- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

Further Upside For ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) Shares Could Introduce Price Risks After 31% Bounce

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 76% in the last year.

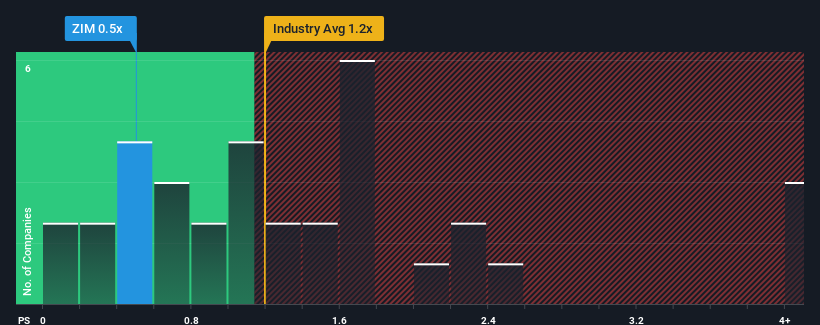

Even after such a large jump in price, considering around half the companies operating in the United States' Shipping industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider ZIM Integrated Shipping Services as an solid investment opportunity with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for ZIM Integrated Shipping Services

What Does ZIM Integrated Shipping Services' P/S Mean For Shareholders?

ZIM Integrated Shipping Services hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on ZIM Integrated Shipping Services will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, ZIM Integrated Shipping Services would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 48% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 8.9% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 23% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 1.4%, which is noticeably less attractive.

With this in consideration, we find it intriguing that ZIM Integrated Shipping Services' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From ZIM Integrated Shipping Services' P/S?

ZIM Integrated Shipping Services' stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at ZIM Integrated Shipping Services' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for ZIM Integrated Shipping Services that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives