- United States

- /

- Transportation

- /

- NasdaqGS:GRAB

Grab (NasdaqGS:GRAB) Turns Profitable; Rapid Earnings Growth Outpaces Market Narratives

Reviewed by Simply Wall St

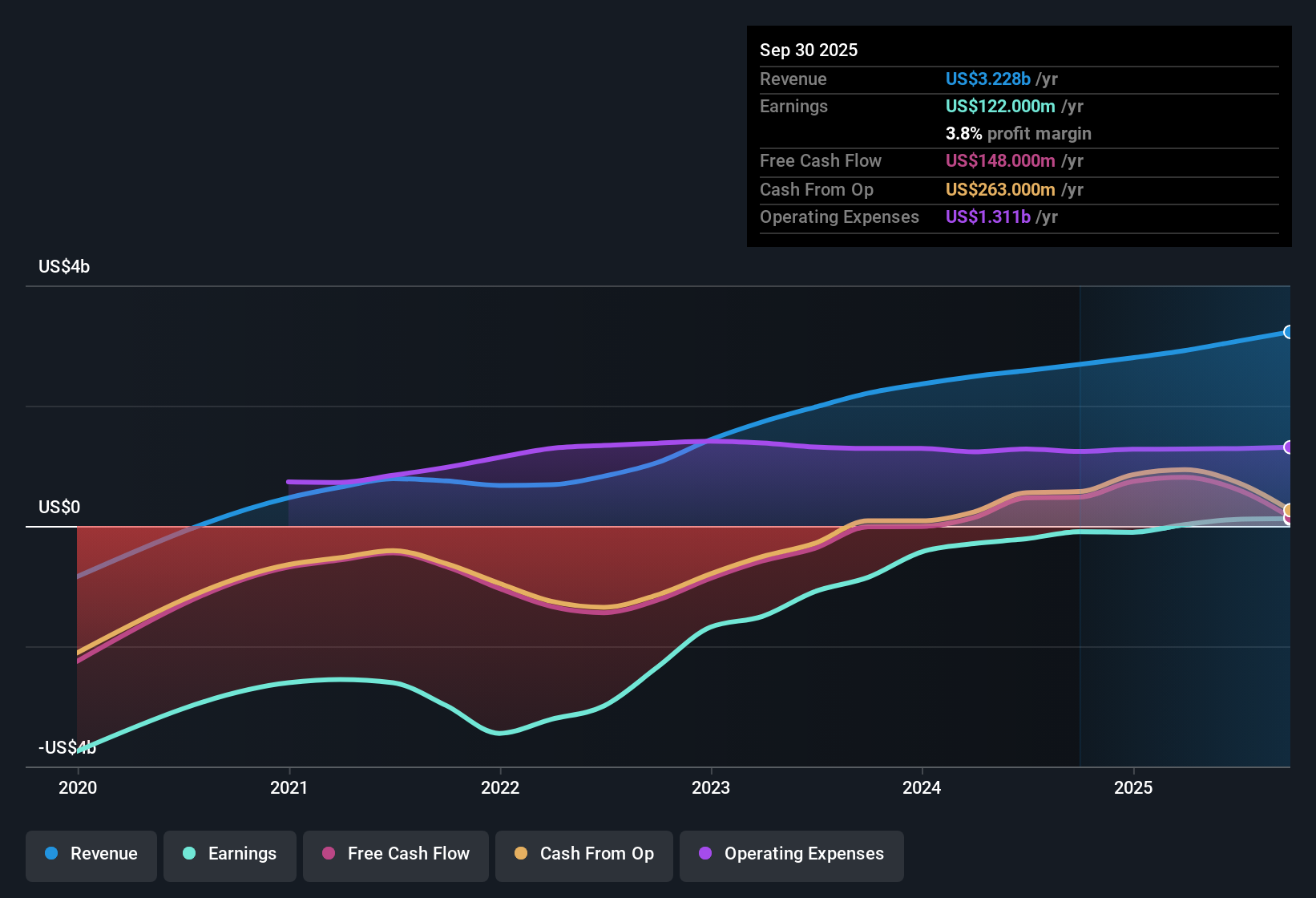

Grab Holdings (NasdaqGS:GRAB) has turned profitable this year, with its net profit margin on the rise and earnings forecast to grow at an impressive 39.5% per year. That rate is well ahead of both the US market’s average earnings growth of 16% and Grab’s own expected annual revenue growth of 15.8%. This figure also surpasses the US market’s 10.5% forecast. Over the last five years, earnings surged at a 55.3% annual pace, reinforcing Grab's position as a company in the midst of rapid earnings and revenue momentum.

See our full analysis for Grab Holdings.Next up, we will measure these headline numbers against the key narratives floating around Grab to see which stories are supported and where the recent results stand out.

See what the community is saying about Grab Holdings

Margin Expansion Outpaces Expectations

- Analysts forecast Grab’s profit margin to climb from 3.6% today to 15% in three years, highlighting a rapid improvement in operating leverage and cost efficiency. Such progress is not yet common across the Southeast Asian tech landscape.

- Analysts' consensus view heavily supports margin upside, citing:

- Operational efficiencies and ongoing tech investments, including AI and automation, are driving improved net margins. This is occurring even as Grab increases investments in affordability and new user acquisition.

- The expansion and monetization of cross-vertical products, such as premium rides and fintech, are expected to grow higher-margin revenue streams and sustain year-on-year margin gains.

Sales Multiples Far Exceed Sector Norms

- Grab trades at a Price-to-Sales Ratio of 7.3x, a pronounced premium over both the US Transportation industry average of 1.2x and its peer average of 1.6x. This underscores investors’ willingness to pay for anticipated growth.

- Analysts' consensus view highlights tension between growth optimism and valuation risk:

- While consensus expects annual revenue to grow 20.4% over the next three years, the elevated sales multiple raises the bar for execution and could amplify downside if growth underdelivers.

- Current pricing reflects expectations of a long-duration growth story but may prove volatile if competitive pressures or incentive spending persist longer than anticipated.

Consensus Price Target Sits Above Current Share Price

- The average analyst price target of $6.63 is 14.6% above today’s share price of $5.79, with estimates ranging broadly from $5.10 to $8.00. This reflects both optimism and division among covering analysts.

- Analysts' consensus view reveals that to justify the target, earnings must surge from $111 million today to $802.4 million in 2028, with the company trading at a still-elevated PE ratio of 40.1x, which is above the industry’s 25.4x.

- This implies faith in the durability of Grab's earnings runway. However, the price target gap is only justified if management delivers on margin expansion and surpasses fierce regional competition.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Grab Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the figures another way? Share your point of view and frame your own narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Grab Holdings.

See What Else Is Out There

Grab’s valuation remains elevated, with its premium sales and earnings multiples vulnerable if growth or margin expansion falls short of high expectations.

To counter costly price tags and hunt for better value, see how these 844 undervalued stocks based on cash flows can uncover stocks with stronger upside and lower valuation risk right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAB

Grab Holdings

Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives