- United States

- /

- Transportation

- /

- NYSE:SNDR

Schneider National (SNDR): Evaluating Valuation After Mixed Q3 Results With Rising Sales and Falling Profits

Reviewed by Simply Wall St

Schneider National just released its third quarter results. The report shows higher sales year-over-year, but net income and earnings per share are both lower than last year. Investors took note of the revenue growth along with lower profitability.

See our latest analysis for Schneider National.

After announcing increased sales but lower profits for the quarter, Schneider National’s share price saw a small bounce, rising 2.66% in a day and 6.46% over the last week. Still, bigger picture momentum is fading, with a 1-year total shareholder return of -26.6% reflecting ongoing challenges despite buybacks and continued dividends.

If this shifting momentum has you wondering which other companies could be at a turning point, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With sales growing but profits falling and the stock down over 26% in the past year, the real question is whether Schneider National is a bargain right now or if the market is already accounting for future growth potential.

Most Popular Narrative: 10.5% Undervalued

With Schneider National closing at $22.75, the most popular narrative places its fair value at $25.42. This perspective is shaped by expectations about technology upgrades, industry pressures, and how management is responding. This sets the stage for a closer look.

Schneider's continued investments and focus on technology-driven efficiency (AI, automation, digital freight platform) and cost reduction initiatives are set to drive sustainable operational improvements, containing expenses even in inflationary environments. This should support higher net margins and earnings growth as volumes recover.

Want to know what growth vision justifies this upside? The narrative’s foundation is bold projections that hinge on margin gains and profitability drivers few expect from trucking. The real surprise lies in the assumptions that make this fair value stand apart. See the full story to uncover the numbers behind the optimism.

Result: Fair Value of $25.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure and rising operating expenses could limit Schneider National’s margin expansion and challenge the bullish narrative if market conditions worsen.

Find out about the key risks to this Schneider National narrative.

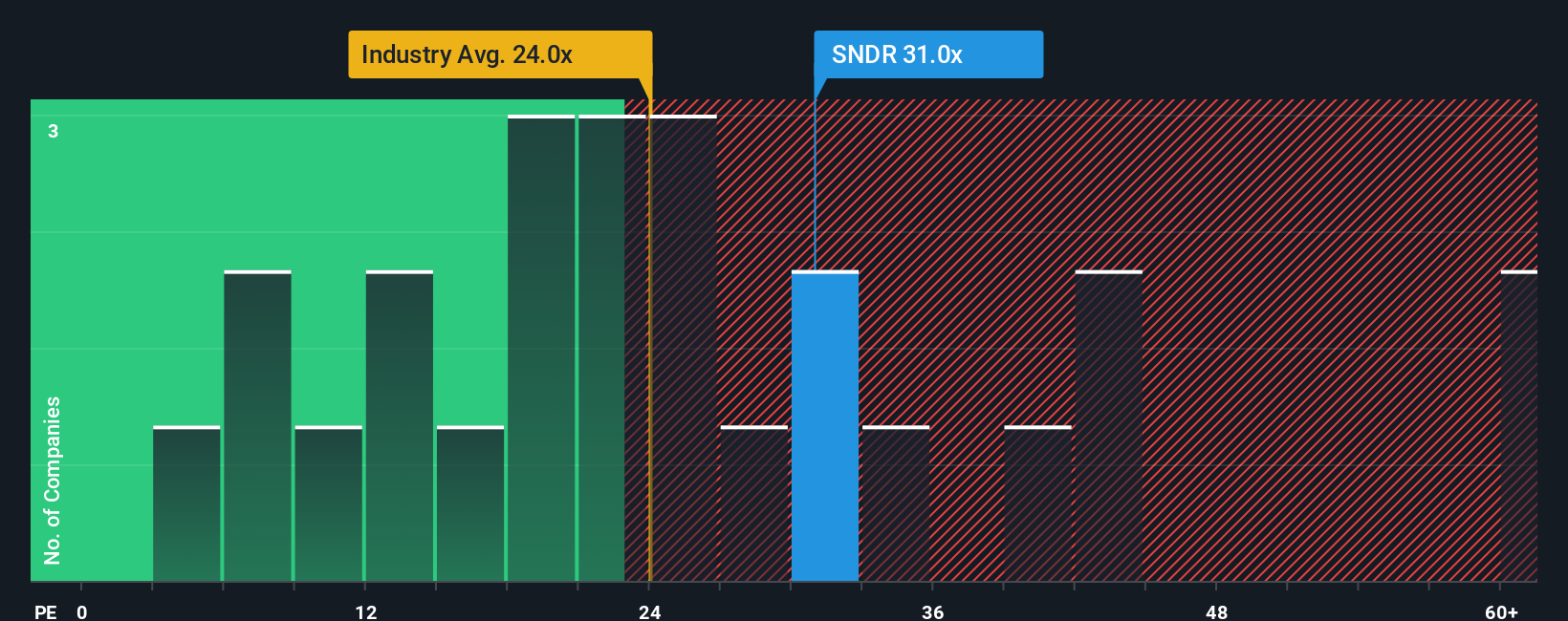

Another View: Looking at Earnings Ratios

Taking a step back from fair value narratives, Schneider National’s price-to-earnings ratio is 35x. This is noticeably higher than the US Transportation industry average of 26.5x, the peer average of 28.7x, and even the fair ratio of 22.3x that the market could shift toward. This premium raises questions about whether hopes for stronger growth truly justify today’s price, or if expectations are set too high.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Schneider National Narrative

If you see the numbers differently or want to dig into Schneider National’s data your way, you can craft a custom analysis yourself in just a few minutes, and Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Schneider National.

Looking for more investment ideas?

Smart investors know opportunity waits for no one. Make your next move count by scanning these unique lists, each targeting tomorrow's biggest winners and strong performers.

- Snap up reliable income by checking out these 16 dividend stocks with yields > 3% with yields above 3% for powerful compounding potential.

- Position yourself early in transformative technology by seeing these 24 AI penny stocks as they power advances in automation, analytics, and artificial intelligence.

- Get ahead of the curve and uncover hidden gems using these 870 undervalued stocks based on cash flows that are aligned with strong cash flows for value-focused investing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNDR

Schneider National

Provides multimodal surface transportation and logistics solutions in the United States, Canada, and Mexico.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives