- United States

- /

- Transportation

- /

- NasdaqGS:WERN

Werner Enterprises (WERN) Is Down 5.3% After Reporting Net Loss and $18M Legal Settlement – What's Changed

Reviewed by Sasha Jovanovic

- Werner Enterprises recently reported a third quarter net loss of US$20.58 million, reversing profitability from a year earlier despite increasing quarterly revenue to US$771.5 million, while also settling longstanding class action lawsuits for US$18 million, subject to court approval.

- The combination of the unexpected quarterly net loss and a significant legal settlement marks a substantial shift in the company's operating landscape and long-term cost structure.

- We'll explore how the third quarter net loss and litigation settlement may affect Werner's investment outlook and long-term growth plans.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Werner Enterprises Investment Narrative Recap

To be a shareholder in Werner Enterprises right now, you have to believe the company’s long-term investments in fleet modernization, technology, and integrated logistics can offset current cost pressures and restore profitability. The sharp third quarter net loss and US$18 million class action settlement are meaningful in the short term, with the litigation settlement immediately impacting the company’s expenses and highlighting that insurance and legal costs remain the most important risk to watch at present.

Of the company's latest updates, the recently announced class action settlement stands out as the most relevant development. This US$18 million agreement to resolve decade-old driver wage claims brings cost clarity, but also underscores the persistent nature of litigation risk, a core challenge for the industry and Werner's cost base, even after the reversal of a previous US$90 million verdict in Texas earlier in the year.

However, while new contracts and technology upgrades offer long-term promise, the risk of recurring insurance and litigation costs remains a factor investors should not overlook…

Read the full narrative on Werner Enterprises (it's free!)

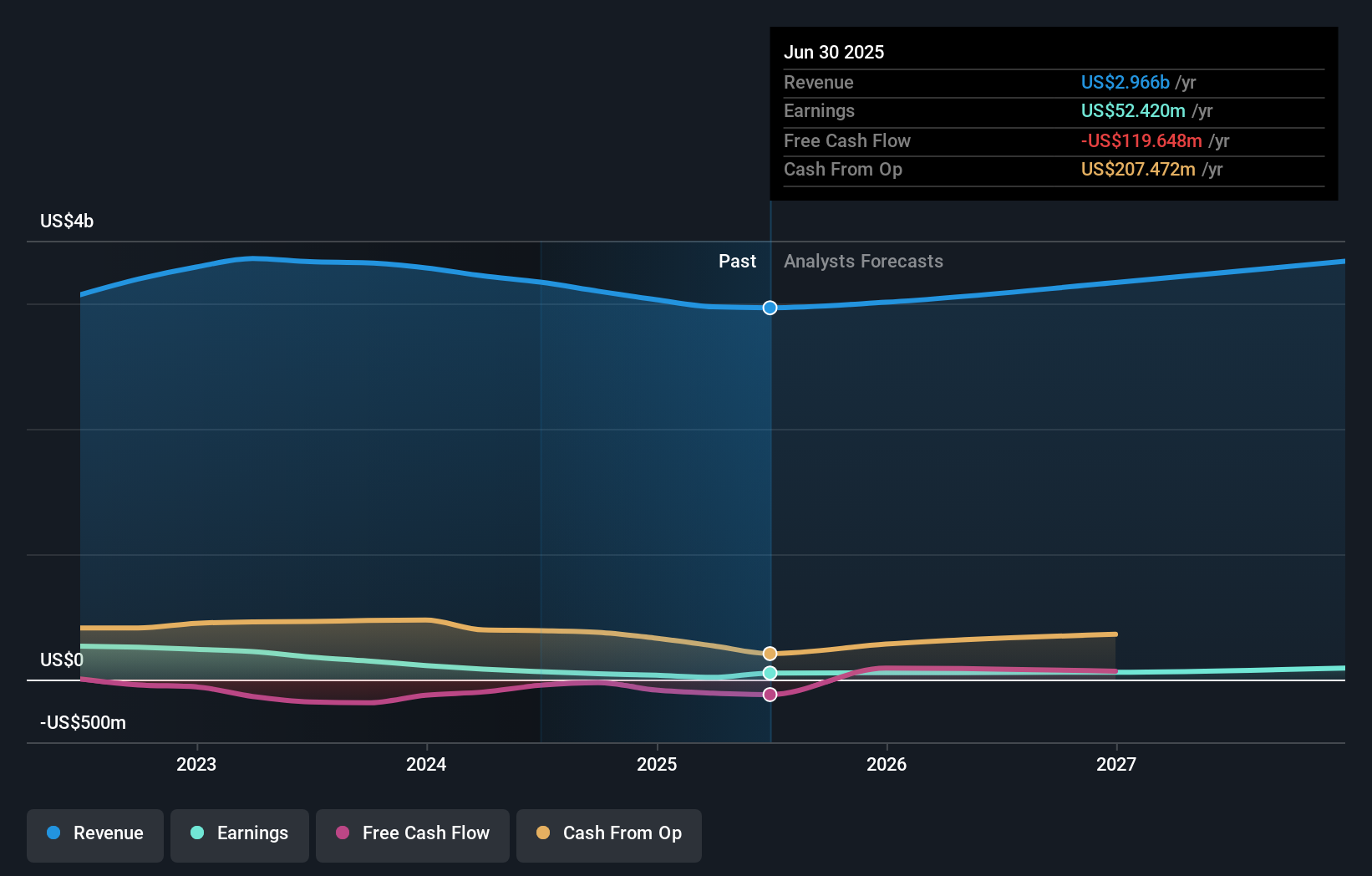

Werner Enterprises' outlook anticipates $3.4 billion in revenue and $100.2 million in earnings by 2028. This projection is based on a 5.0% annual revenue growth rate and nearly doubling earnings, an increase of about $47.8 million from the current earnings of $52.4 million.

Uncover how Werner Enterprises' forecasts yield a $27.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

The single fair value estimate from the Simply Wall St Community sits at US$27, unchanged since before the US$20.58 million quarterly loss and US$18 million legal settlement. While many see upside in fleet and tech investments, persistent legal expenses may continue to weigh on performance, so take time to compare the range of community outlooks.

Explore another fair value estimate on Werner Enterprises - why the stock might be worth as much as $27.00!

Build Your Own Werner Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Werner Enterprises research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Werner Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Werner Enterprises' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Werner Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WERN

Werner Enterprises

Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives