- United States

- /

- Logistics

- /

- NYSE:GXO

Will GXO’s (GXO) Aerospace Certification in Germany Redefine Its Competitive Edge in Logistics?

Reviewed by Sasha Jovanovic

- GXO Logistics recently announced that its multi-user facility in Dormagen, Germany has achieved EN 9120 aerospace quality certification for the storage and distribution of over 9,000 Boeing aircraft parts.

- This recognition demonstrates GXO’s commitment to high standards in aerospace logistics and expands its presence in Germany to support faster delivery times for European airlines.

- We will examine how GXO’s new aerospace quality certification could strengthen its position in key sectors and inform its investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

GXO Logistics Investment Narrative Recap

To be a GXO Logistics shareholder, you need to believe in the company’s ability to deliver on growth opportunities in advanced logistics and automation, while carefully managing integration, including recent moves into aerospace logistics with high standards for quality and compliance. The EN 9120 certification at Dormagen strengthens GXO’s offering in aerospace, but is not likely to materially change the biggest near-term catalyst: realizing synergies and expanded verticals from the Wincanton integration. Short-term risk remains around management transitions and integration execution, which could affect margins and earnings stability if not well managed.

Among recent developments, GXO’s multi-year expansion in Germany and the launch of its AI-powered GXO IQ platform stand out. The focus on automation and proprietary technology not only supports sector positioning but also links directly to GXO’s efforts to improve margins and capture large-scale, long-term contracts. Success in these initiatives will be closely watched in the context of ongoing sector consolidation and heightened customer expectations.

However, investors should also be aware that, in contrast, high customer concentration in sectors like e-commerce and aerospace brings risks if...

Read the full narrative on GXO Logistics (it's free!)

GXO Logistics' outlook anticipates $15.3 billion in revenue and $440.6 million in earnings by 2028. This calls for 6.5% yearly revenue growth and a $377.6 million increase in earnings from the current $63.0 million.

Uncover how GXO Logistics' forecasts yield a $63.94 fair value, a 34% upside to its current price.

Exploring Other Perspectives

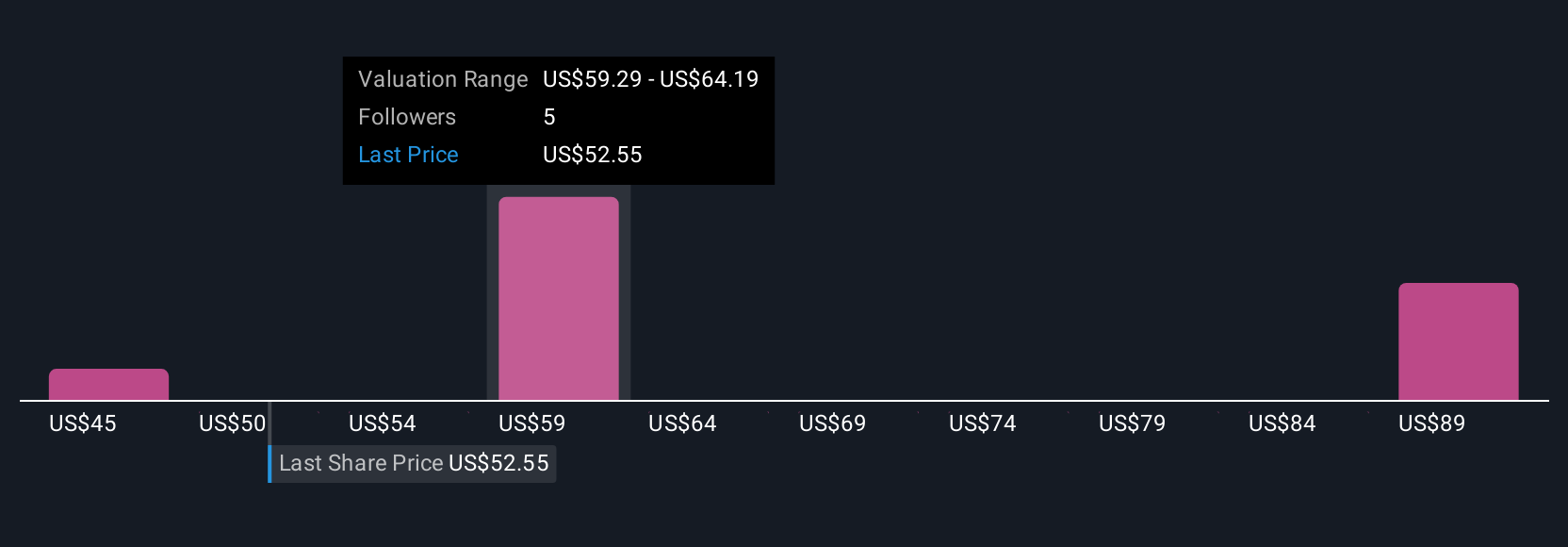

Three members of the Simply Wall St Community have issued fair value estimates for GXO Logistics, ranging widely from US$44.45 to US$63.94. While many see long-term contract wins as a growth engine, high customer concentration in select sectors may affect revenue and earnings stability, see how different viewpoints assess this balance.

Explore 3 other fair value estimates on GXO Logistics - why the stock might be worth as much as 34% more than the current price!

Build Your Own GXO Logistics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free GXO Logistics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GXO Logistics' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GXO

Moderate growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives