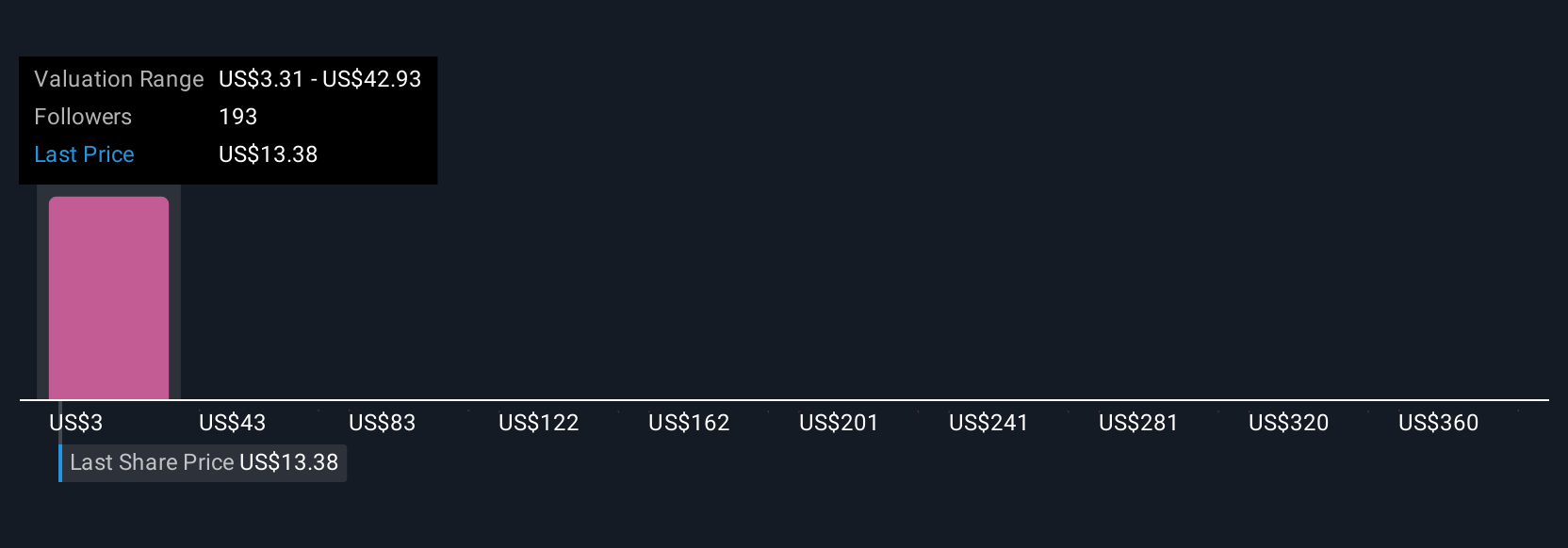

Uncover how ZIM Integrated Shipping Services' forecasts yield a $13.26 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span US$3.24 to US$452.35 across 33 submissions. With industry overcapacity weighing heavily on freight rates, consider the full range of opinions before making your own assessment.

Explore 33 other fair value estimates on ZIM Integrated Shipping Services - why the stock might be worth less than half the current price!

Build Your Own ZIM Integrated Shipping Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ZIM Integrated Shipping Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ZIM Integrated Shipping Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ZIM Integrated Shipping Services' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives