- United States

- /

- Marine and Shipping

- /

- NasdaqGS:SBLK

Can Star Bulk Carriers’ (SBLK) ESG Progress Offset Weakening Earnings Expectations?

Reviewed by Sasha Jovanovic

- Star Bulk Carriers Corp. has published its 2024 Environmental, Social, and Governance (ESG) Report, providing details on its sustainability strategy, measurable ESG progress, and alignment with global standards, with limited assurance by EY in Greece.

- Despite progress highlighted in the ESG report, recent analyst coverage indicates consensus earnings estimates for the company have been revised significantly lower, reflecting heightened concerns about near-term profitability.

- Next, we'll explore how downward revisions in earnings expectations impact Star Bulk Carriers' investment narrative amid ongoing sustainability efforts.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Star Bulk Carriers Investment Narrative Recap

To be a shareholder in Star Bulk Carriers, you need to believe that ongoing investments in fleet upgrades and sustainability will position the company to benefit from tightening environmental regulations and a potentially more balanced dry bulk market. The recent ESG report may strengthen the company’s long-term credentials, but the sharp downward revision of earnings expectations casts uncertainty over short-term profitability, the main catalyst for a rebound, as well as heightens visibility on operational and regulatory risks. This earnings revision appears material, as it may influence decisions around dividends and buybacks, critical to the investment case right now.

Among recent announcements, the continued commitment to a quarterly cash dividend of US$0.05 per share stands out. While dividend payments are a sign of confidence, maintaining them as earnings projections come under pressure becomes directly relevant for investors focused on near-term cash returns; future payout stability may depend on how quickly profitability recovers. In contrast, investors should be aware that debt levels remain high and any further decline in freight rates could...

Read the full narrative on Star Bulk Carriers (it's free!)

Star Bulk Carriers' outlook projects $1.0 billion in revenue and $521.3 million in earnings by 2028. This assumes a 3.8% annual decline in revenue and an increase in earnings of $397 million from the current $124.2 million.

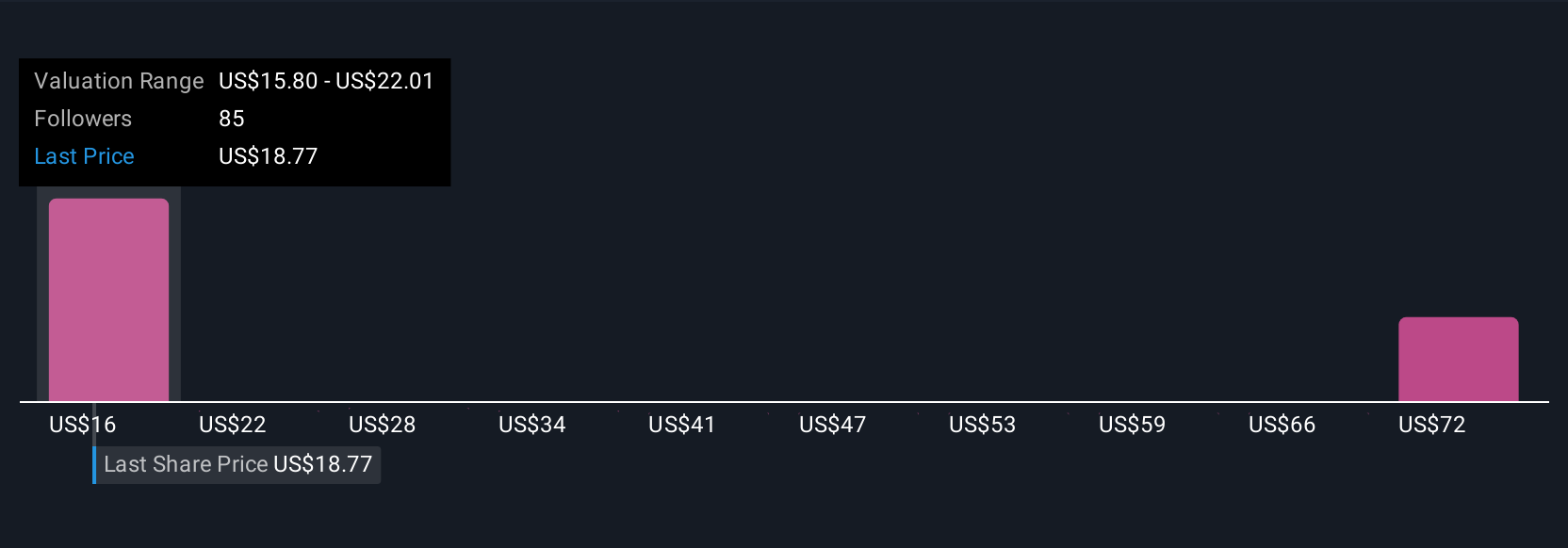

Uncover how Star Bulk Carriers' forecasts yield a $21.86 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community provided fair value estimates for Star Bulk Carriers ranging from US$21.86 to US$92.42 per share. Although opinions greatly differ, many remain focused on whether falling near-term earnings could challenge the company’s dividend consistency and outlook.

Explore 8 other fair value estimates on Star Bulk Carriers - why the stock might be worth over 4x more than the current price!

Build Your Own Star Bulk Carriers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Star Bulk Carriers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Star Bulk Carriers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Star Bulk Carriers' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBLK

Star Bulk Carriers

A shipping company, engages in the ocean transportation of dry bulk cargoes through the ownership and operation of dry bulk carrier vessels worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives