- United States

- /

- Transportation

- /

- NasdaqGS:WERN

How Investors Are Reacting to Werner Enterprises (WERN) Third Quarter Loss and Higher Litigation Costs

Reviewed by Sasha Jovanovic

- Werner Enterprises reported third quarter 2025 results showing revenue of US$771.5 million and a net loss of US$20.58 million, primarily due to increased operating costs and an US$18 million litigation settlement.

- The Werner Logistics segment delivered 12.5% revenue growth and improved operating income, signaling resilience amid wider cost and legal pressures on the company.

- We'll examine how elevated operating expenses, including litigation costs, impact Werner Enterprises' investment outlook and future profit potential.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Werner Enterprises Investment Narrative Recap

To be a shareholder in Werner Enterprises right now, you need to believe in the company’s ability to manage elevated costs and ongoing legal risks while leveraging growth in its logistics segment. The Q3 2025 results highlight how litigation settlements and higher operating expenses remain a headwind, impacting short-term profitability but not triggering a new major catalyst or risk beyond what has already been in focus for investors.

One recent announcement directly tied to these challenges is Werner’s $18 million settlement in ongoing class action lawsuits, recorded in the latest quarter. This settlement underpins the near-term pressure on earnings and reinforces the importance of effective legal and cost risk management as a central consideration for shareholders weighing the current catalysts and risks around the stock.

In contrast, it’s essential investors are aware of how persistent litigation and insurance costs could erode net margins over time if not contained…

Read the full narrative on Werner Enterprises (it's free!)

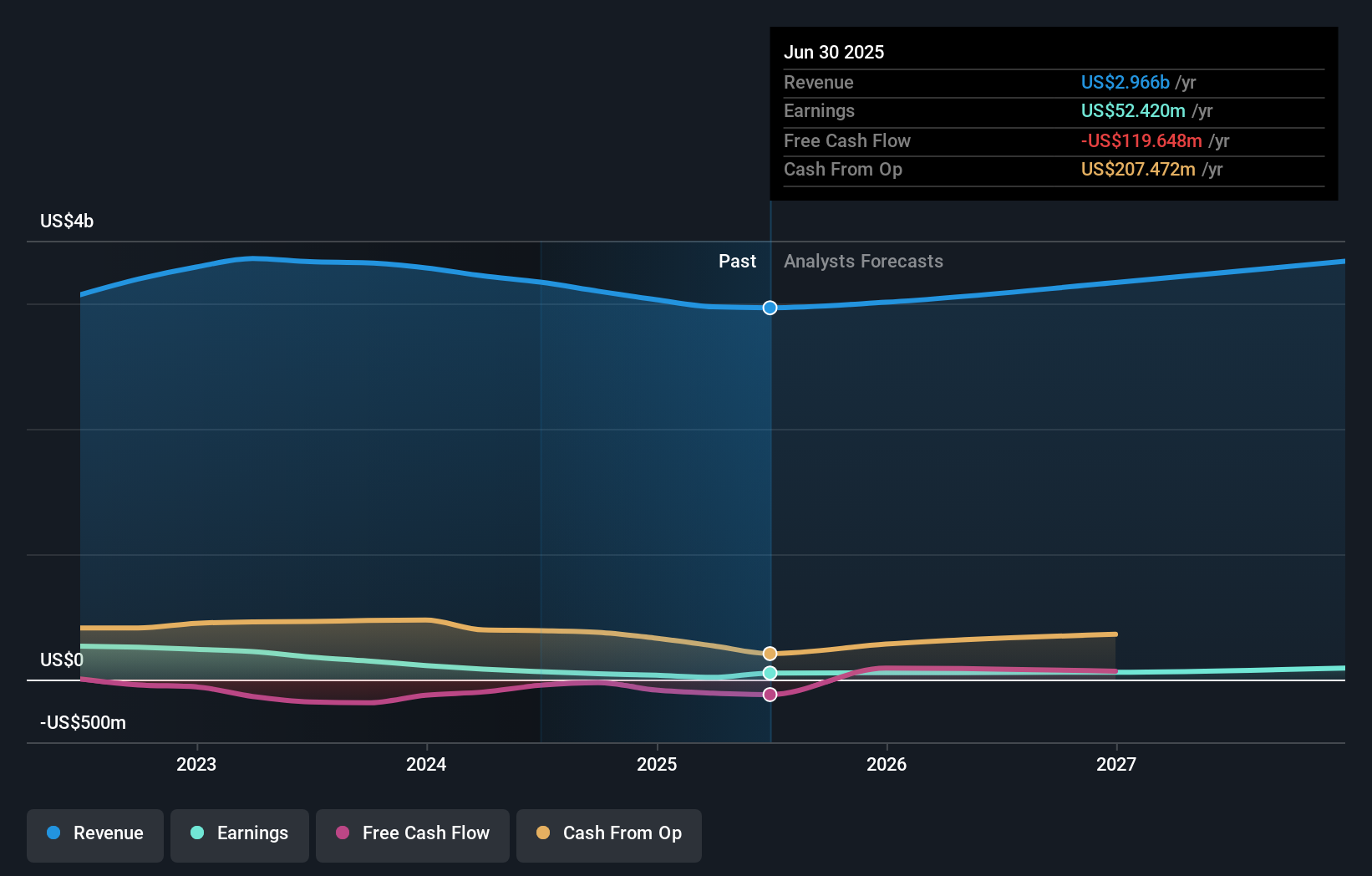

Werner Enterprises' outlook anticipates $3.4 billion in revenue and $100.2 million in earnings by 2028. This assumes a 5.0% annual revenue growth rate and an earnings increase of $47.8 million from the current $52.4 million.

Uncover how Werner Enterprises' forecasts yield a $26.13 fair value, in line with its current price.

Exploring Other Perspectives

One retail investor from the Simply Wall St Community valued Werner at US$26.13, with no variation in estimates. Many are focused on how rising legal costs may impact future earnings reliability, which brings up several views worth considering.

Explore another fair value estimate on Werner Enterprises - why the stock might be worth just $26.13!

Build Your Own Werner Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Werner Enterprises research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Werner Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Werner Enterprises' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Werner Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WERN

Werner Enterprises

Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives