- United States

- /

- Airlines

- /

- NYSE:LUV

Is Southwest Airlines’ (LUV) Expanded Global Reach Recasting Its Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- In late October 2025, Southwest Airlines reported third-quarter earnings, reaffirmed full-year EBIT guidance, expanded its global ticketing reach through an interline agreement with Hahnair, and completed over US$1.49 billion in fixed-rate, callable, unsecured note offerings due in 2028 and 2035.

- This move not only signals Southwest’s ongoing focus on international market presence but also highlights increased capital management activity through significant share buybacks and debt issuance.

- We'll explore how Southwest's partnership with Hahnair to broaden overseas ticket sales could influence its future investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

Southwest Airlines Investment Narrative Recap

To be a shareholder of Southwest Airlines right now, you need to believe in the carrier’s ability to leverage new international partnerships and maintain operational efficiency to overcome variable booking trends and macro uncertainty. While the Hahnair agreement expands global reach, its immediate impact on the key catalyst, stronger booking volumes through diverse channels, remains limited, and the biggest risk continues to be unpredictable demand in leisure travel rather than this development.

Of all the recent announcements, the reaffirmation of full-year EBIT guidance remains the most relevant. By sticking to its US$600 million to US$800 million target, Southwest signals stability in earnings expectations despite shifting travel patterns, which ties directly to investor focus on revenue consistency as major catalysts unfold.

However, investors should be aware that despite these updates, uncertainty around future demand, especially for leisure travel, still looms large...

Read the full narrative on Southwest Airlines (it's free!)

Southwest Airlines' outlook anticipates $32.6 billion in revenue and $1.9 billion in earnings by 2028. This scenario is based on 5.9% annual revenue growth and an increase in earnings of $1.5 billion from the current $392 million.

Uncover how Southwest Airlines' forecasts yield a $33.76 fair value, a 11% upside to its current price.

Exploring Other Perspectives

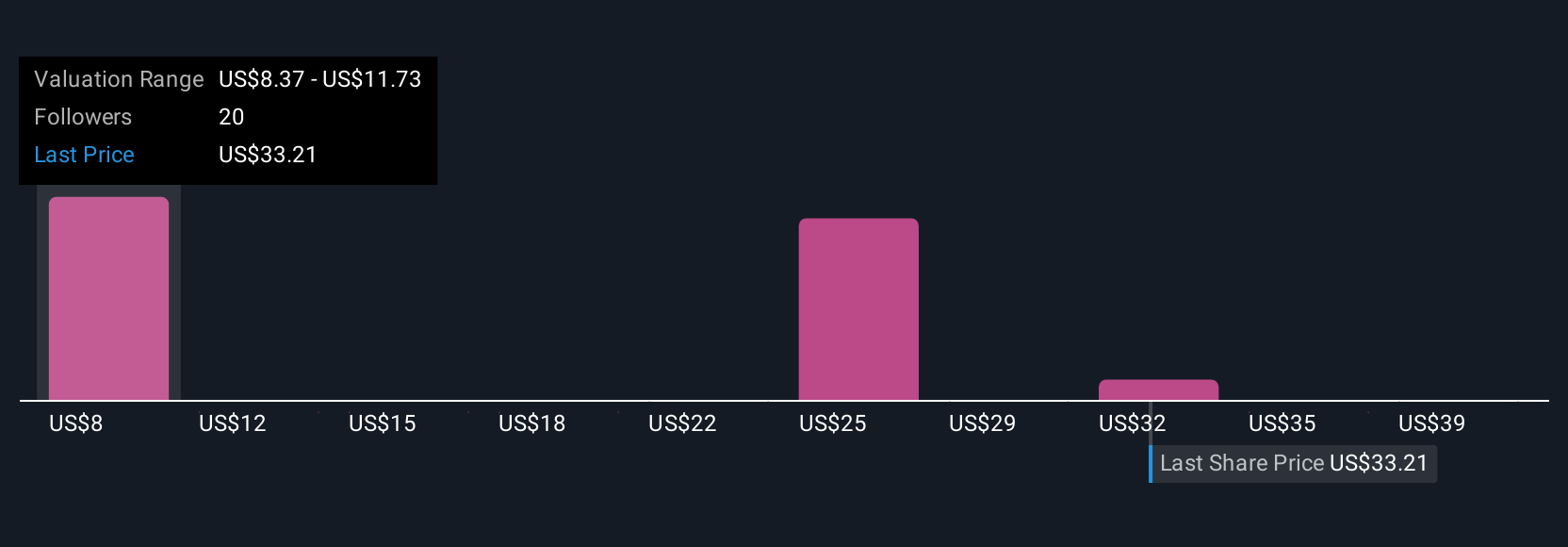

Seven Simply Wall St Community fair value estimates for Southwest Airlines range widely, from US$7.74 to US$45.91. While some see opportunity, ongoing macroeconomic uncertainty casts a shadow over the company’s near-term earnings and pricing power.

Explore 7 other fair value estimates on Southwest Airlines - why the stock might be worth as much as 51% more than the current price!

Build Your Own Southwest Airlines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southwest Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Airlines' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUV

Southwest Airlines

Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives