- United States

- /

- Airlines

- /

- NasdaqGS:ALGT

Does Allegiant's Route Expansion, Share Offering and Labor Tensions Signal a Shift in ALGT's Growth Story?

Reviewed by Sasha Jovanovic

- Earlier this week, Allegiant Travel Company announced the addition of 30 new nonstop routes connecting 35 cities, along with a shelf registration for 1 million shares of common stock valued at US$61.77 million, and a pilots' union demonstration calling for improved contract terms.

- This multi-faceted news underscores Allegiant's intent to grow its network in underserved leisure markets, while also highlighting mounting labor tensions and the possibility of share dilution related to an ESOP-linked stock offering.

- We'll examine how Allegiant's substantial network expansion and related labor negotiations could alter its investment narrative and growth outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Allegiant Travel Investment Narrative Recap

To be an Allegiant Travel shareholder today, you need conviction in the long-term strength of value-oriented leisure travel and the company's niche in underserved U.S. cities. The recent announcement of broad route expansion could excite those watching for a growth catalyst, but short-term optimism may be tempered by unresolved labor tensions, particularly with pilots, a risk factor now sharper, yet not fundamentally shifting the main narrative for near-term performance.

Among recent developments, the company’s filing for a US$61.77 million shelf registration tied to an ESOP offering stands out. While potentially facilitating employee ownership, this move intersects with ongoing labor disputes, surfacing precisely as pilot contract negotiations escalate, keeping cost pressures and workforce stability at the forefront of the company’s catalysts and risks.

Yet, against expectations of steady growth and improving margins, investors should be aware that Allegiant’s exposure to labor action and industry-wide pilot shortages may...

Read the full narrative on Allegiant Travel (it's free!)

Allegiant Travel is expected to reach $3.1 billion in revenue and $267.8 million in earnings by 2028. Achieving these targets requires annual revenue growth of 6.0%, with earnings rising by $553.9 million from a current loss of $-286.1 million.

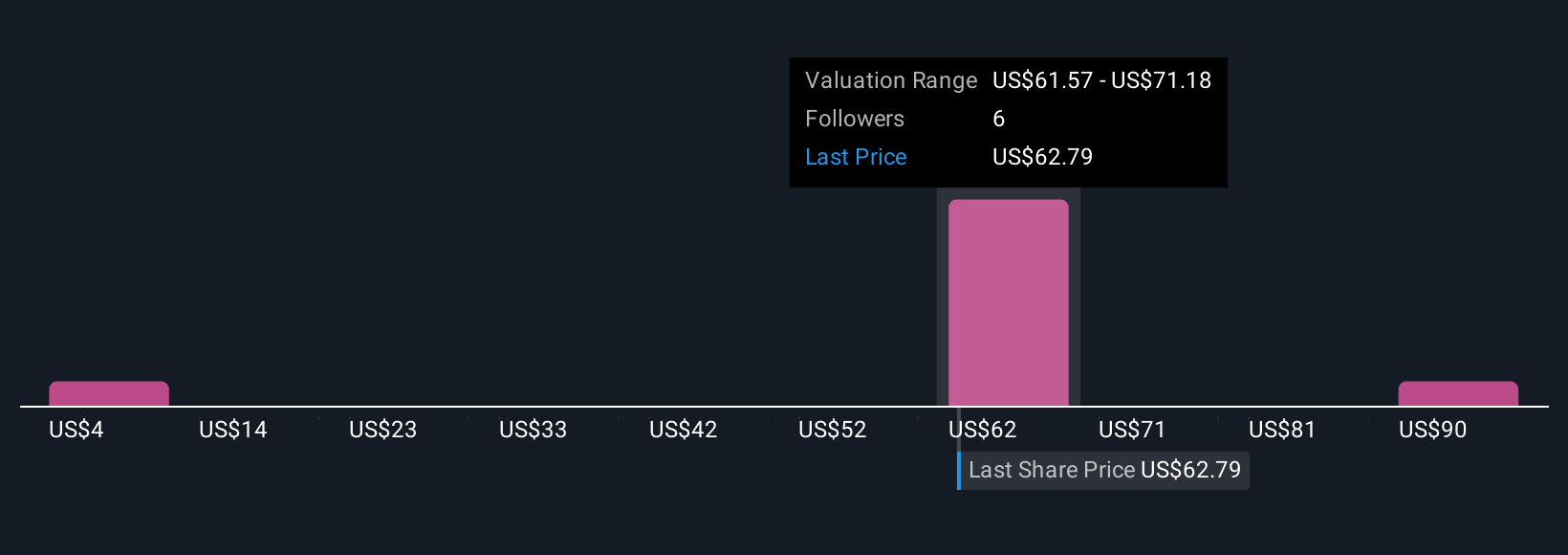

Uncover how Allegiant Travel's forecasts yield a $69.17 fair value, a 6% upside to its current price.

Exploring Other Perspectives

All Simply Wall St Community fair value estimates sit at US$69.17, showing consensus among a single contributor. Still, with labor risks prominent, consider how future union outcomes could impact the company’s trajectory and inform your view.

Explore another fair value estimate on Allegiant Travel - why the stock might be worth as much as 6% more than the current price!

Build Your Own Allegiant Travel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allegiant Travel research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Allegiant Travel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allegiant Travel's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGT

Allegiant Travel

A leisure travel company, provides travel and leisure services and products to residents of under-served cities in the United States.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives