- United States

- /

- Marine and Shipping

- /

- NYSE:CMRE

A Fresh Look at Costamare (NYSE:CMRE) Valuation as Shares Outperform Analyst Targets

Reviewed by Simply Wall St

See our latest analysis for Costamare.

The recent surge in Costamare’s share price, up 17.3% over the past month and 26.6% in the last 90 days, has caught investors’ attention and hints at growing confidence in the company’s value and outlook. While short-term gains stand out, the stock’s strong 1-year total shareholder return of 30.9% and substantial 269.6% over five years show that momentum is clearly building for patient investors.

If you’re watching how shipping stocks are gaining traction, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

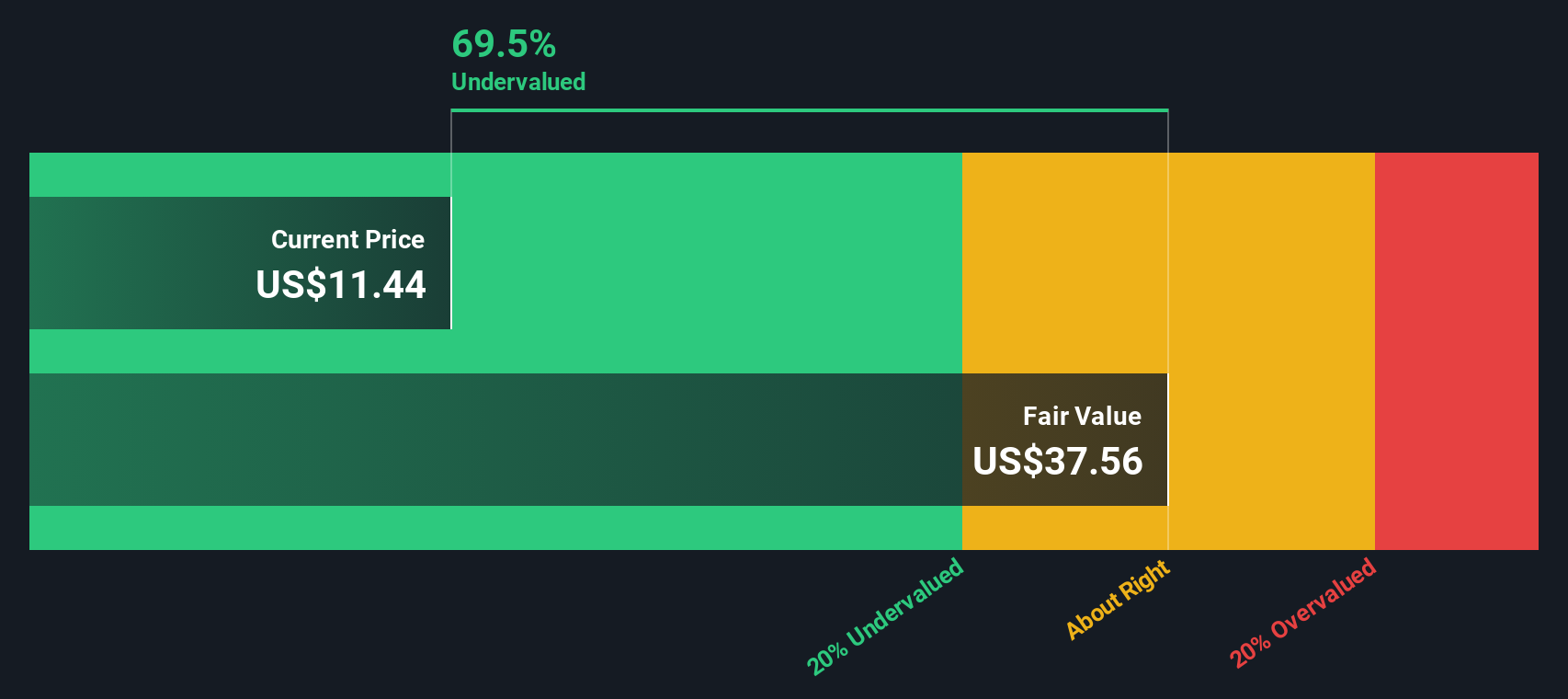

With shares surging above analyst price targets yet fundamentals staying mostly flat, the real question is whether Costamare remains an undervalued gem or if the market is already factoring in future growth expectations. Is there still a buying opportunity?

Most Popular Narrative: 21% Overvalued

Costamare’s last close at $13.50 stands conspicuously higher than the most widely followed fair value estimate of $11.15. That gap sets the stage for a closer look at the catalysts fueling analyst expectations and the assumptions behind them.

The recent increase in price targets reflects confidence in the company’s ability to maintain revenue momentum and capitalize on industry demand. However, valuation upgrades are tempered by structural challenges. Some analysts maintain a more neutral stance until improvements in balance sheet metrics are observed.

Curious about the bold financial moves underpinning this valuation? Dive deeper to discover which strong profit margin assumptions and forward-looking earnings projections are tipping the scales in this narrative’s fair value math. Find out which levers analysts believe could redefine Costamare’s story.

Result: Fair Value of $11.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained contracted revenue and disciplined fleet renewal could offset long-term headwinds and support Costamare’s earnings even if shipping conditions soften.

Find out about the key risks to this Costamare narrative.

Another View: Discounted Cash Flow Suggests Upside

Looking beyond market multiples, our SWS DCF model points to a markedly different outcome. It values Costamare at $39.62 per share, which is well above today’s price. This significant gap suggests the market might be overlooking future cash flows, or the model could be too optimistic.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Costamare Narrative

If you want to dig into the numbers yourself or see where your take on Costamare differs, you can put your own narrative together in just a few minutes, your way Do it your way

A great starting point for your Costamare research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stock markets reward those who keep their eyes open for emerging themes and compelling opportunities. Get ahead of the curve by using these powerful tools to track unique trends and build a smarter portfolio now.

- Boost your passive income by checking out these 17 dividend stocks with yields > 3% with yields that go beyond the average market offering.

- Position yourself at the forefront of tech innovation by tapping into these 28 quantum computing stocks, which is shaping the future of quantum computing.

- Uncover remarkable value opportunities before the crowd by reviewing these 862 undervalued stocks based on cash flows, driven by robust cash flows and financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMRE

Costamare

Owns and operates containerships and dry bulk vessels worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives