- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

Even With A 25% Surge, Cautious Investors Are Not Rewarding ZIM Integrated Shipping Services Ltd.'s (NYSE:ZIM) Performance Completely

Despite an already strong run, ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) shares have been powering on, with a gain of 25% in the last thirty days. The last month tops off a massive increase of 235% in the last year.

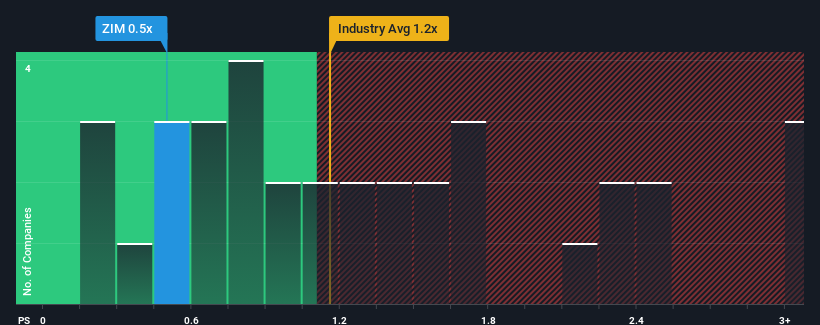

In spite of the firm bounce in price, when close to half the companies operating in the United States' Shipping industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider ZIM Integrated Shipping Services as an enticing stock to check out with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for ZIM Integrated Shipping Services

What Does ZIM Integrated Shipping Services' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, ZIM Integrated Shipping Services' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ZIM Integrated Shipping Services.Is There Any Revenue Growth Forecasted For ZIM Integrated Shipping Services?

The only time you'd be truly comfortable seeing a P/S as low as ZIM Integrated Shipping Services' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 8.1% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 15% as estimated by the five analysts watching the company. Meanwhile, the broader industry is forecast to contract by 0.5%, which would indicate the company is doing very well.

With this in mind, we find it intriguing that ZIM Integrated Shipping Services' P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

ZIM Integrated Shipping Services' stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that ZIM Integrated Shipping Services currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 2 warning signs for ZIM Integrated Shipping Services that you should be aware of.

If you're unsure about the strength of ZIM Integrated Shipping Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026