- United States

- /

- Logistics

- /

- NYSE:GXO

GXO Logistics (GXO) Margin Hit by $171M One-Off Loss, Challenging Bullish Narratives

Reviewed by Simply Wall St

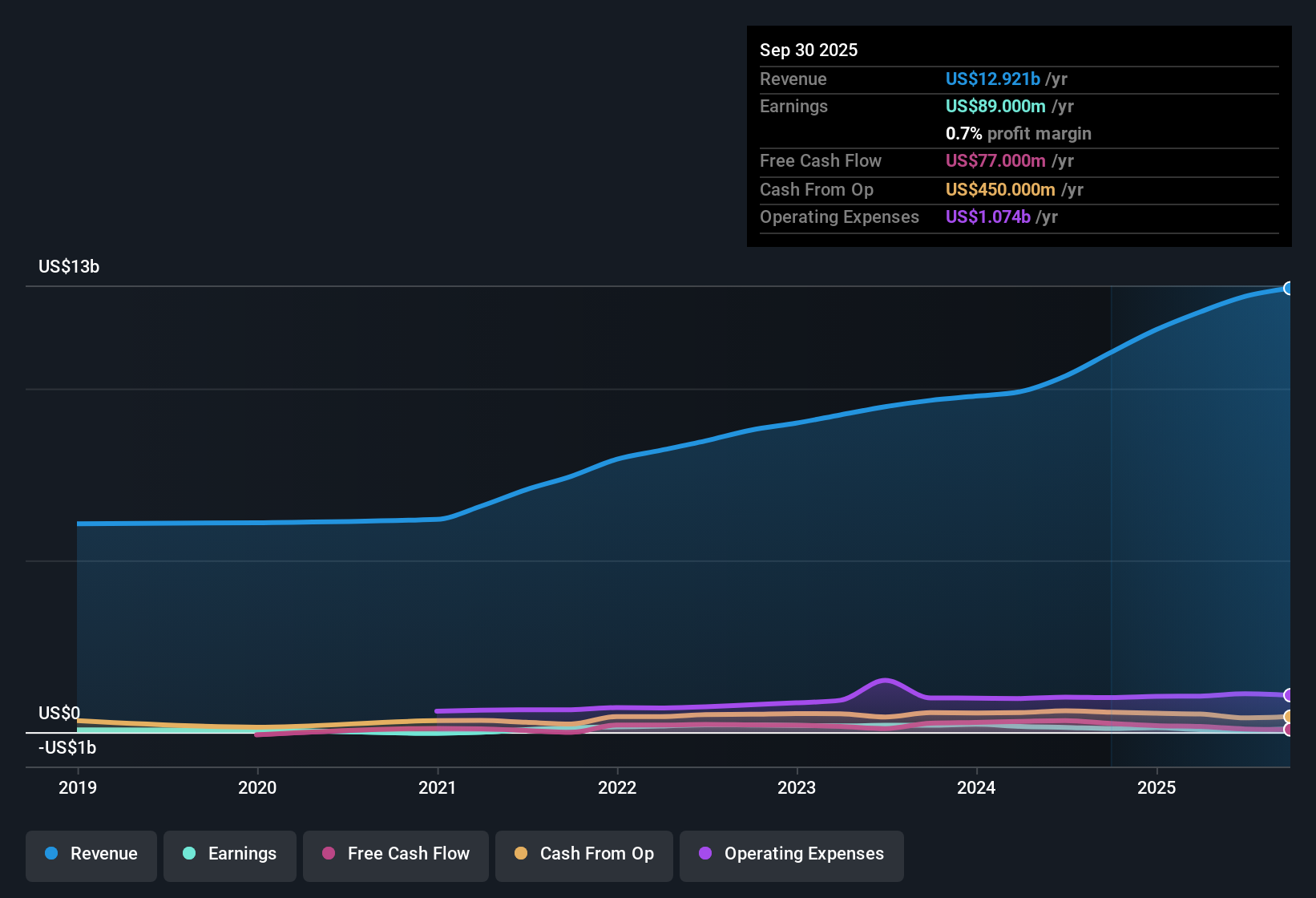

GXO Logistics (GXO) reported net profit margins of 0.5%, down from 1.4% a year ago, as a one-off loss of $171 million weighed heavily on the bottom line. Despite the negative earnings growth and near-term margin pressure, the company has delivered an average annual earnings growth of 8.7% over the past five years. Looking ahead, forecasts suggest a robust 53.49% per year earnings growth, easily outpacing the broader US market’s expected 16%, with shares currently trading at $52.54 and a price-to-earnings ratio of 95.5x, well above industry peers.

See our full analysis for GXO Logistics.The next section puts GXO’s headline numbers up against the most widely followed narratives for the stock, highlighting where current results match the story and where they push back against the crowd.

See what the community is saying about GXO Logistics

Margin Expansion Forecasted Despite Recent Dip

- Analysts predict that profit margins will climb from the current 0.5% to 2.9% over the next three years, a notable recovery fueled by the integration of automation and cost synergies.

- According to the analysts' consensus view, margin improvement is seen as credible because:

- Recent automation efforts and the launch of proprietary software like GXO IQ are expected to cut labor costs and boost operational efficiency. These initiatives are anticipated to directly support the forecasted jump in profitability.

- The integration of Wincanton is projected to deliver $60 million in cost synergies by 2026, further strengthening operating leverage and supporting the margin expansion outlook.

- Consensus narrative underscores the margin recovery, aligning with the view that GXO’s technology investments are on track to drive meaningful earnings upside following a short-term margin dip.

See how analysts expect technology gains to reshape GXO’s profit story: 📊 Read the full GXO Logistics Consensus Narrative.

Customer Wins Secure Cash Flow Stability

- GXO’s mid-90s% customer retention rate, along with a record streak of large contract wins in e-commerce, healthcare, and aerospace, signals highly stable and predictable future cash flows.

- Analysts' consensus narrative highlights that:

- Long-term, blue-chip client contracts act as a buffer against earnings volatility. These contracts help GXO manage near-term disruptions related to margin pressure and integration efforts.

- GXO’s position in high-growth, outsourced logistics verticals provides a competitive advantage for new business wins. This further bolsters cash flow durability and supports planned reinvestments.

Valuation Premium vs. Growth Outlook

- The current price-to-earnings ratio of 95.5x stands well above peer and industry averages. Analysts have set a price target of $62.12, which implies an upside of roughly 18% from the current share price of $52.54.

- Analysts' consensus view calls attention to the balance between the valuation premium and future growth:

- For GXO to justify its current multiple and reach consensus price targets, it will need to deliver sustained earnings growth and margin expansion as outlined in analyst assumptions. This includes a 53.49% per year earnings growth rate and a future PE multiple of 17.8x on 2028 earnings.

- If margin expansion or integration benefits are less than expected, the current premium could result in the stock reverting to valuations more in line with logistics sector norms (current sector PE 16.6x).

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for GXO Logistics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Share your unique perspective and craft your narrative in just a few minutes: Do it your way

A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

GXO's elevated valuation and dependency on margin improvements mean future returns could disappoint if growth forecasts are not fully realized.

If you’re concerned about paying too much for potential, our these 838 undervalued stocks based on cash flows can help you pinpoint companies with more attractive valuations right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GXO

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives