- United States

- /

- Marine and Shipping

- /

- NasdaqGS:SBLK

Earnings Estimate Cuts Could Be a Game Changer for Star Bulk Carriers (SBLK)

Reviewed by Sasha Jovanovic

- In recent trading sessions, Star Bulk Carriers experienced a reduction in analyst earnings estimates and a downward revision in business outlook ahead of its upcoming earnings announcement, with projections reflecting a marked decrease in earnings per share compared to the prior year.

- This shift in analyst sentiment, with a revised sell rating and lower EPS forecasts, has raised concerns about the company's near-term performance within the shipping sector.

- To understand the impact of these reduced earnings expectations, we’ll explore how this change affects Star Bulk Carriers’ investment narrative and future outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Star Bulk Carriers Investment Narrative Recap

For investors considering Star Bulk Carriers, the key thesis typically centers on exposure to global dry bulk trade volumes and the ability to generate strong shareholder returns through disciplined capital allocation. The recent downward revision in analyst earnings estimates and a sell rating highlight near-term earnings headwinds, which may challenge the immediate catalyst of improved freight rates offsetting operational risks. This shift also intensifies the most pressing risk: sustained pressure on revenue and profit margins if market conditions remain soft.

Among recent announcements, the completion of a substantial share buyback, nearly 5% of shares for US$79.65 million, stands out. While this move can support earnings per share in weaker periods, it does not directly address the earnings uncertainty flagged by revised analyst outlooks, keeping the focus on how Star Bulk responds to shorter-term profitability challenges. Despite this shareholder-friendly action, investors should be aware of the risk posed by an aging fleet and...

Read the full narrative on Star Bulk Carriers (it's free!)

Star Bulk Carriers' outlook anticipates $1.0 billion in revenue and $521.3 million in earnings by 2028. This reflects a 3.8% annual decline in revenue and a $397.1 million increase in earnings from the current $124.2 million.

Uncover how Star Bulk Carriers' forecasts yield a $21.86 fair value, a 20% upside to its current price.

Exploring Other Perspectives

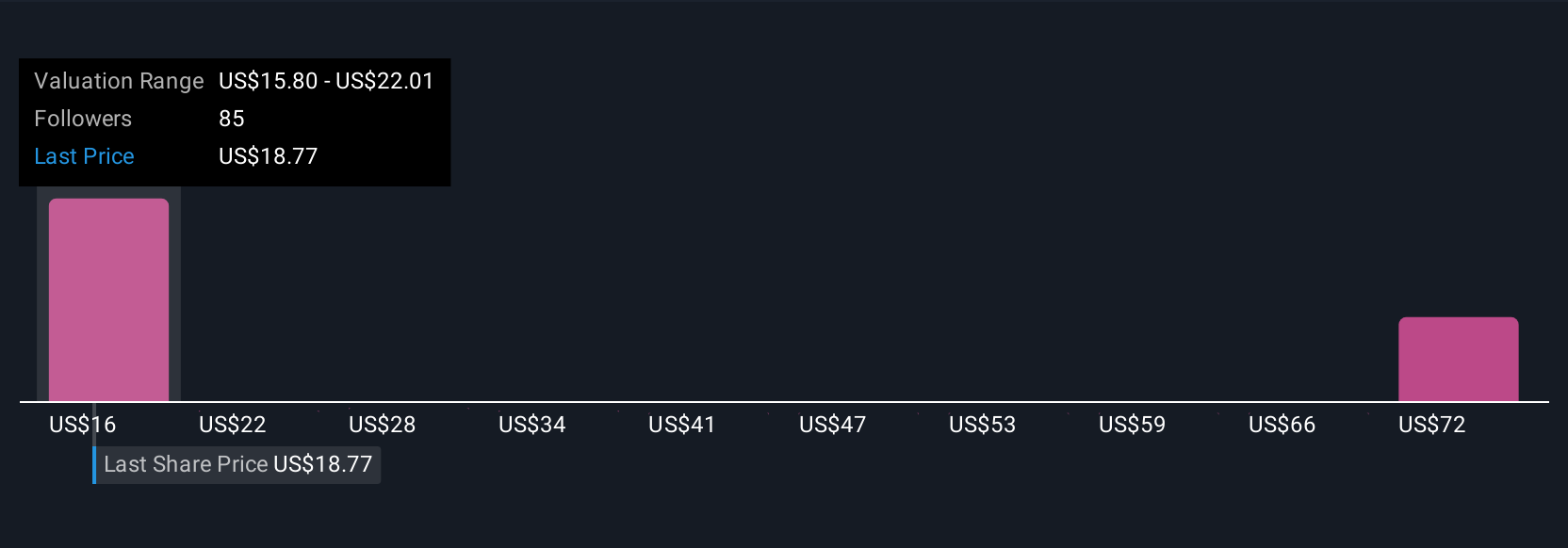

Eight Simply Wall St Community members place Star Bulk Carriers’ fair value between US$21.86 and US$94.21, a wide spread of views. Earnings downside risks from flat dry bulk trade growth may weigh on future share price momentum, so it’s worth exploring how various investors see potential outcomes.

Explore 8 other fair value estimates on Star Bulk Carriers - why the stock might be worth over 5x more than the current price!

Build Your Own Star Bulk Carriers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Star Bulk Carriers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Star Bulk Carriers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Star Bulk Carriers' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBLK

Star Bulk Carriers

A shipping company, engages in the ocean transportation of dry bulk cargoes through the ownership and operation of dry bulk carrier vessels worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives