- United States

- /

- Logistics

- /

- NasdaqGS:CHRW

The Bull Case For C.H. Robinson (CHRW) Could Change Following Earnings Guidance Hike and Dividend Boost

Reviewed by Sasha Jovanovic

- C.H. Robinson Worldwide recently reported third quarter results, raising its 2026 earnings guidance and announcing an increased regular quarterly dividend of US$0.63 per share, with additional board and share repurchase updates.

- The improved outlook and higher earnings amid challenging market conditions indicate operational resilience and signal confidence in sustained profitability.

- We'll explore how the boosted earnings forecast and dividend increase could influence C.H. Robinson Worldwide's future investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

C.H. Robinson Worldwide Investment Narrative Recap

To be a shareholder in C.H. Robinson Worldwide, you need to believe in the company's ability to drive sustained margin expansion and earnings growth through automation, technology, and resilient supply chain services, despite ongoing shifts in global trade and heightened industry competition. The recent earnings guidance boost and increased dividend showed continued management confidence and operational agility, but these developments did not materially alter the critical short-term catalyst, C.H. Robinson’s continued execution on AI-driven process automation, or shift the biggest risk, which remains external trade policy uncertainty.

Among recent company announcements, the unveiling of the Agentic Supply Chain™ platform stands out as most relevant, reinforcing the role of advanced automation as a key catalyst. As C.H. Robinson accelerates its use of AI-powered logistics tools, the company may further strengthen its competitive position in a market where digital capabilities are rapidly becoming more accessible to all players.

On the other hand, investors should be aware that even the strongest automation initiatives can’t fully offset the potential impact of persistent trade volatility and...

Read the full narrative on C.H. Robinson Worldwide (it's free!)

C.H. Robinson Worldwide's narrative projects $18.4 billion revenue and $677.2 million earnings by 2028. This requires 2.6% yearly revenue growth and a $142.9 million earnings increase from $534.3 million.

Uncover how C.H. Robinson Worldwide's forecasts yield a $150.31 fair value, in line with its current price.

Exploring Other Perspectives

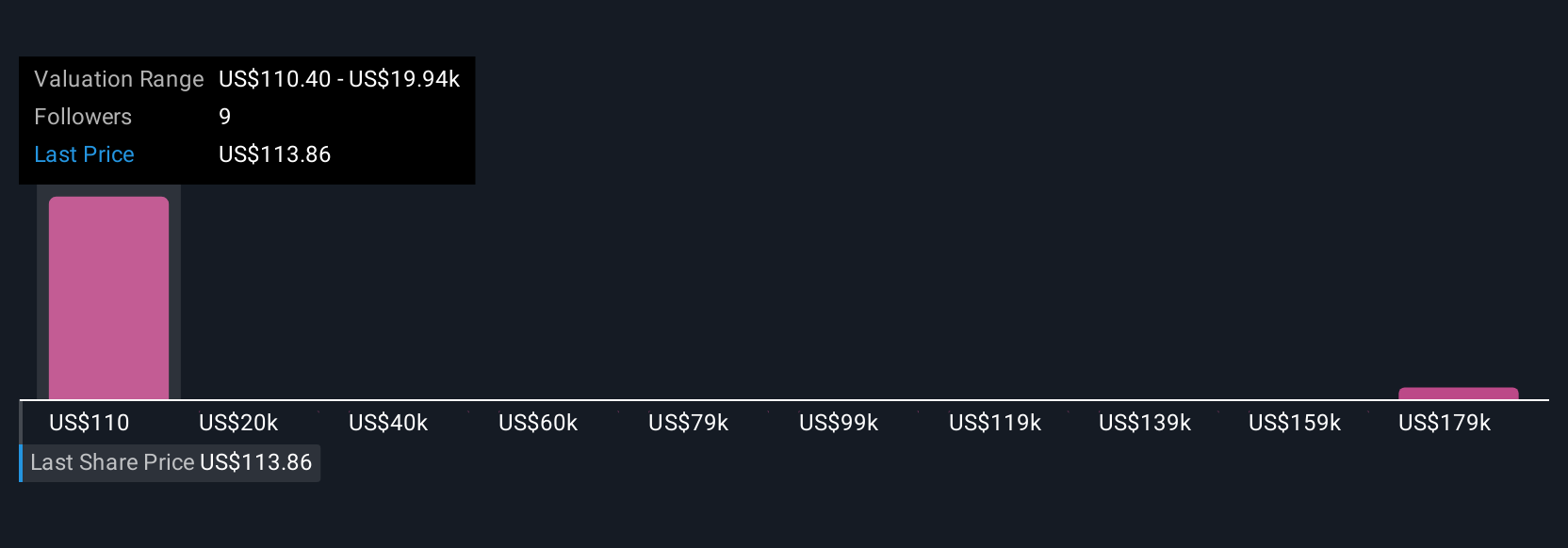

Simply Wall St Community investors provided three fair value analyses for C.H. Robinson Worldwide, ranging from US$72 to a dramatic US$198,416. Current company momentum is centered on automation and digital efficiency, but the broad spread in user valuations is a reminder to check how your own view stacks up against wider market debates.

Explore 3 other fair value estimates on C.H. Robinson Worldwide - why the stock might be a potential multi-bagger!

Build Your Own C.H. Robinson Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your C.H. Robinson Worldwide research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free C.H. Robinson Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate C.H. Robinson Worldwide's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRW

C.H. Robinson Worldwide

Provides freight transportation and related logistics and supply chain services in the United States and internationally.

Solid track record established dividend payer.

Market Insights

Community Narratives