- United States

- /

- Transportation

- /

- NasdaqGS:CAR

A Fresh Look at Avis Budget Group (CAR) Valuation Following Strong Earnings and Operational Gains

Reviewed by Kshitija Bhandaru

Avis Budget Group (CAR) posted quarterly earnings that beat expectations, reporting a 29% jump in Adjusted EBITDA while revenue remained steady compared to last year. Investors are paying close attention to this combination of operational efficiency and financial discipline.

See our latest analysis for Avis Budget Group.

Shares of Avis Budget Group have seen substantial volatility this year, rallying 89.2% year-to-date, even as a 29% jump in Adjusted EBITDA made headlines. Over the past year, total shareholder return stands at an impressive 85.3%, reflecting renewed optimism as the company delivers robust operational gains and invests in future growth. This comes after a challenging stretch, with three-year total returns still showing a slight decline.

If the market’s reaction to Avis Budget’s earnings piqued your interest, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares rallying nearly 90% this year, investors must ask whether these operational gains signal a fresh buying opportunity or if the market has already priced in Avis Budget’s growth potential.

Most Popular Narrative: 2.9% Overvalued

With Avis Budget Group’s widely followed narrative fair value at $148, the latest close at $152.22 puts the stock slightly above what this outlook suggests it is worth. High expectations for strategic initiatives and future market position drive this narrative, setting the scene for one of its boldest claims.

The launch and rapid scaling of Avis First, a premium rental offering, could be fueling expectations of significant revenue and margin expansion. Investors anticipate a sustained uplift in average revenue per day (RPD) and market share capture from price-insensitive travelers. This optimism may not fully account for competitive responses or changing customer preferences, increasing the risk that future revenue and net margin improvements fall short of current valuations.

Want to know what numbers justify this valuation? It all comes down to ambitious profit turnaround and a future multiple that rewrites the rules for rental companies. Which assumptions are powering such an aggressive target? Only by reading the full narrative will you uncover the key projections behind that price.

Result: Fair Value of $148 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several factors could derail these bullish expectations. These include stronger competition in premium rentals and slower-than-anticipated adoption of autonomous mobility partnerships.

Find out about the key risks to this Avis Budget Group narrative.

Another View: A Different Take on Value

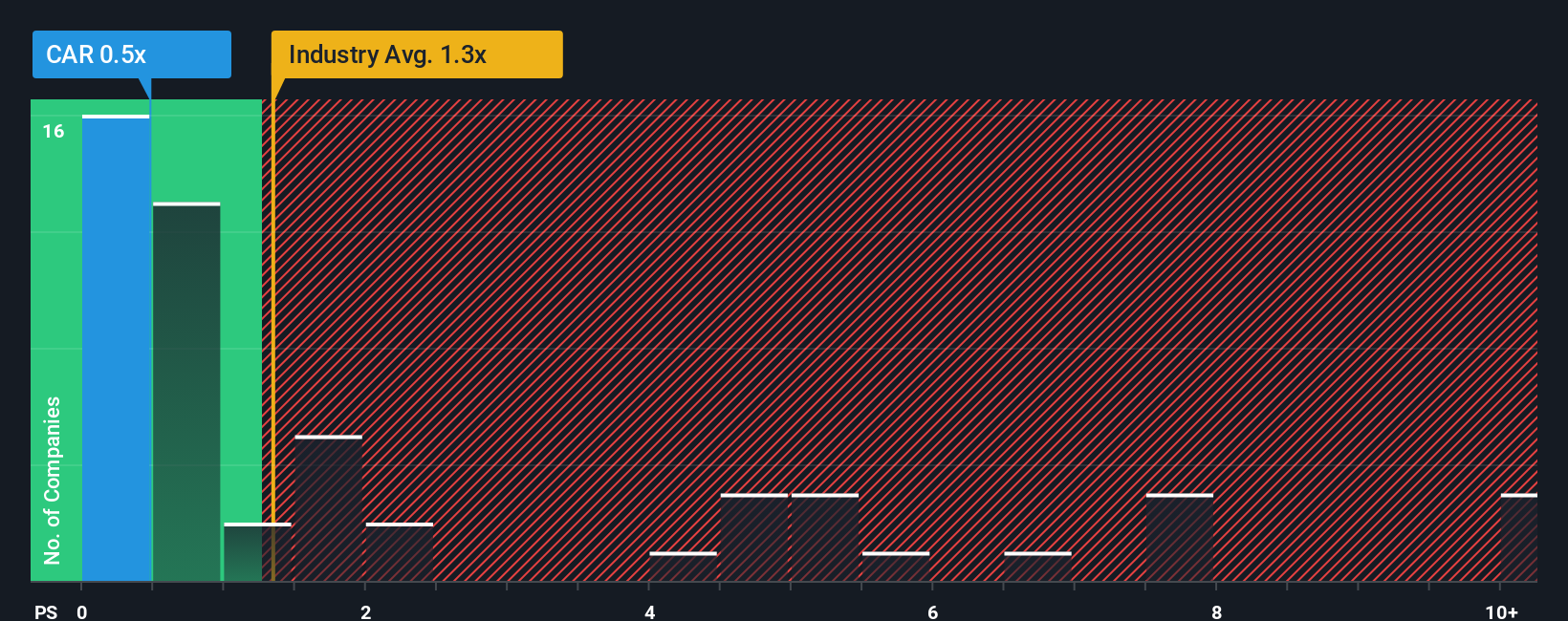

While the narrative of fair value paints Avis Budget Group as slightly overvalued, a closer analysis of sales ratios offers a more favorable angle. The company is trading at just 0.5 times its sales, below both the industry average of 1.3x and the peer average of 2.6x. If the market moves toward its fair ratio of 0.9x, there could be upside ahead. However, it is worth considering whether this discount truly reflects long-term opportunity, or if the risks are keeping investors cautious.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Avis Budget Group Narrative

If these conclusions do not align with your perspective, or you want to dig into the numbers personally, crafting your own view takes just a few minutes. Do it your way

A great starting point for your Avis Budget Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always a step ahead. Unlock exciting opportunities by checking out these standout stock ideas before the next market move leaves you behind.

- Tap into tomorrow’s innovations by evaluating companies advancing artificial intelligence. Use these 24 AI penny stocks to see who is at the forefront of this technology shift.

- Boost your income streams efficiently by reviewing these 18 dividend stocks with yields > 3%, which offers yields above 3% and delivers consistent shareholder returns.

- Stay ahead with undervalued opportunities by reviewing these 874 undervalued stocks based on cash flows, based on strong cash flow fundamentals and attractive entry prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAR

Avis Budget Group

Provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives