- United States

- /

- Airlines

- /

- NYSE:DAL

Is Delta’s Legal Battle with U.S. Regulators Creating an Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Delta Air Lines stock? You’re not alone. The past year has been a whirlwind, with the share price up 10.9%. If you zoom out to three years, it’s nearly doubled. Even just this past week, Delta rallied an impressive 8.0%. What’s powering that kind of growth, and is there more room to run?

Some of the action can be chalked up to headlines. Delta has been in the news lately for everything from suing over a dissolved joint venture with Aeromexico to swapping out engine units on hundreds of jets and settling a class action lawsuit. There are bumps in the road, such as FAA staffing delays throwing a wrench into travel plans, and tech experiments with AI-driven fares sparking debate. So far, these risks haven’t derailed the stock’s momentum.

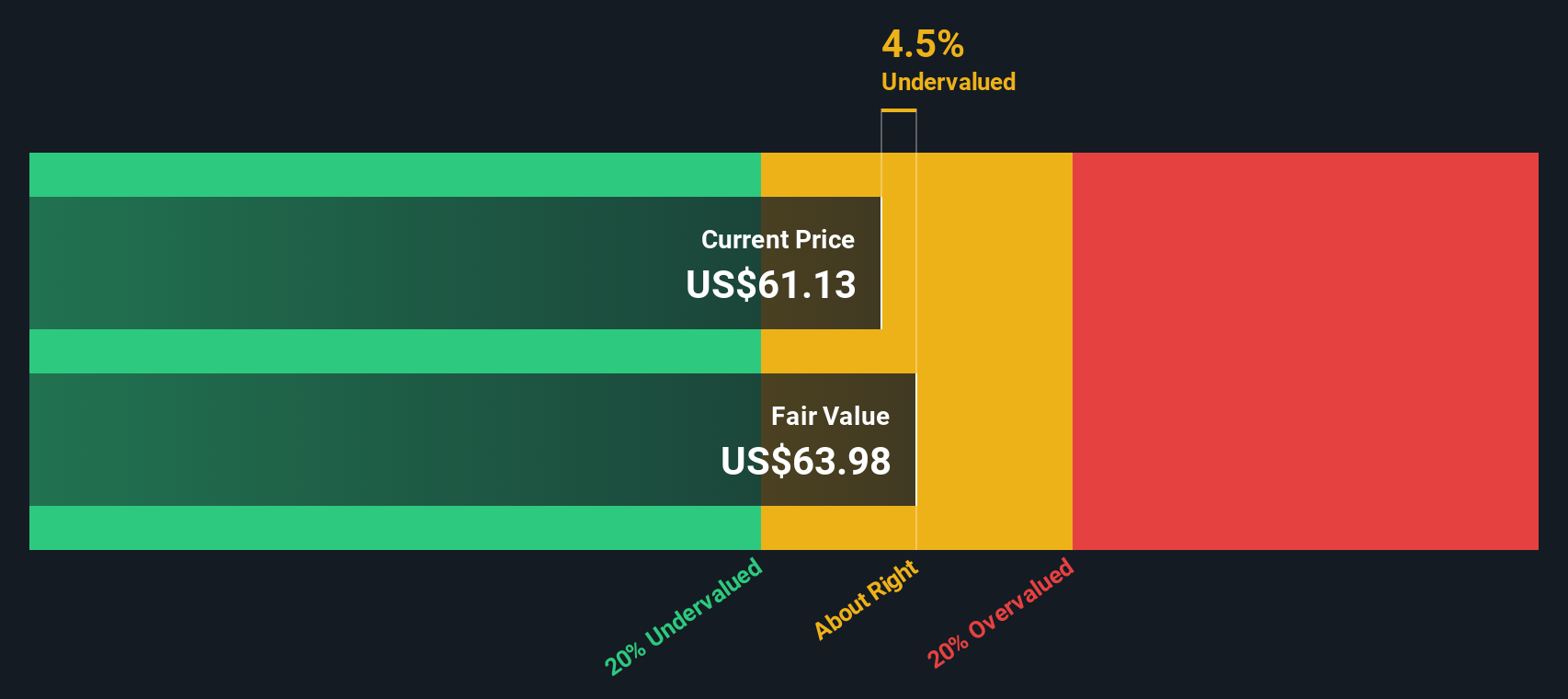

Despite all this commotion, here’s the real kicker: Delta scores a hefty 5 out of 6 on our valuation checklist. That means by almost every metric, the shares look undervalued. Some investors are starting to recognize the opportunity, and it’s visible in that 101.3% five-year return. But how do those valuation models actually stack up, and is there a deeper way to judge whether Delta is truly a deal? Let’s break down the main valuation approaches before we dig into the way savvy investors are reading between the lines.

Why Delta Air Lines is lagging behind its peers

Approach 1: Delta Air Lines Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to today’s value. For Delta Air Lines, this involves considering how much cash the business generates now, projecting how much it could generate in the future, and evaluating what those future dollars are worth in today’s terms.

Delta’s latest twelve-month free cash flow stands at $2.3 Billion. Analyst estimates project steady growth, with free cash flow reaching $4.7 Billion by 2028. After that, projections continue to 2035, steadily increasing to an estimated $5.6 Billion before discounting. Each year of forecasted cash flow is discounted to reflect its present value, ensuring a conservative and grounded approach.

Based on this DCF analysis, Delta’s fair value comes out to $99.98 per share. With the current share price trading at a 38.3% discount to this intrinsic value, Delta Air Lines stock appears significantly undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Delta Air Lines is undervalued by 38.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Delta Air Lines Price vs Earnings

For companies like Delta Air Lines that generate positive earnings, the Price-to-Earnings (PE) ratio is often the go-to metric for investors. It helps you gauge how much you’re paying for each dollar of a company’s profits. The lower the ratio, the cheaper the stock appears relative to its earnings.

Of course, what counts as a “normal” or “fair” PE ratio isn’t one-size-fits-all. Higher-growth, lower-risk companies generally warrant higher PE ratios, while more mature or uncertain businesses tend to trade closer to their historical or industry averages.

Currently, Delta trades at a PE ratio of 8.6x. That is lower than the industry average for airlines at 9.9x, and it looks even cheaper compared to the company’s peer average of 21.9x.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, calculated at 12.8x for Delta, reflects not just peer comparisons but also factors in Delta’s earnings growth, profit margins, market capitalization, and company-specific risks. Unlike basic averages, it offers a more tailored view of what investors should be willing to pay.

With Delta’s actual PE well below its Fair Ratio, the shares look undervalued according to this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Delta Air Lines Narrative

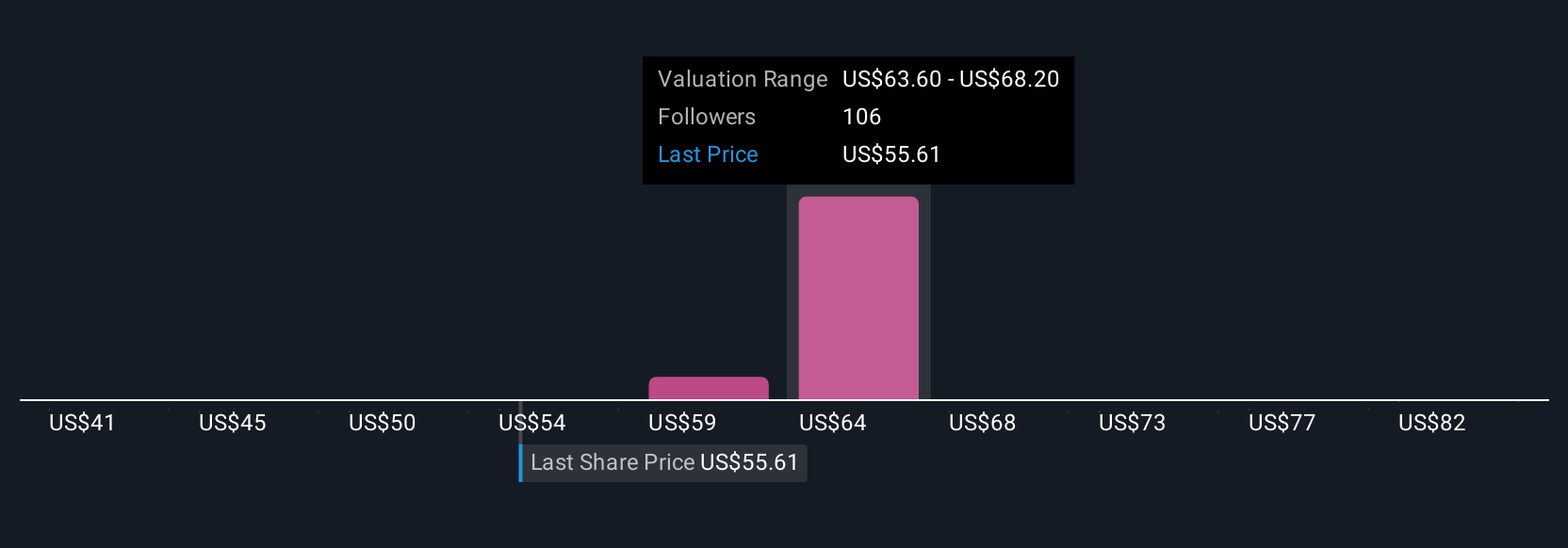

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story. It connects your outlook for a company (like Delta Air Lines), including your fair value estimate and forecasts for future revenue, earnings, and profit margins, to a clear, quantitative valuation.

Instead of relying only on formulas, Narratives help you tie together the company’s unique situation, your expectations, and market events, so you can see how different factors might change your investment thesis over time. Narratives are available to everyone on Simply Wall St’s Community page, where millions of investors use them to build and refine their strategies.

You can use a Narrative to decide when to buy or sell by comparing your calculated Fair Value with the current share price, helping you act with confidence rather than guesswork. What makes Narratives especially powerful is that they update automatically as new data, news, or earnings reports come in, giving you a living, breathing picture of your investment idea.

For example, some investors see Delta’s Fair Value near $49 per share if they’re concerned about travel demand and profit margins. Others believe it could reach $90 if strong earnings and premium offerings continue, both justified with clear numbers and logic.

For Delta Air Lines, we’ll make it easy for you with previews of two leading Delta Air Lines Narratives:

Fair Value: $70.46

Undervalued by: 12.4%

Revenue Growth Forecast: 3.6%

- Analysts project steady revenue growth, led by premium services, global partnerships, and long-term MRO agreements that support diversification.

- Cost management and flat capacity growth are expected to support margins, while a focus on customer loyalty and differentiated service enhances resilience.

- Risks remain from economic uncertainty, tariffs, and competitive pressure, but analyst consensus price target is 10.5% above the current price, reflecting optimism about future earnings.

Fair Value: $59.84

Overvalued by: 3.1%

Revenue Growth Forecast: 3.5%

- Despite strong cost effectiveness and industry leadership, Delta faces headwinds from waning travel demand and has revised down its future growth estimates.

- Major threats include a strained balance sheet susceptible to economic shocks and the impact of U.S. tariff policies, which are depressing travel demand, especially on key transatlantic routes.

- While Delta is expected to outperform peers, thin margins and visibility issues limit its upside, and shares are considered moderately overvalued at current levels.

Do you think there's more to the story for Delta Air Lines? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Very undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives