- United States

- /

- Airlines

- /

- NYSE:DAL

Should Investors Rethink Delta After Recent Travel Demand Fuels Market Optimism?

Reviewed by Bailey Pemberton

- Curious about whether Delta Air Lines stock is a great buy now? If you're looking for value and growth, you're in the right place.

- The share price has moved a bit lately, with a 3.2% dip over the last week but a respectable 80.3% jump over three years. This shows that long-term gains are still in play.

- Recently, upbeat travel demand and new route expansions have helped fuel investor optimism. These factors have helped offset industry-wide concerns about rising fuel costs and macroeconomic volatility. Major news outlets have highlighted Delta’s steady operational improvements and partnership announcements, providing a solid backdrop for the latest market moves.

- On paper, Delta scores a perfect 6 out of 6 on our undervaluation checks, suggesting the potential for value is strong. Next, we will break down the main approaches investors use to value Delta, and at the end, reveal a smarter way to see the full picture.

Find out why Delta Air Lines's 4.1% return over the last year is lagging behind its peers.

Approach 1: Delta Air Lines Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates what a business is worth today by taking expected future cash flows and discounting them back to present value. In Delta Air Lines' case, this involves projecting how much cash the company will generate over the coming years and calculating what that stream of cash is worth in today's dollars.

Right now, Delta’s last twelve months’ Free Cash Flow sits at $2.3 Billion. Analyses suggest this will climb steadily, reaching a projected $5.6 Billion by 2035. Only the next five years, up to $4.7 Billion in 2028, are based on direct analyst estimates. Further numbers are extended from those trends. Across these years, projections point to a consistent increase in cash generation, which is favorable for long-term value investors.

Based on the detailed DCF analysis, Delta’s estimated intrinsic value comes out to $99.31 per share. When measured against its recent trading levels, this implies the stock is priced around 41.1% below what it’s truly worth, signaling a significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Delta Air Lines is undervalued by 41.1%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Delta Air Lines Price vs Earnings (PE)

The Price-to-Earnings, or PE, ratio is one of the most reliable tools for valuing consistently profitable companies like Delta Air Lines. Because it measures how much investors are willing to pay for a dollar of earnings, PE provides a straightforward snapshot of market sentiment and expectations for future growth.

When analyzing PE ratios, it is important to remember that higher ratios often reflect optimism about future earnings growth or lower perceived risk. Conversely, a lower PE might signal slower expected growth or higher business risks. To see where Delta stands, we can look at several important benchmarks.

- Delta’s current PE ratio: 8.2x

- Airlines industry average: 8.9x

- Peer companies average: 18.4x

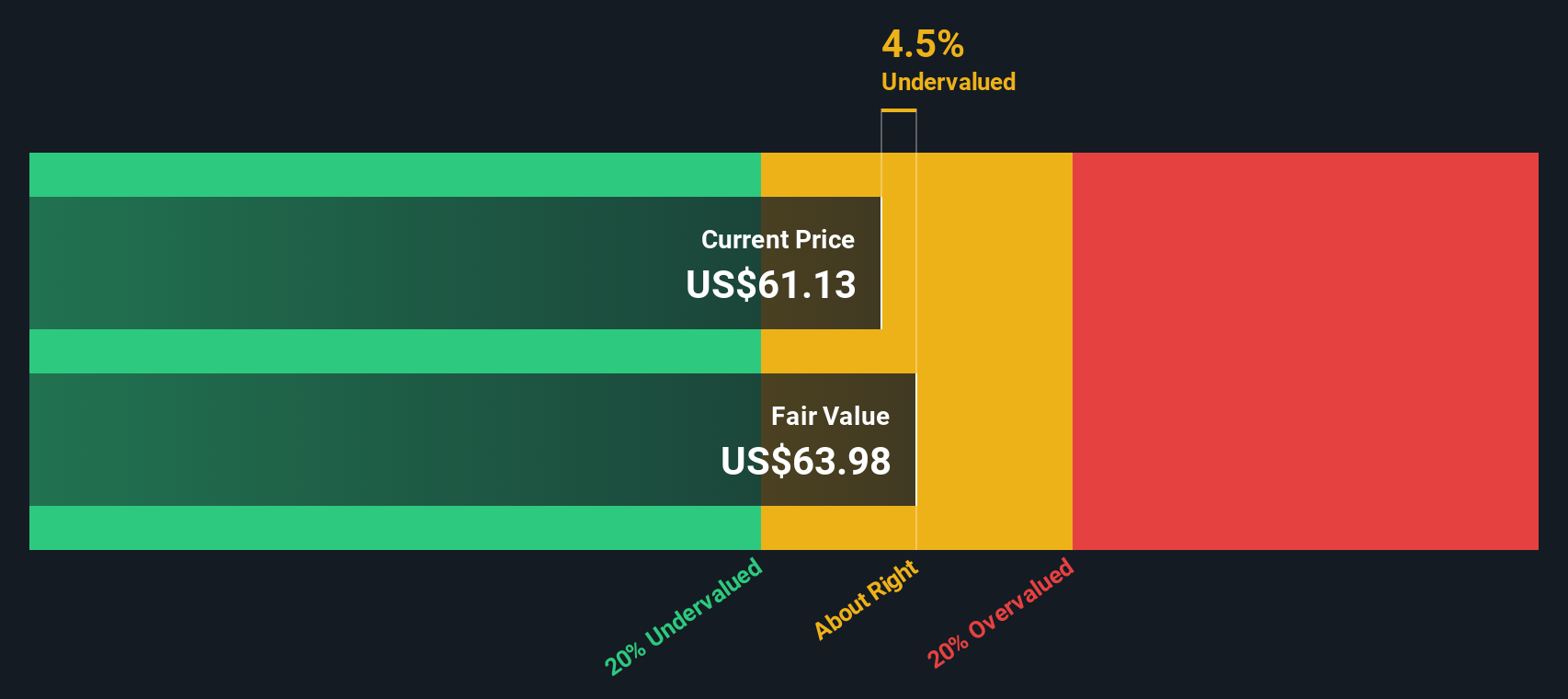

Instead of relying solely on generalized benchmarks, Simply Wall St uses a proprietary “Fair Ratio” that factors in Delta’s own growth outlook, profit margins, risk profile, its industry and market cap. This approach helps avoid misleading comparisons with either high-flying peers or broad industry numbers that may not tell the full story for Delta specifically.

For Delta, the Fair Ratio is 13.3x, which is notably higher than its actual PE of 8.2x. This suggests the market is currently undervaluing Delta based on its current fundamentals and future prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Delta Air Lines Narrative

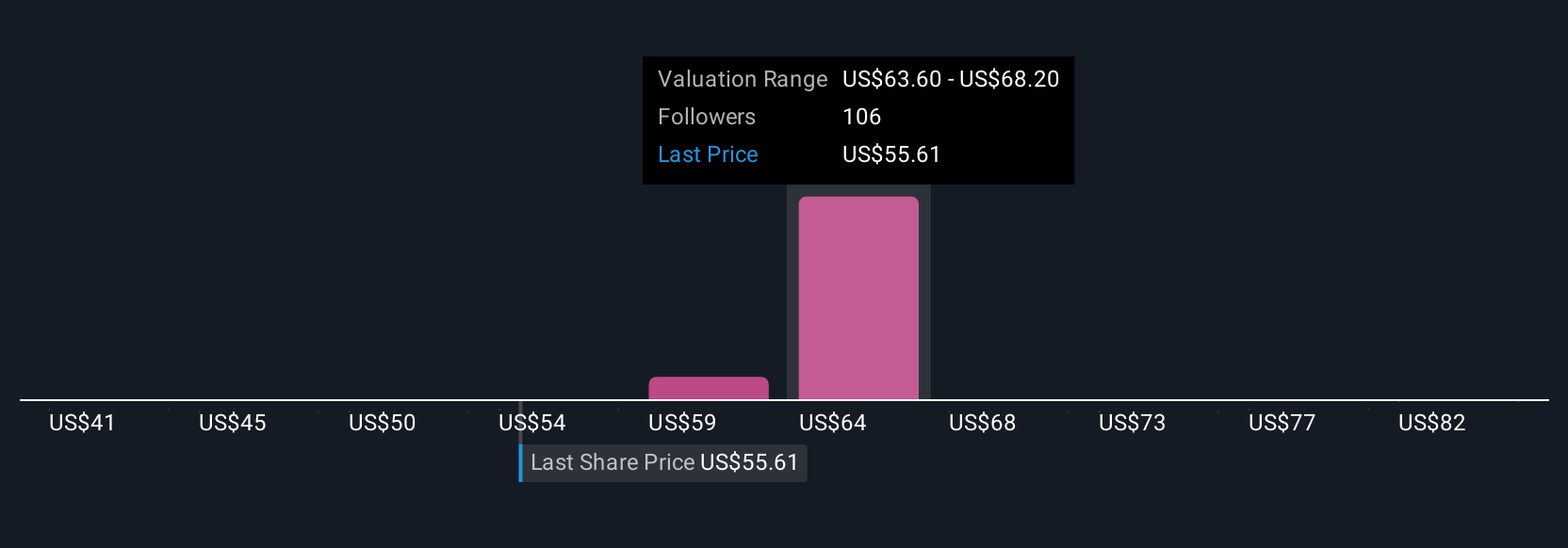

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story for a company like Delta Air Lines. You decide what you believe about Delta’s prospects, and plug in your own fair value, growth estimates, and assumptions about future earnings and margins.

Narratives bridge the gap between financials and forecasts, connecting Delta's real-world business story to a projected financial outcome, and ultimately to the fair value you think is justified. What makes Narratives especially useful is that they are accessible to anyone, right on Simply Wall St’s Community page, where millions of investors share their perspectives.

With Narratives, you can instantly see if your story signals the stock is undervalued or overvalued by comparing your Fair Value with the current Price. This makes it easier to decide when to buy or sell. Because Narratives update dynamically as new news or earnings data comes in, your view always reflects the latest information.

For example, some Delta Narratives see fair value as high as $90 per share, banking on strong premium travel growth, while others are more cautious, estimating fair value closer to $49 in light of economic or industry risks. This is a clear reminder that the market is built on divergent, evolving stories.

Do you think there's more to the story for Delta Air Lines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Very undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives