- United States

- /

- Marine and Shipping

- /

- NYSE:MATX

Is Matson's $1 Billion Fleet Upgrade Shaping a New Strategic Direction for MATX?

Reviewed by Sasha Jovanovic

- On November 18, 2025, Matson, Inc. participated in the Stephens Annual Investment Conference in Nashville, with CFO Joel M. Wine discussing the company’s $1 billion new vessel program and other initiatives.

- A key insight from the conference was Matson’s emphasis on both its capital investment in fleet modernization and its strategic joint venture for terminal operations, underscoring its focus on long-term operational and financial strength.

- We'll review how Matson's new vessel investment, highlighted at the conference, may shape its investment narrative going forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Matson Investment Narrative Recap

Owning shares in Matson means believing in its unique positioning within US domestic and transpacific shipping, where stable trade lanes and ongoing fleet investments are seen as long-term strengths. The recent spotlight on the new vessel program and strategic joint ventures doesn't materially shift the immediate focus: most investors are still watching freight demand trends in core Pacific routes, while volatility in those markets remains a key risk for near-term results.

The company's November partnership with WhaleSpotter Corp. for real-time whale detection systems stands out, reflecting an industry-wide push toward operational sustainability that could appeal to customers and regulators. This announcement underscores Matson’s efforts to adapt, even as efficiency and profitability in core routes remain the most crucial near-term catalysts.

Yet, in contrast, investors should be aware of how any unexpected shifts in Pacific trade demand could...

Read the full narrative on Matson (it's free!)

Matson's outlook anticipates $3.4 billion in revenue and $289.2 million in earnings by 2028. This reflects a -0.3% annual revenue decline and a decrease of $204.9 million in earnings from the current $494.1 million.

Uncover how Matson's forecasts yield a $144.00 fair value, a 37% upside to its current price.

Exploring Other Perspectives

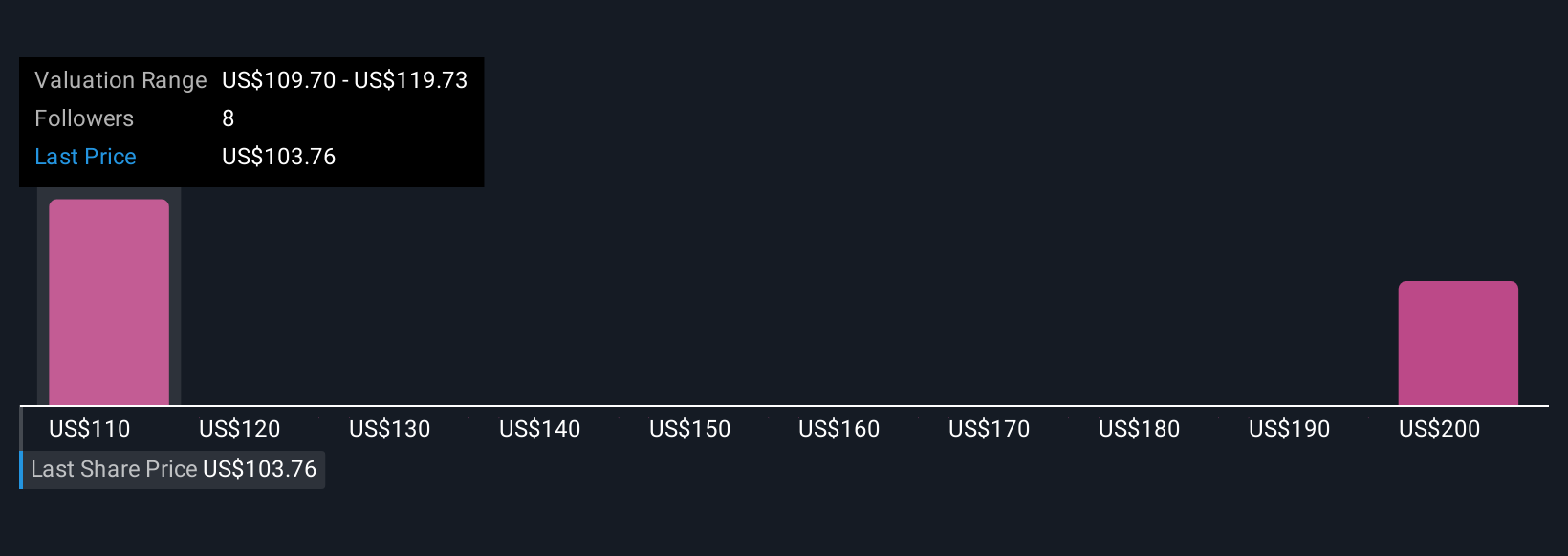

Eight fair value estimates from the Simply Wall St Community range widely, from US$92 to US$210 per share. Against this diversity of opinion, many participants remain focused on the risk of sustained volatility in global trade affecting Matson’s earnings and revenue potential, reminding you to consider how different scenarios might play out for the stock.

Explore 8 other fair value estimates on Matson - why the stock might be worth 13% less than the current price!

Build Your Own Matson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Matson research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Matson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Matson's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MATX

Matson

Engages in the provision of ocean transportation and logistics services.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives