- United States

- /

- Airlines

- /

- NasdaqGS:SKYW

SkyWest (SKYW) Valuation in Focus Following Earnings Beat and New Fleet Growth Initiatives

Reviewed by Simply Wall St

SkyWest (SKYW) just delivered quarterly results that topped both earnings and revenue expectations, giving investors plenty to talk about. Strong operational performance and new fleet initiatives appeared alongside the financial numbers and caught the market’s attention.

See our latest analysis for SkyWest.

After an upbeat quarter, SkyWest’s stock jumped with a 1-day share price return of 5.63%, reflecting renewed optimism as investors digested the company’s earnings beat and fresh fleet agreements. While short-term momentum picked up, the one-year total shareholder return remains slightly negative at -0.84%. This contrasts sharply with SkyWest’s standout three- and five-year total returns of 473% and 224% respectively, which are clear signs of long-term strength despite recent bouts of volatility.

If today’s rally has you curious about other market movers, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading about 38% below the average analyst price target, investors are left to wonder if SkyWest’s current valuation offers a window for upside or if the market is already factoring in future growth.

Most Popular Narrative: 23.8% Undervalued

With SkyWest's recent close at $100.48 and the most popular narrative assigning a fair value of $131.80, there's a noticeable gap that hints at a potential opportunity if these future assumptions hold true.

Fleet modernization through significant orders of new, fuel-efficient E175 aircraft under long-term, flexible contracts is expected to improve cost structure, enhance asset utilization, and boost net margins as newer planes replace older, less efficient models and support new multiyear agreements with major carriers.

What powerful growth and earnings leap do narrative-followers see ahead? The entire case pivots on how SkyWest will juggle its aggressive aircraft upgrades, fresh revenue streams, and runway for future profits. The numbers shaping this viewpoint are bolder than you might expect. See what is driving the upside risk for yourself.

Result: Fair Value of $131.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as pilot shortages and rising labor costs could quickly change SkyWest's outlook. These factors may put pressure on margins and reduce expected growth.

Find out about the key risks to this SkyWest narrative.

Another View: Is SkyWest Really Undervalued?

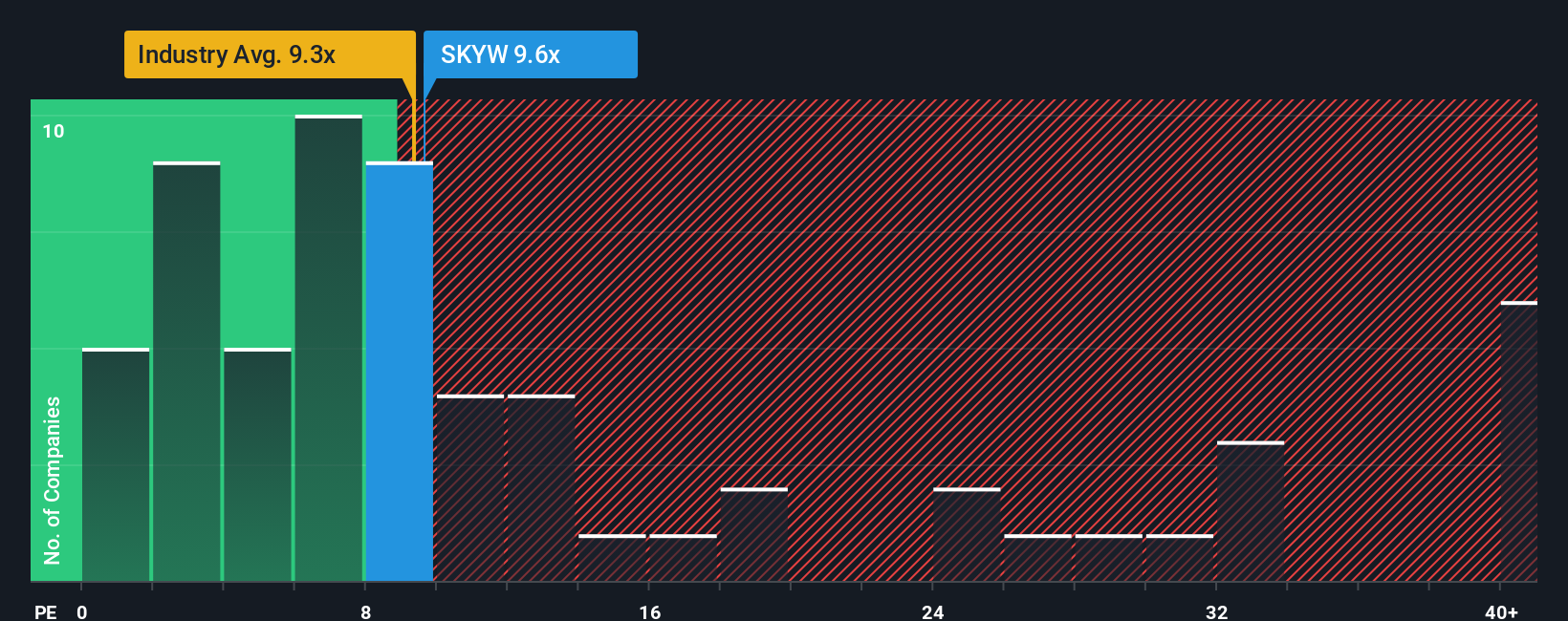

While SkyWest looks undervalued compared to analyst forecasts, a quick look at its price-to-earnings ratio paints a very different picture. The current P/E is 9.3x, actually higher than the global airlines industry average of 9.1x. However, it remains below its peer group’s 24x and the fair ratio of 11.4x.

This leaves investors with contrasting stories: does the smaller gap to that fair ratio represent an opportunity or a warning sign as sentiment shifts? The numbers can go either way.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SkyWest Narrative

If you see the story differently or want to dig into the numbers firsthand, you can craft your own narrative in just a few minutes: Do it your way

A great starting point for your SkyWest research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your strategy to a single opportunity when the market is bursting with standouts. Take charge of your next move with these unique angles:

- Spot high-yield opportunities and strengthen your portfolio by checking out these 22 dividend stocks with yields > 3% offering consistent payouts above 3%.

- Capture the momentum in artificial intelligence by scanning these 26 AI penny stocks poised for rapid growth and innovation.

- Get ahead of the next wave by researching these 3588 penny stocks with strong financials with solid financial foundations and big potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SKYW

SkyWest

Through its subsidiaries, engages in the operation of a regional airline in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives