- United States

- /

- Marine and Shipping

- /

- NYSE:GSL

How Investors May Respond To Global Ship Lease (GSL) Earnings Beat Dividend Hike and Share Buybacks

Reviewed by Sasha Jovanovic

- Global Ship Lease recently reported stronger third quarter 2025 results with revenue of US$192.67 million, up from US$174.06 million a year earlier, and increased its dividend to US$0.625 per Class A common share payable in December 2025.

- These developments were accompanied by the completion of a multi-year share repurchase program, with the company having bought back 2,555,075 shares, representing 7.1% of shares outstanding for a total of US$46.98 million since March 2022.

- We’ll explore how the company’s higher earnings and dividend increase shape Global Ship Lease’s investment narrative going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Global Ship Lease Investment Narrative Recap

To be a Global Ship Lease shareholder today, you need to believe that ongoing shifts in global supply chains will drive sustained demand for midsize and smaller containerships, even as market uncertainties remain elevated. The company’s recent earnings growth, stronger dividend, and completed buyback program reinforce its near-term catalyst: capital returns. These developments bolster shareholder confidence, but the risk of a sharp correction in charter rates due to changing trade flows and market normalization remains, and none of the latest announcements materially diminish this risk for now.

The most relevant event here is the dividend increase to US$0.625 per share for the third quarter of 2025, up from prior quarters, with payment scheduled for December. This rising dividend highlights GSL’s commitment to shareholder returns, a key part of its pitch in a sector characterized by volatile charter rates and limited long-term contract visibility. With that said, the most pressing risk for investors is the potential for charter rates to fall more quickly than expected, impacting margins and payout sustainability...

Read the full narrative on Global Ship Lease (it's free!)

Global Ship Lease's outlook forecasts $621.0 million in revenue and $270.6 million in earnings by 2028. This reflects a 5.3% annual revenue decline and a $112.4 million decrease in earnings from the current $383.0 million.

Uncover how Global Ship Lease's forecasts yield a $37.67 fair value, a 9% upside to its current price.

Exploring Other Perspectives

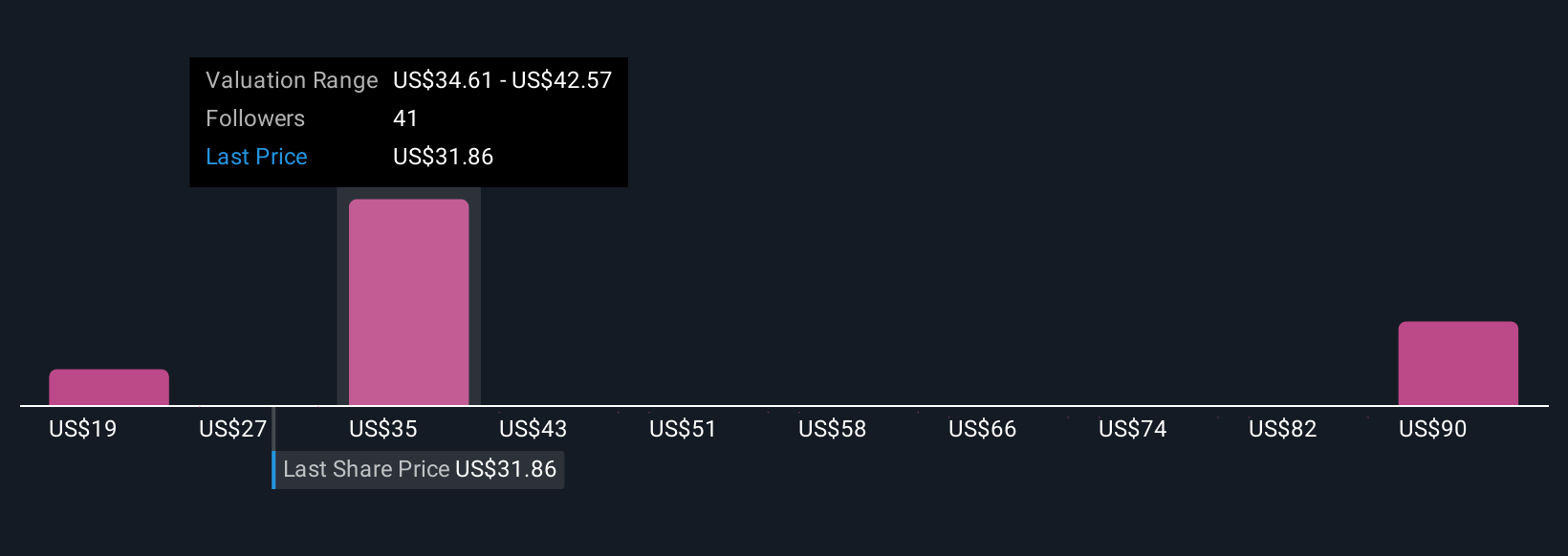

Nine members of the Simply Wall St Community estimate GSL’s fair value between US$22.06 and US$101.91 per share. While opinions range widely, industry supply constraints in midsize and smaller ships remain a central consideration for future earnings, check out the full spread of views to see how your outlook might compare.

Explore 9 other fair value estimates on Global Ship Lease - why the stock might be worth over 2x more than the current price!

Build Your Own Global Ship Lease Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Ship Lease research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Global Ship Lease research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Ship Lease's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GSL

Global Ship Lease

Engages in owning and chartering of containerships under fixed-rate charters to container shipping companies worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives