- United States

- /

- Logistics

- /

- NYSE:UPS

Is There an Opportunity in UPS After Recent 11% Share Price Rebound?

Reviewed by Bailey Pemberton

- Ever wondered if United Parcel Service is truly a bargain, or if there is hidden value waiting to be discovered? Let’s dig into what might be driving interest in the stock right now.

- After a quick 11.2% rebound over the last month, shares are still down sharply for the year, losing 22.5% year-to-date and 23.0% over the past 12 months. This suggests shifting perceptions around growth and risk.

- Recent headlines highlight industry disruptions, including delivery network changes across the sector and renewed discussions about the future of express shipping. These developments have been stirring up conversations among investors about what the next chapter holds for UPS.

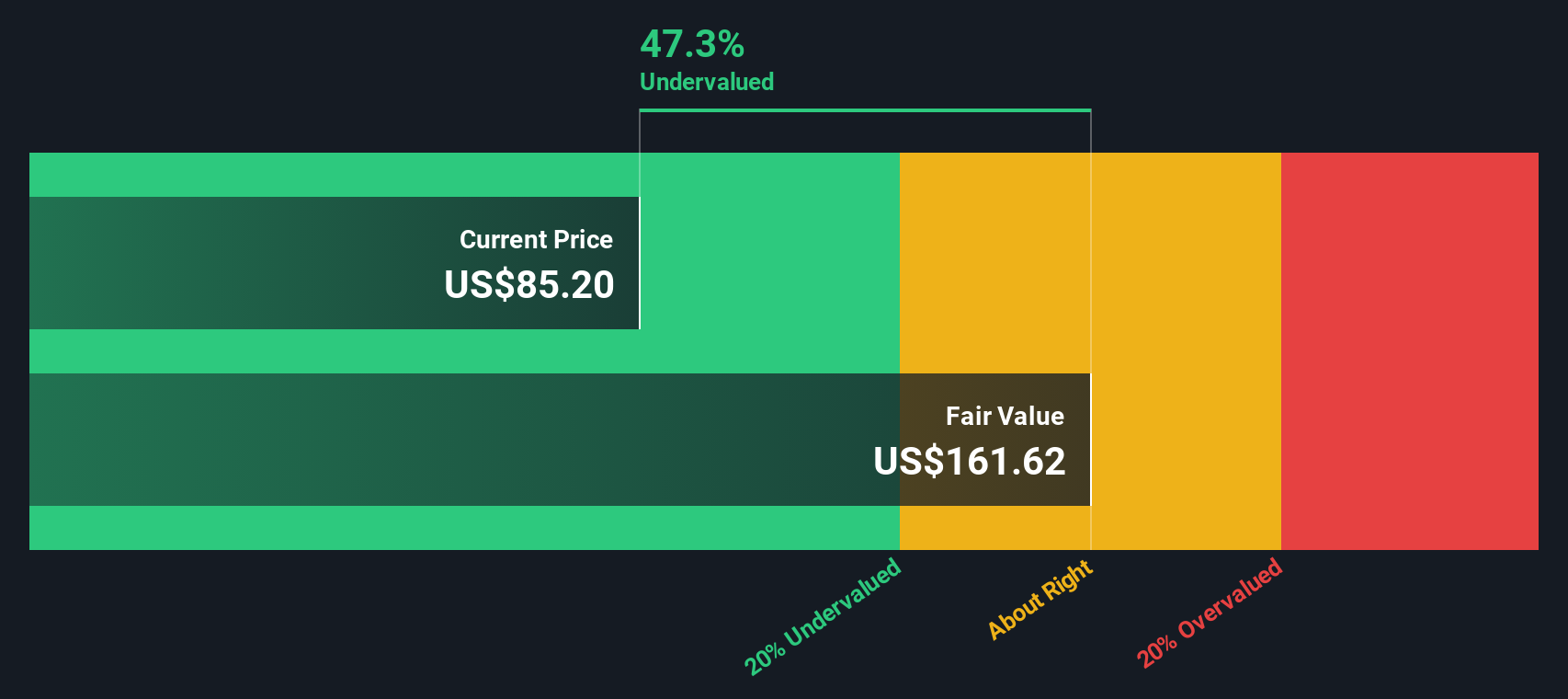

- Despite the volatility, United Parcel Service sports a valuation score of 5/6 for being undervalued on several key metrics. Let’s look at how these numbers are calculated, and stay tuned for an even better way to interpret what the valuation really means.

Find out why United Parcel Service's -23.0% return over the last year is lagging behind its peers.

Approach 1: United Parcel Service Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to their present value. This approach gives investors insight into what the business may be worth based on how much cash it is expected to generate over time.

For United Parcel Service, the latest reported Free Cash Flow stands at approximately $3.71 billion. Analyst consensus projects Free Cash Flow to grow to $6.24 billion by 2029, with the next ten years' annual figures gradually increasing according to the 2 Stage Free Cash Flow to Equity model. Notably, estimates beyond five years are extrapolations rather than direct analyst forecasts, so growth assumptions are important to consider.

Using this method, the DCF yields an estimated intrinsic value of $136.13 per share. This represents a 29.5% discount from the current market price, suggesting that, according to these assumptions, UPS shares may appear undervalued based on future cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Parcel Service is undervalued by 29.5%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

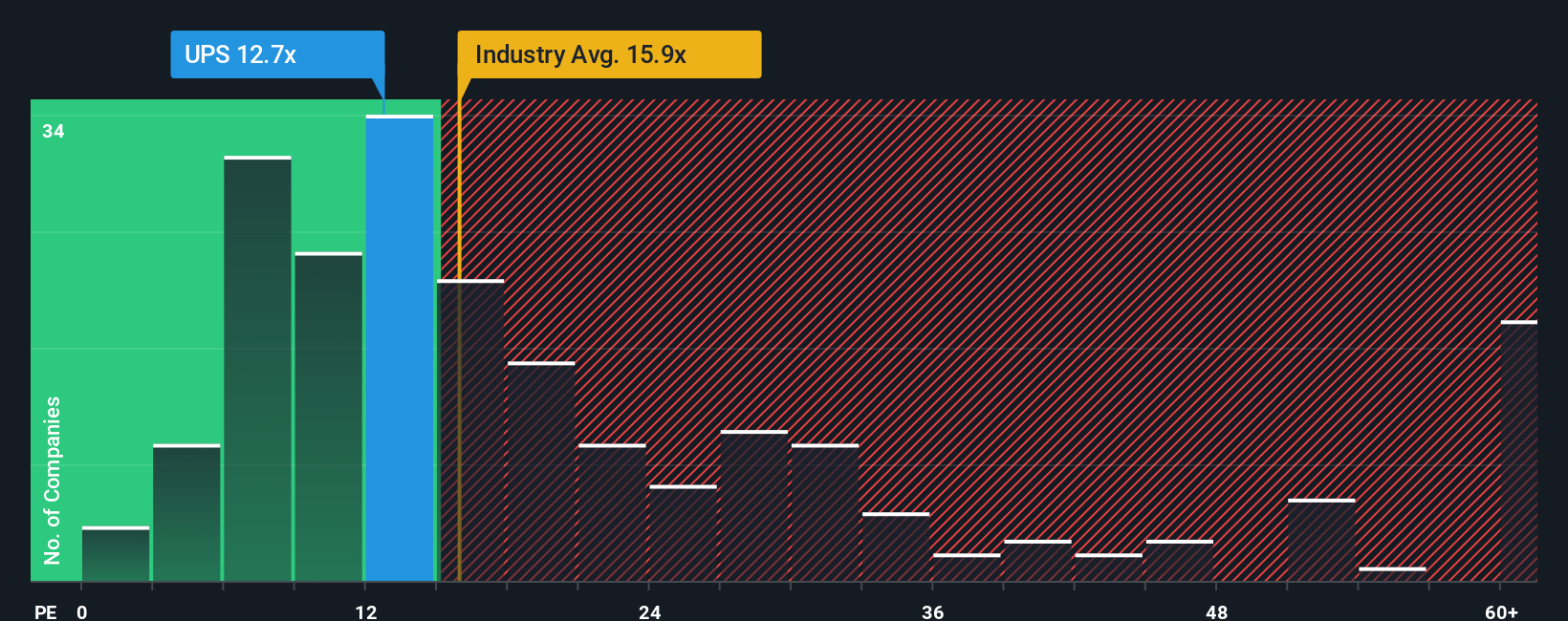

Approach 2: United Parcel Service Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like United Parcel Service. It helps investors gauge how much they are paying for each dollar of current earnings, making it especially relevant for businesses with stable profitability and mature operations.

The appropriate or "fair" PE ratio for a company depends on several factors, such as growth expectations, company-specific risks, competitive strength, and market confidence. Higher growth prospects and lower risk typically justify a higher PE, while concerns about earnings sustainability or sector headwinds tend to depress the valuation multiple.

Currently, United Parcel Service trades at a PE ratio of 14.8x, which sits slightly below the Logistics industry average of 16.0x and well beneath the peer group average of 19.6x. While comparing these figures can provide a basic sense of relative value, it does not consider unique factors like UPS's future earnings potential, operating margins, or scale.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio is calculated based on UPS’s earnings outlook, industry landscape, profitability, market cap, and underlying risks, providing a more customized benchmark than any raw average. For UPS, the Fair Ratio is 18.7x, which is above both its current PE and the industry baseline. Because this tailored benchmark integrates company-specific strengths and sector context, it offers a superior reference point for deciding if a stock is attractively priced.

With the actual PE ratio well below the Fair Ratio, UPS’s shares appear undervalued relative to what would be justified by its fundamentals and prospects as assessed by Simply Wall St.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

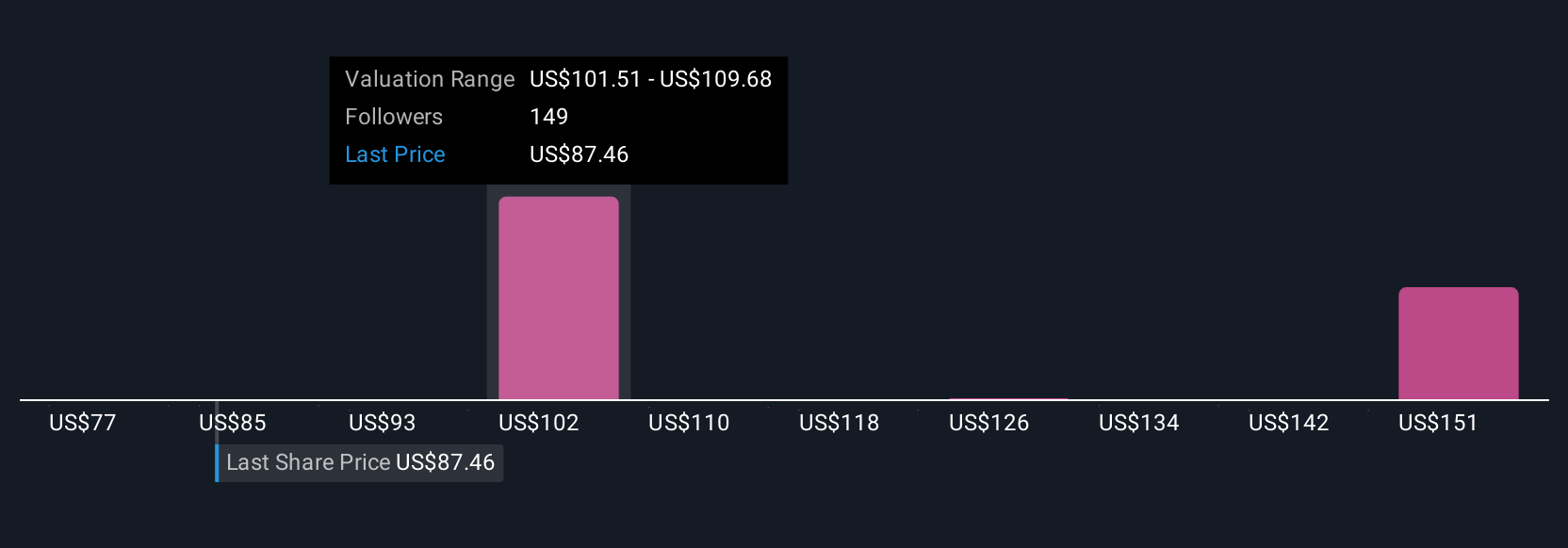

Upgrade Your Decision Making: Choose your United Parcel Service Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative combines your view of a company’s story with projected financials, allowing you to connect what’s driving United Parcel Service now, such as new initiatives or sector trends, to realistic forecasts and a calculated fair value. On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to articulate the beliefs and assumptions behind their investment decisions, which the platform then translates into dynamic forecasts and actionable valuation targets.

Narratives empower you to make confident buy or sell decisions by comparing your calculated Fair Value (based on your assumptions) to the current share price, and they keep your perspective current by updating automatically when new news or financial results emerge. For United Parcel Service, you might see some investors taking a more cautious stance, setting a Fair Value near $75 due to concerns about rising costs and revenue risks. Others may take an optimistic view, targeting $133 and focusing on efficiency gains, healthcare expansion, and automation. Narratives show you these differing views side by side, helping you sense-check numbers and understand the real drivers behind valuation so you can choose the story you believe in most.

For United Parcel Service, we’ll make it really easy for you with previews of two leading United Parcel Service Narratives:

- 🐂 United Parcel Service Bull Case

Fair Value: $132.37

Currently trading at 27.5% below narrative fair value

Forecast Revenue Growth: 2.3%

- Rapid automation, network efficiency, and targeted cost-cutting are improving margins and setting UPS up for sustainable outperformance versus expectations.

- Diversification into healthcare logistics and global trade, combined with investments in digital capabilities, positions UPS for robust long-term growth.

- Key risks include rising labor and regulatory costs, competition and tech disruption, and requirements for costly sustainability investments. Bullish analysts see these as manageable given UPS's scale and execution.

- 🐻 United Parcel Service Bear Case

Fair Value: $95.21

Currently trading at 0.8% above narrative fair value

Forecast Revenue Growth: 1.8%

- While management's cost-cutting initiatives are ambitious, continued revenue and EPS declines, labor conflicts, and governance concerns may undermine sustained profitability.

- Rising long-term interest expenses and shareholder pressure add to the strain on financial flexibility and management’s ability to drive recovery.

- Even with new partnerships and network upgrades, analysts with a cautious outlook see current share price as slightly overvalued given near-term risks and weak recent performance.

Do you think there's more to the story for United Parcel Service? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives