- United States

- /

- Marine and Shipping

- /

- NasdaqGS:SBLK

Market Cool On Star Bulk Carriers Corp.'s (NASDAQ:SBLK) Earnings

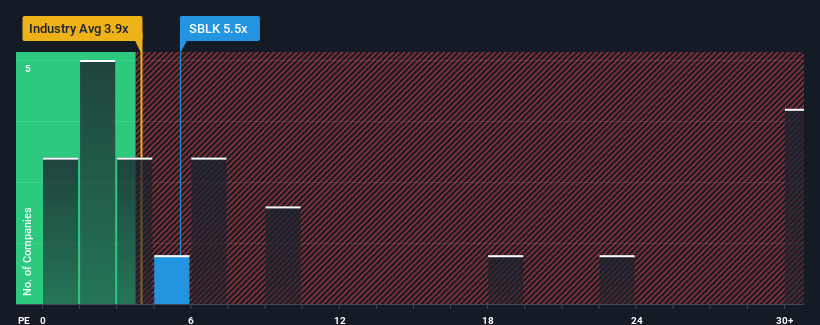

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider Star Bulk Carriers Corp. (NASDAQ:SBLK) as a highly attractive investment with its 5.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Star Bulk Carriers certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Star Bulk Carriers

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Star Bulk Carriers' is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 62% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 61% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 14% per year over the next three years. With the market only predicted to deliver 10% each year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Star Bulk Carriers' P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Star Bulk Carriers' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Star Bulk Carriers you should be aware of.

If these risks are making you reconsider your opinion on Star Bulk Carriers, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SBLK

Star Bulk Carriers

A shipping company, engages in the ocean transportation of dry bulk cargoes through the ownership and operation of dry bulk carrier vessels worldwide.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives