- United States

- /

- Logistics

- /

- NYSE:GXO

GXO Logistics (GXO): Valuation Insights as Leadership Shakeup Aims to Boost Growth and Operational Execution

Reviewed by Simply Wall St

GXO Logistics is rolling out significant changes to its leadership, appointing Michael Jacobs as President of the Americas and Asia Pacific and creating a new Chief Operating Officer role. The company is also streamlining management to focus on global execution.

See our latest analysis for GXO Logistics.

These leadership moves come as GXO Logistics continues to attract attention for its sharp year-to-date share price return of 28.6%. However, the total shareholder return over the last year sits slightly in the red at -4%. Momentum appears to be building lately, with a solid 9.7% share price gain in the past three months as investors look for renewed growth and execution under the new team.

If you’re curious about what else is gaining momentum, now is a smart time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares gaining ground in recent months but still trading below analyst targets, investors are left to consider whether GXO Logistics is undervalued or if the market is already factoring in the company’s future growth potential.

Most Popular Narrative: 10.9% Undervalued

At $55.37, GXO Logistics trades below the narrative fair value of $62.12. This is an active signal that the market sees less upside than analysts. This gap prompts a closer look at what is driving the current conviction around the stock’s prospects.

"Enhanced deployment of automation, AI, and proprietary software (with recent launches like GXO IQ) is rapidly improving warehouse productivity, reducing labor costs, and increasing operational efficiency, which is beginning to drive margin expansion and should positively impact net earnings and EBITDA margins."

What secret weapon powers this valuation? It is not just about automation; it is a radical transformation in how future revenues and earnings are projected. Want to decode the discipline and ambition behind these bullish assumptions? Unpack the future-shaping financial forecasts inside the narrative.

Result: Fair Value of $62.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent leadership turnover and execution risks from recent acquisitions could derail margin gains and challenge the bullish outlook for GXO Logistics.

Find out about the key risks to this GXO Logistics narrative.

Another View: High Market Expectations

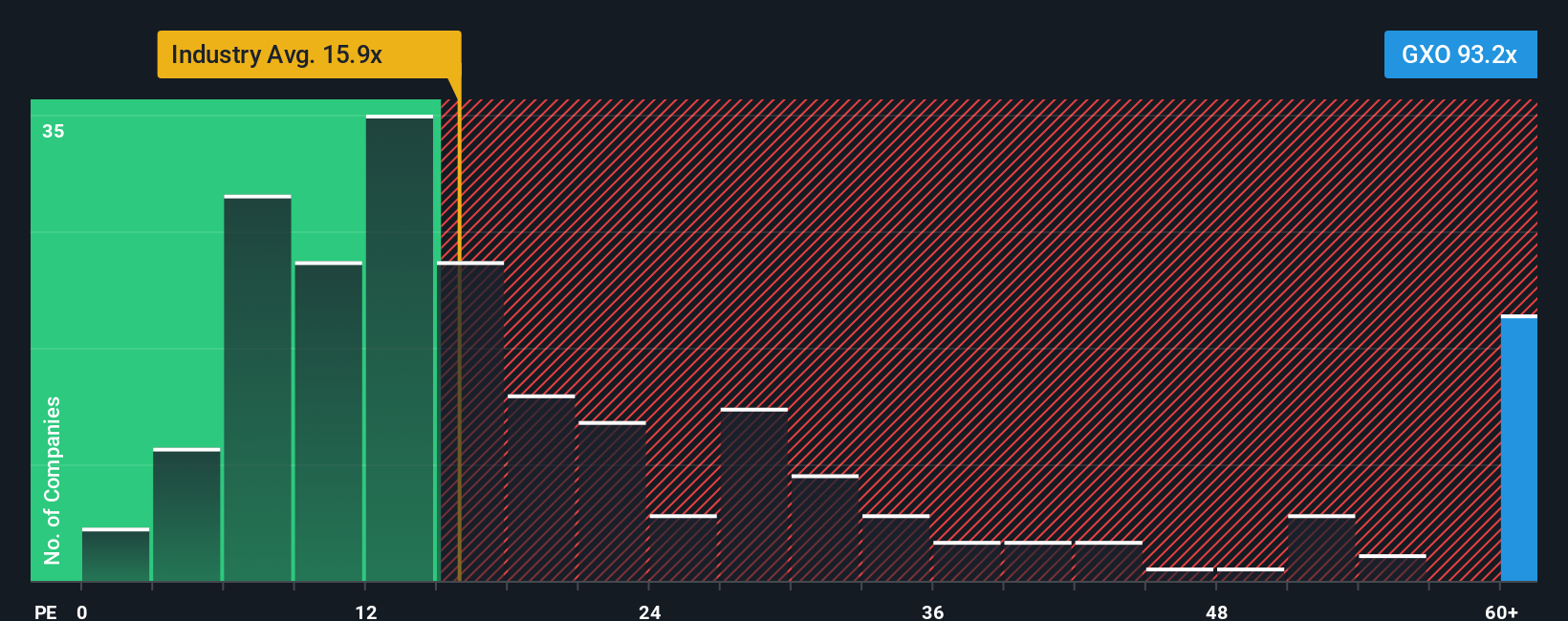

While the fair value estimate points to GXO Logistics being undervalued, looking at typical market price comparisons tells a different story. The company’s price-to-earnings ratio is remarkably high at 100.6 times earnings, far above both its industry peers (21.2x) and the fair ratio of 41.6x. This means investors are paying a significant premium for growth and execution, making valuation riskier if the expected profit acceleration does not materialize. Could this optimism be overextended, or is there something the market sees coming?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GXO Logistics Narrative

If you have a different perspective or want to dive into the numbers yourself, you can build your own GXO Logistics narrative in just a few minutes. Do it your way

A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why limit your opportunities? Gain the edge with pre-screened stock ideas backed by real data. Now is the time to catch quality businesses before the market does.

- Accelerate your search for fast growth by tapping into these 27 AI penny stocks that are poised for breakthroughs in artificial intelligence and automation.

- Secure steady income potential with these 20 dividend stocks with yields > 3% which deliver robust yields above 3% and strong cash flow fundamentals.

- Position yourself for tomorrow’s tech wave by reviewing these 28 quantum computing stocks, found at the frontier of quantum computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GXO

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives