Stock Analysis

- United States

- /

- Infrastructure

- /

- NYSE:CAAP

If You Had Bought Corporación América Airports (NYSE:CAAP) Stock A Year Ago, You'd Be Sitting On A 45% Loss, Today

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Corporación América Airports S.A. (NYSE:CAAP) share price slid 45% over twelve months. That falls noticeably short of the market return of around 6.3%. Corporación América Airports hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. On top of that, the share price is down 18% in the last week. But this could be related to the soft market, which is down about 11% in the same period.

Check out our latest analysis for Corporación América Airports

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Corporación América Airports managed to increase earnings per share from a loss to a profit, over the last 12 months.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action. So it makes sense to check out some other factors.

Corporación América Airports managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

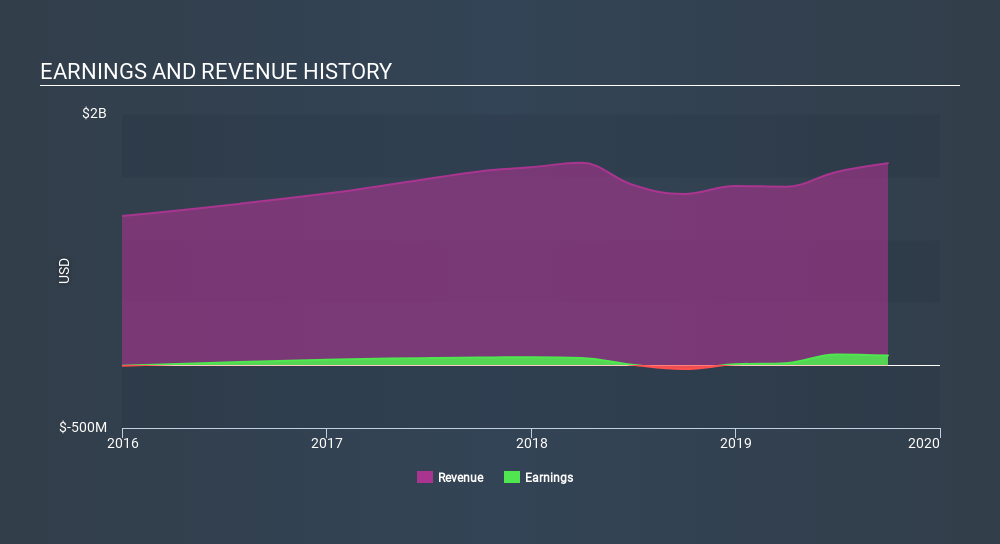

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Corporación América Airports has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While Corporación América Airports shareholders are down 45% for the year, the market itself is up 6.3%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 4.1%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Corporación América Airports (1 is concerning!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:CAAP

Corporación América Airports

Through its subsidiaries, acquires, develops, and operates airport concessions.

Undervalued with proven track record.