- United States

- /

- Marine and Shipping

- /

- NasdaqCM:PANL

Many Still Looking Away From Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL)

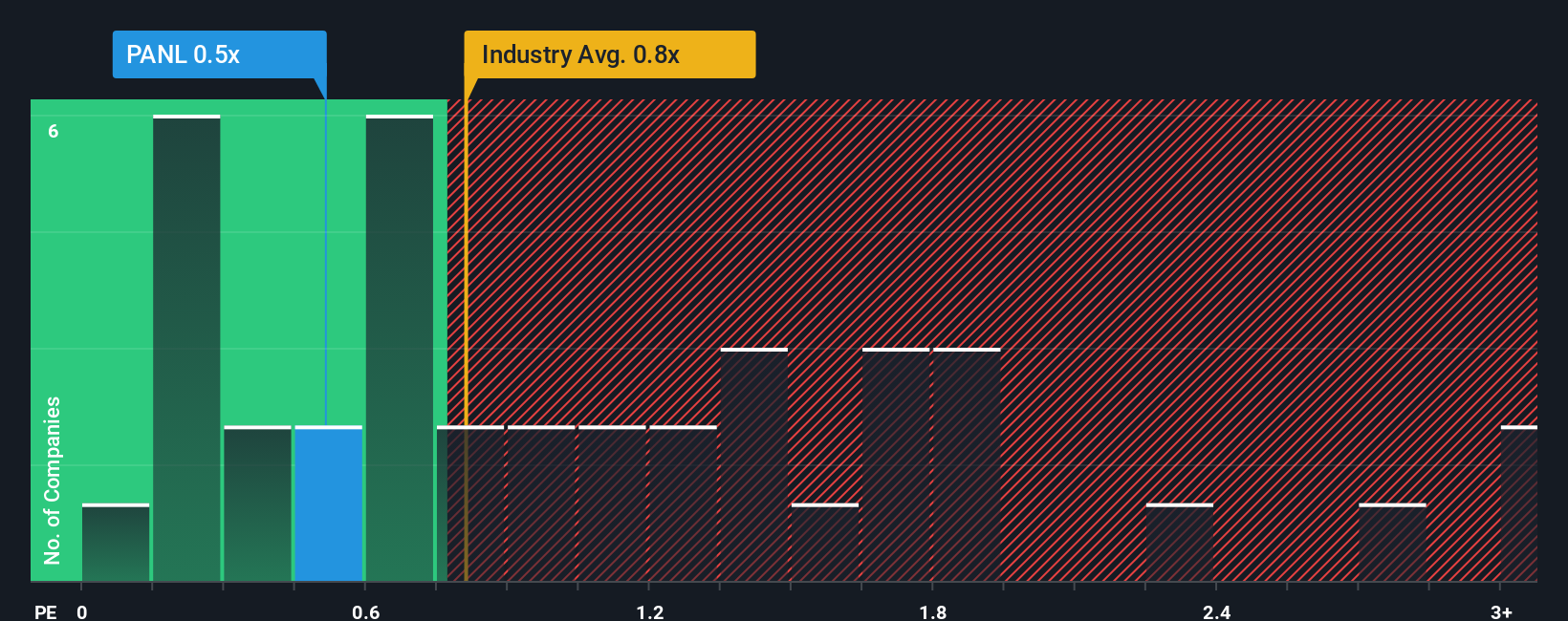

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Shipping industry in the United States, you could be forgiven for feeling indifferent about Pangaea Logistics Solutions, Ltd.'s (NASDAQ:PANL) P/S ratio of 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Pangaea Logistics Solutions

What Does Pangaea Logistics Solutions' P/S Mean For Shareholders?

Recent revenue growth for Pangaea Logistics Solutions has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Pangaea Logistics Solutions will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Pangaea Logistics Solutions would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 31% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 9.2% during the coming year according to the two analysts following the company. Meanwhile, the broader industry is forecast to contract by 7.8%, which would indicate the company is doing very well.

With this in mind, we find it intriguing that Pangaea Logistics Solutions' P/S trades in-line with its industry peers. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Pangaea Logistics Solutions currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. The market could be pricing in the event that tough industry conditions will impact future revenues. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Pangaea Logistics Solutions (3 are significant!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PANL

Pangaea Logistics Solutions

Provides seaborne dry bulk logistics and transportation services to industrial customers worldwide.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026