- United States

- /

- Marine and Shipping

- /

- NasdaqCM:PANL

Pangaea Logistics Solutions' (NASDAQ:PANL) Weak Earnings May Only Reveal A Part Of The Whole Picture

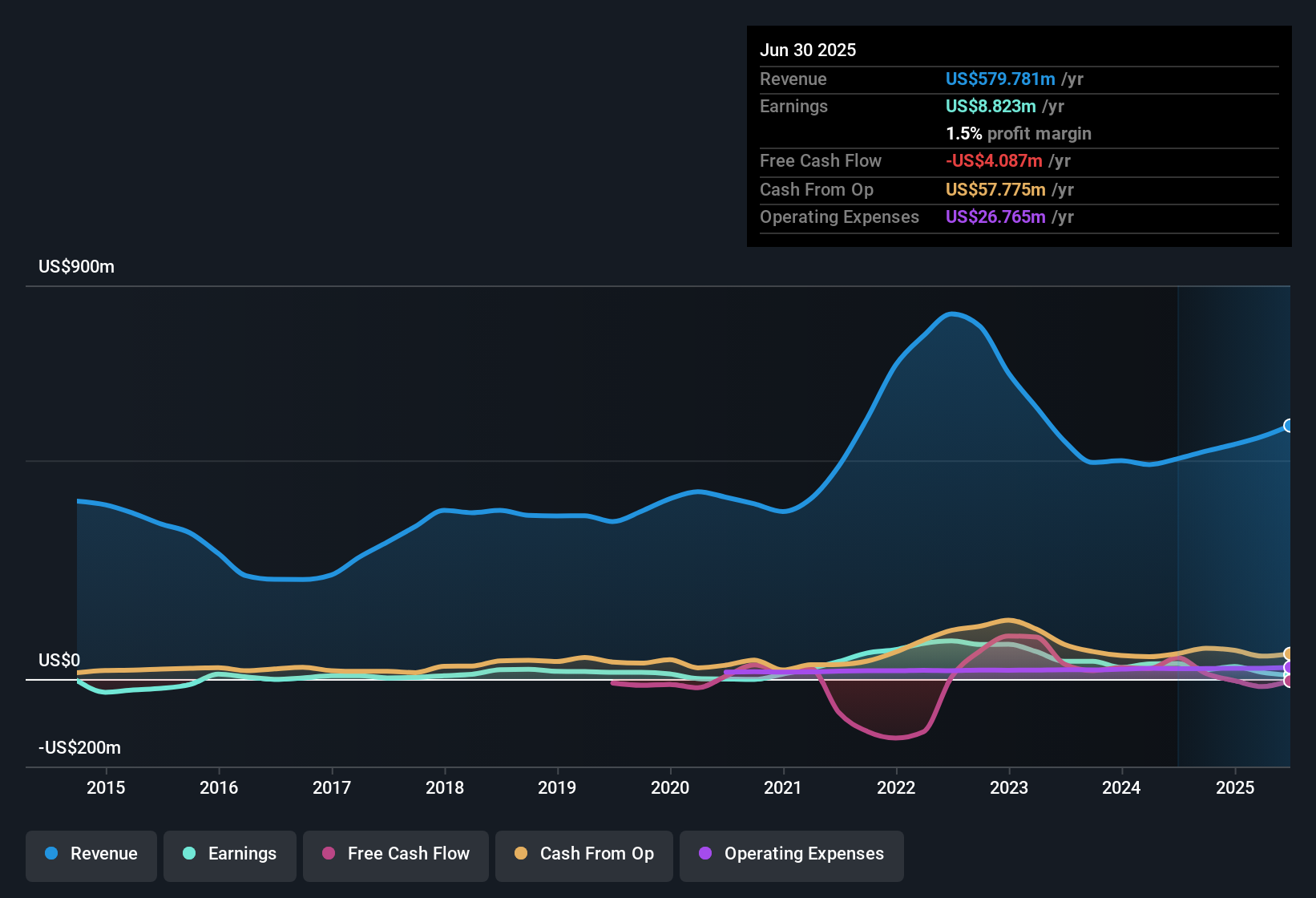

A lackluster earnings announcement from Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL) last week didn't sink the stock price. We think that investors are worried about some weaknesses underlying the earnings.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Pangaea Logistics Solutions increased the number of shares on issue by 39% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Pangaea Logistics Solutions' historical EPS growth by clicking on this link.

A Look At The Impact Of Pangaea Logistics Solutions' Dilution On Its Earnings Per Share (EPS)

Unfortunately, Pangaea Logistics Solutions' profit is down 90% per year over three years. Even looking at the last year, profit was still down 75%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 79% in the same period. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

In the long term, if Pangaea Logistics Solutions' earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Pangaea Logistics Solutions' Profit Performance

Over the last year Pangaea Logistics Solutions issued new shares and so, there's a noteworthy divergence between EPS and net income growth. For this reason, we think that Pangaea Logistics Solutions' statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. Sadly, its EPS was down over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. To help with this, we've discovered 4 warning signs (3 can't be ignored!) that you ought to be aware of before buying any shares in Pangaea Logistics Solutions.

Today we've zoomed in on a single data point to better understand the nature of Pangaea Logistics Solutions' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PANL

Pangaea Logistics Solutions

Provides seaborne dry bulk logistics and transportation services to industrial customers worldwide.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives