- United States

- /

- Logistics

- /

- NYSE:EXPD

Expeditors International (EXPD): Assessing Valuation as Q3 Earnings Anticipation Builds

Reviewed by Simply Wall St

Investors are focused on Expeditors International of Washington (EXPD) as the company prepares to announce its third-quarter results on November 4. Despite weaker freight demand, there is optimism for strong earnings outcomes this quarter.

See our latest analysis for Expeditors International of Washington.

Expeditors International of Washington has caught a wave of investor optimism lately, with the share price up 10.8% year-to-date as anticipation builds for the upcoming earnings report. While the 1-year total shareholder return sits at a solid 3.7%, it is the company’s strong three- and five-year total returns (33.3% and 46.2% respectively) that highlight steady, long-term momentum despite some recent short-term volatility.

If you’re following the market’s movers and shakers in transportation, this could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

The question now is whether Expeditors International of Washington is trading below its true value or if the market has already factored in any upside, leaving little room for a true buying opportunity.

Price-to-Earnings of 19.4x: Is it justified?

With Expeditors International of Washington trading at a price-to-earnings (P/E) ratio of 19.4x and a recent closing price of $121.9, the stock appears expensive compared to several key benchmarks, despite delivering strong shareholder returns.

The P/E ratio captures how much investors are willing to pay for each dollar of earnings. It is a central metric for valuing established, profitable companies like Expeditors. In the context of global logistics firms, a high P/E could signal optimism for sustained earnings or imply the stock is trading on future expectations.

Expeditors’ current multiple sits above the industry average of 16x and significantly exceeds its fair P/E estimate of 12.6x. This suggests the market is assigning a premium to Expeditors’ earnings, potentially pricing in outperformance or unique strengths not reflected in sector-wide metrics. However, the gap to the fair ratio points to a level the market may reconsider, especially if growth does not accelerate as anticipated.

Explore the SWS fair ratio for Expeditors International of Washington

Result: Price-to-Earnings of 19.4x (OVERVALUED)

However, analysts caution that stagnant revenue growth and a noticeable drop in annual net income may signal looming headwinds for the company’s upward momentum.

Find out about the key risks to this Expeditors International of Washington narrative.

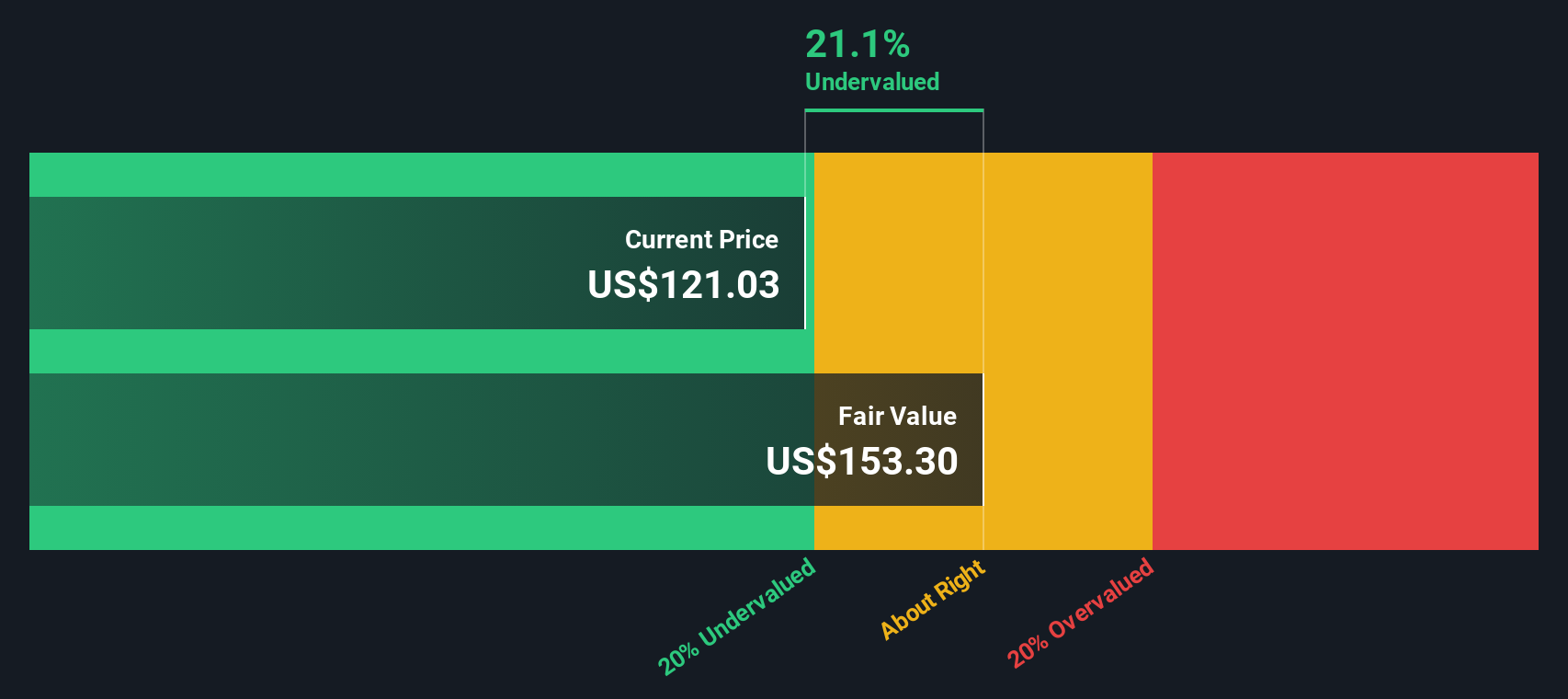

Another View: Discounted Cash Flow

While the price-to-earnings ratio points to Expeditors International of Washington being overvalued against peers and sector averages, our DCF model paints a different picture. Based on future cash flow estimates, the stock trades about 21% below its fair value. This signals possible undervaluation despite muted near-term growth forecasts. Is the market being too cautious, or is something lurking behind the numbers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Expeditors International of Washington for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Expeditors International of Washington Narrative

If you’re driven to reach your own conclusions or want to investigate the numbers from a fresh angle, you can put together your own assessment in just a few minutes. Do it your way

A great starting point for your Expeditors International of Washington research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready to Spot More Standout Opportunities?

Set yourself up for smarter investing by uncovering some of the hottest market themes right now. Your next great idea is only a click away. Don’t let these chances slip by.

- Tap into emerging health technology by starting your search with these 33 healthcare AI stocks, where pioneering companies are upgrading patient care through artificial intelligence.

- Capture stable returns and long-term income. Check out these 22 dividend stocks with yields > 3% featuring companies generating yields above 3% and solid financials.

- Ride the blockchain boom and see which businesses are shaping the digital asset revolution in these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expeditors International of Washington might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXPD

Expeditors International of Washington

Provides logistics services in the Americas, North Asia, South Asia, Europe, and MAIR.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives