- United States

- /

- Marine and Shipping

- /

- NYSE:NMM

Navios Maritime Partners (NYSE:NMM): Exploring Valuation After Bond Issuance and Latest Cash Distribution

Reviewed by Simply Wall St

Navios Maritime Partners (NYSE:NMM) has attracted investor focus after declaring a $0.05 per unit cash distribution for the recent quarter, reflecting an annualized payout of $0.20 per unit. This move highlights the company’s ongoing priority on capital returns to unitholders.

See our latest analysis for Navios Maritime Partners.

Momentum has been building lately for Navios Maritime Partners, with a 1-month share price return of nearly 10% and a 7% gain over the past week following its successful bond placement and continued cash distributions. While the short-term rally stands out, the longer-term picture is more complex. Its 1-year total shareholder return remains negative, even though the 5-year return is remarkable at nearly 687%.

If you’re eager to see where else strong capital moves and insider confidence are reshaping portfolios, now is an ideal moment to discover fast growing stocks with high insider ownership

With shares trading at a discount to analyst targets and strong long-term returns, the question becomes clear: Is Navios Maritime Partners offering a bargain for value-focused investors, or is the market already pricing in its future growth?

Most Popular Narrative: 26% Undervalued

Comparing the widely followed narrative’s fair value estimate of $66.50 to the latest close of $49.14 reveals a substantial gap favoring valuation upside. The analysis contrasts today’s price with forecasts and assumptions that could spark a major shift in investor expectations.

Ongoing fleet renewal, with significant investment in newer, more energy-efficient vessels, positions Navios to capitalize on tightening environmental regulations. This can result in lower operating costs and allow for premium charter rates, thereby supporting improved net margins and competitive advantage over peers with older fleets.

Which future transformation will tip the scales? The most popular narrative centers on bold earnings and margin projections, fueled by fleet upgrades and industry shifts. Curious what assumptions these analysts are betting on to reach that price target? The surprises behind their numbers might turn conventional wisdom on its head. Read on to get the full story behind this valuation call.

Result: Fair Value of $66.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weak freight markets or unplanned regulatory costs could dampen future earnings and challenge even the most optimistic price target projections.

Find out about the key risks to this Navios Maritime Partners narrative.

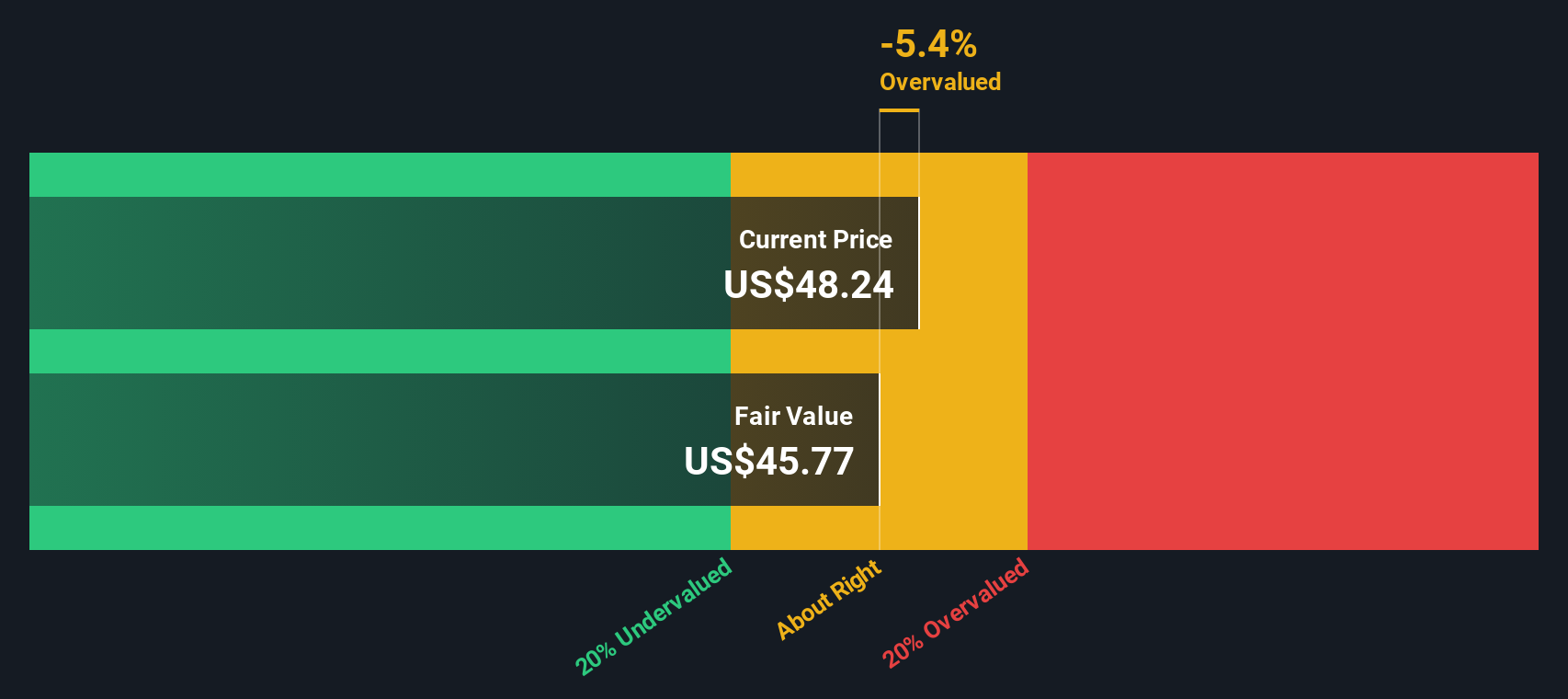

Another View: The SWS DCF Model’s Perspective

While the analyst consensus sees upside for Navios Maritime Partners, our SWS DCF model arrives at a different conclusion. It estimates the stock’s fair value at $36.97, which suggests that today’s market price is above this calculation. Do valuation models really agree on what’s truly “cheap” in this case?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Navios Maritime Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Navios Maritime Partners Narrative

If you see things differently or want to dig into the numbers yourself, you can piece together your own perspective in just a few minutes, and Do it your way.

A great starting point for your Navios Maritime Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Even More Winning Ideas?

If you’re keen to find your next standout investment, don’t wait for others to spot the opportunities first. The Simply Wall Street Screener is your shortcut to the markets' hidden gems and breakthrough leaders.

- Spot rapid innovation in healthcare by following these 33 healthcare AI stocks. These companies are delivering solutions at the frontlines of medical technology and data-driven care.

- Boost your portfolio’s income with these 22 dividend stocks with yields > 3%, a selection that offers attractive yields and resilient cash flows, handpicked for steady returns.

- Capitalize on the AI boom by targeting these 26 AI penny stocks, companies built for the next wave of intelligence and automation breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navios Maritime Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NMM

Navios Maritime Partners

Owns and operates dry cargo vessels in Asia, Europe, North America, and Australia.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives