- United States

- /

- Airlines

- /

- NYSE:LUV

Does Southwest Airlines' (LUV) Dividend Reveal Strength in Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- Southwest Airlines' Board of Directors has declared a quarterly cash dividend of US$0.18 per share for shareholders of record as of December 26, 2025, with payment scheduled for January 16, 2026.

- This dividend declaration indicates the company's continued commitment to returning value to shareholders and may reflect underlying confidence in its financial position and outlook.

- We'll examine how Southwest Airlines' latest dividend declaration could influence its investment narrative, particularly regarding shareholder confidence and financial stability.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Southwest Airlines Investment Narrative Recap

To be a shareholder in Southwest Airlines, you need to believe in the carrier’s ability to convert its well-known brand, network, and evolving product strategy into sustainable profitability, even amid industry swings. The recent dividend declaration underscores management’s intent to maintain regular payouts, but it does not materially alter the central short-term catalyst of increasing booking volumes, nor does it resolve the persistent risk of uncertain leisure travel demand and ongoing cost challenges.

Among recent announcements, the July 29 rollout of assigned and premium seating, set to launch in January 2026, is particularly relevant. This product shift aligns closely with the key catalyst of driving higher revenue yields across more customer segments, though the connection with dividend stability is mostly indirect compared to the impact of actual booking trends and cost control efforts.

On the other hand, investors should not overlook the risk that softened booking demand could ...

Read the full narrative on Southwest Airlines (it's free!)

Southwest Airlines' outlook foresees $32.6 billion in revenue and $1.9 billion in earnings by 2028. This projection is based on 5.9% annual revenue growth and a $1.5 billion increase in earnings from the current $392.0 million.

Uncover how Southwest Airlines' forecasts yield a $34.07 fair value, a 4% upside to its current price.

Exploring Other Perspectives

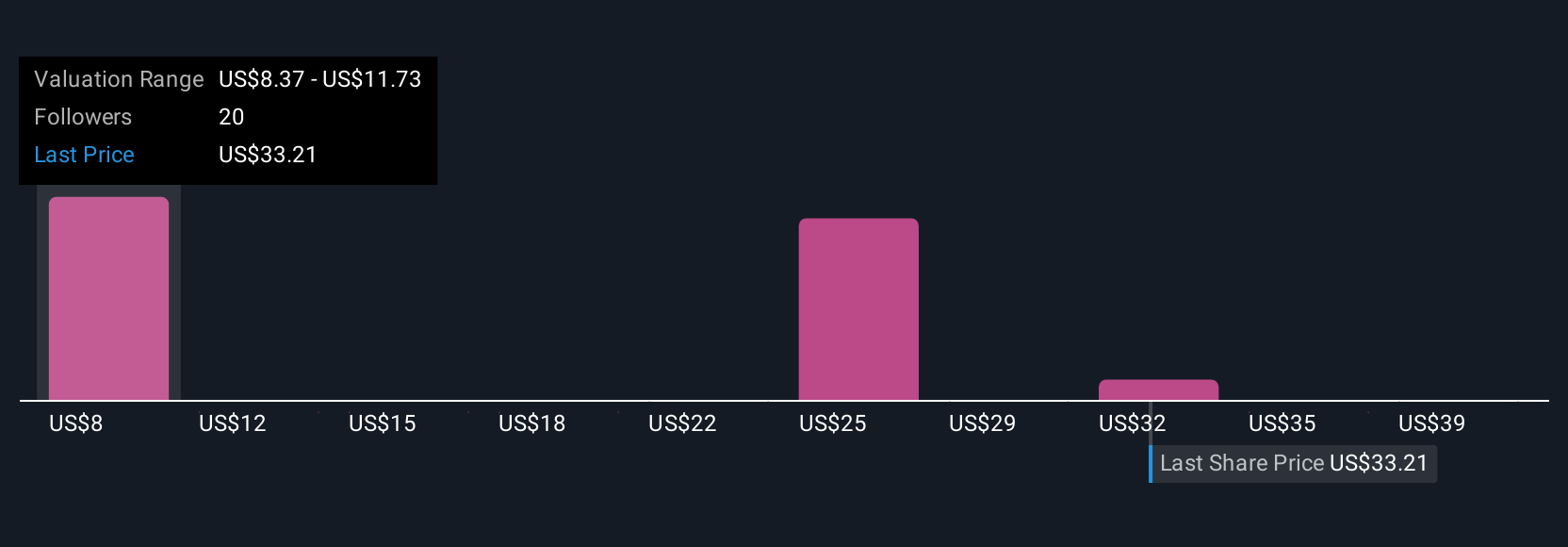

Seven members of the Simply Wall St Community set fair value estimates for Southwest between US$8.14 and US$45.91 per share. With demand swings and cost pressures still in play, your outlook may hinge on how you weigh these risks against possible revenue growth ahead.

Explore 7 other fair value estimates on Southwest Airlines - why the stock might be worth as much as 40% more than the current price!

Build Your Own Southwest Airlines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southwest Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Airlines' overall financial health at a glance.

No Opportunity In Southwest Airlines?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUV

Southwest Airlines

Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives