- United States

- /

- Logistics

- /

- NYSE:EXPD

Will Expeditors (EXPD) Shareholder Rewards Reflect a Strategic Shift in Capital Allocation?

Reviewed by Sasha Jovanovic

- Expeditors International of Washington reported its third quarter 2025 results, declared a semi-annual US$0.77 per share dividend payable on December 15, 2025, and announced the recent completion of a 1.8 million share buyback tranche at a cost of US$215.37 million.

- These combined actions highlight the company’s consistent approach to shareholder returns and reflect management’s confidence in operational performance.

- With shareholder returns in focus, we’ll explore how the latest dividend increase shapes Expeditors International’s investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Expeditors International of Washington's Investment Narrative?

Owning Expeditors International of Washington means believing in the company’s disciplined capital allocation and focus on returning cash to shareholders, even when revenue growth is muted. The freshly declared US$0.77 dividend and recent US$215.37 million buyback send a clear message: management is positioned to reward shareholders, signaling ongoing operational strength despite a third quarter revenue dip and minor net income decrease. These shareholder-friendly actions, coupled with high return on equity, may help underpin confidence in the business and cushion short-term headwinds, such as softer revenue trends and executive transition risk, following the appointment of a new CFO. However, the recent pop in share price and ongoing insider selling add uncertainty, keeping some risks in play. For near-term catalysts, continued disciplined execution and stability in margins will be important to watch as the company works to sustain its track record. But beneath these shareholder returns, insider selling is a risk every investor should keep on their radar.

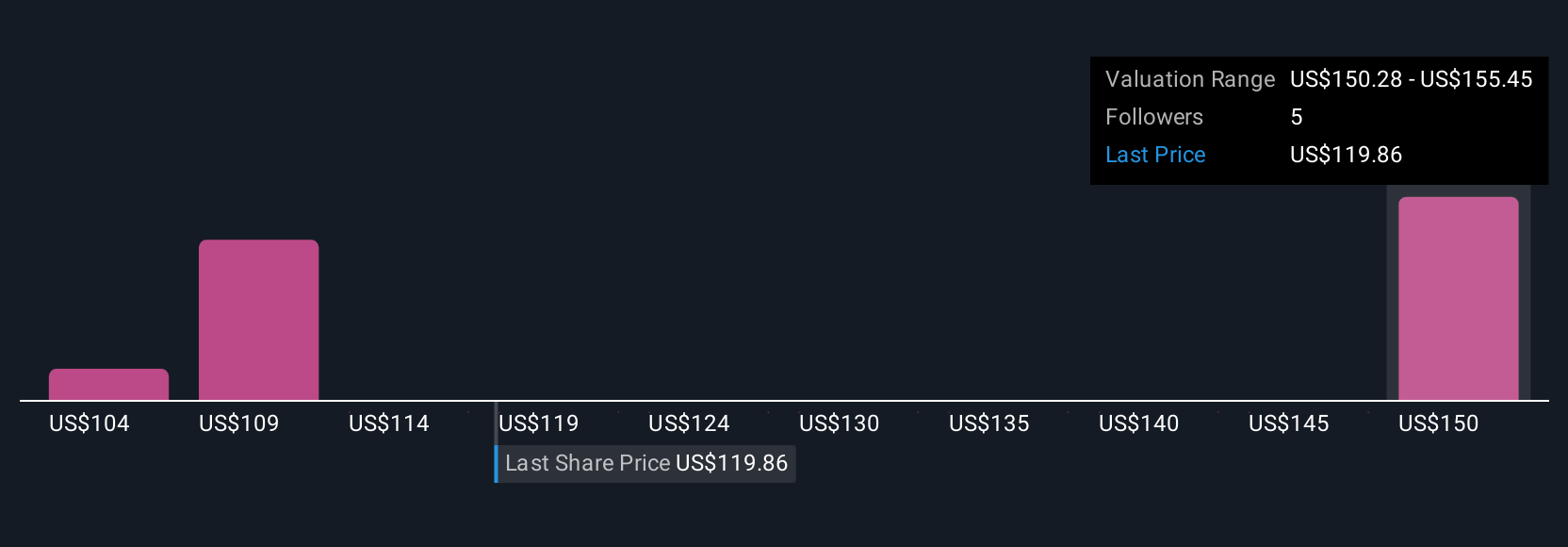

Expeditors International of Washington's shares have been on the rise but are still potentially undervalued by 27%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Expeditors International of Washington - why the stock might be worth 25% less than the current price!

Build Your Own Expeditors International of Washington Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expeditors International of Washington research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Expeditors International of Washington research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expeditors International of Washington's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expeditors International of Washington might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXPD

Expeditors International of Washington

Provides logistics services in the Americas, North Asia, South Asia, Europe, and MAIR.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives