- United States

- /

- Airlines

- /

- NYSE:LUV

Assessing Southwest Airlines (LUV) Valuation After Recent Share Price Uptick

Reviewed by Simply Wall St

See our latest analysis for Southwest Airlines.

Southwest’s recent share price bump has caught the eye after a solid 7-day return of 4.49%, suggesting some renewed optimism even as the year-to-date share price return remains slightly negative. Over the longer term, momentum is still building back, with a 1-year total shareholder return of just under 5% while longer periods still show negative returns.

If you’re watching for stocks that could be on the move next, now is an ideal time to broaden your search and discover See the full list for free.

With earnings steadily improving and shares still trading below all-time highs, is Southwest Airlines truly undervalued, or is the market already factoring in any potential rebound in growth? Could this be a real buying opportunity, or is future optimism already accounted for in the current price?

Most Popular Narrative: 2% Undervalued

The most widely followed narrative currently puts Southwest Airlines’ fair value at $34.07, just above the latest closing price of $33.28. This minimal gap signals a market consensus that any big edge might rest on subtle future shifts, not obvious mispricing.

Expansion through new distribution channels and differentiated pricing strategies is expected to drive revenue and improve net margins. Operational efficiencies and cost-effective strategies are likely to enhance net margins and earnings, supported by loyalty program optimization.

Want to know what gives this stock its edge? There’s a game-changing shift in how Southwest plans to boost earnings and margins. One move could rewrite expectations. The secret behind these numbers might surprise you. Get the full rundown on what’s driving this calculation and how future optimism stacks up against hard data.

Result: Fair Value of $34.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from airlines offering premium services and unpredictable macroeconomic shifts could change the outlook for Southwest Airlines more quickly than expected.

Find out about the key risks to this Southwest Airlines narrative.

Another View: Trading at a Premium?

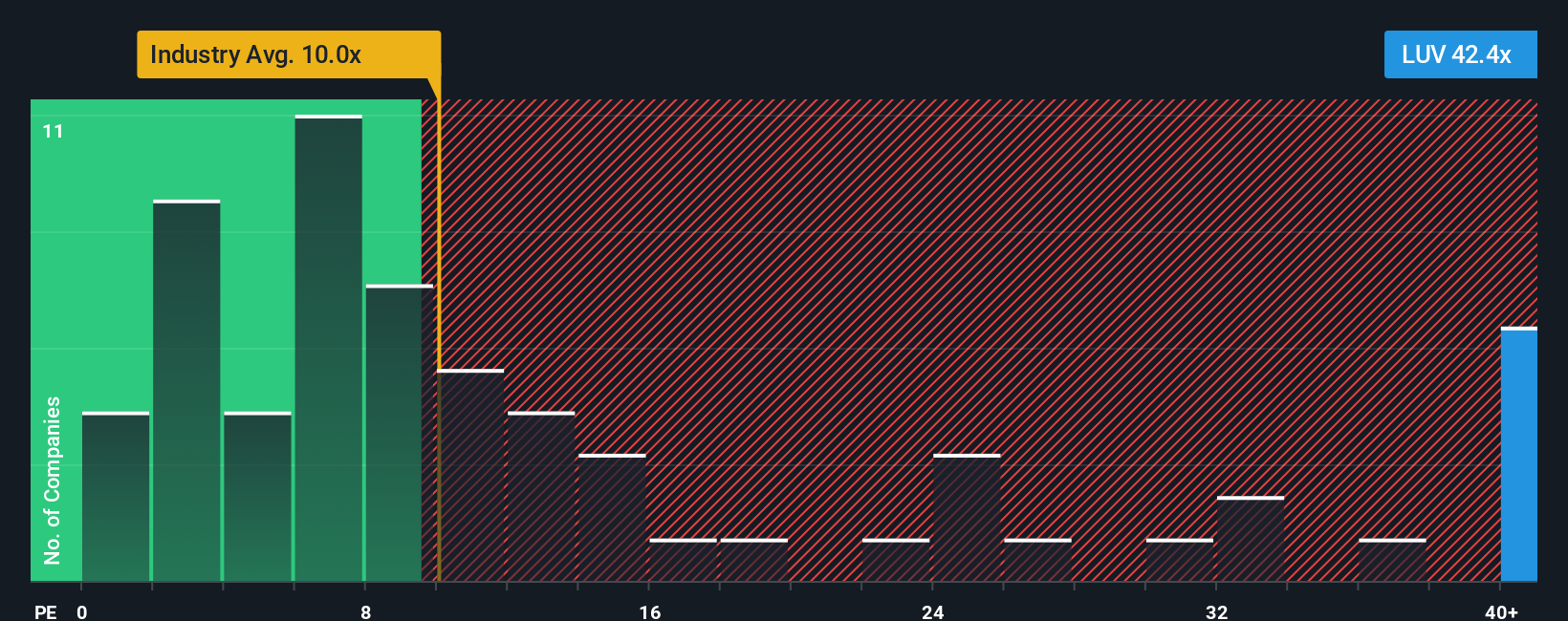

Looking at the company's price-to-earnings ratio from another perspective, Southwest Airlines trades at 45.4x, which is much higher than both the industry average of 8.7x and the fair ratio of 27.8x. This premium could indicate significant expectations built into today’s stock price, raising questions about valuation risk versus opportunity.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southwest Airlines Narrative

If you want to dig into the numbers yourself or add your perspective, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t stop at just one opportunity. Take charge of your portfolio today by exploring unique stock ideas you won’t find in the headlines. Missing these could mean leaving gains on the table.

- Accelerate your passive income strategy with strong yield opportunities by checking out these 14 dividend stocks with yields > 3%.

- Tap into innovation and stay ahead of the curve with a handpicked selection of next-gen sectors through these 26 AI penny stocks.

- Unlock value where others might have overlooked it by screening for hidden gems using these 922 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUV

Southwest Airlines

Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success