- United States

- /

- Airlines

- /

- NasdaqGS:ALGT

Allegiant Travel (ALGT): Losses Worsen but Earnings Forecast to Jump 99.56% Annually

Reviewed by Simply Wall St

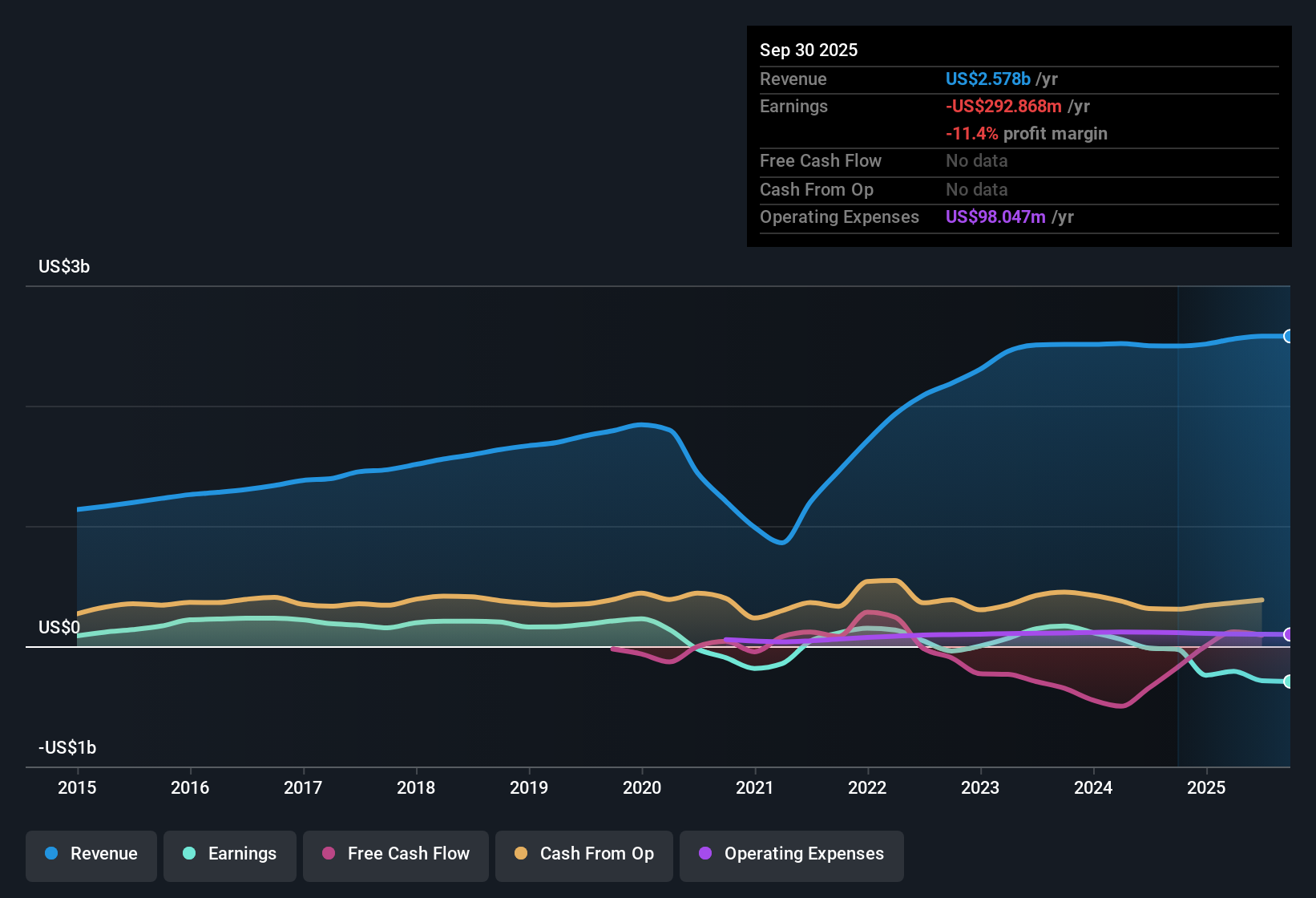

Allegiant Travel (ALGT) remains in the red, posting losses that have deepened at an average rate of 19.8% per year over the past five years, with no improvement in its net profit margin over the last year. Even so, analysts are calling for a dramatic turnaround, forecasting earnings growth of 99.56% per year and expecting the company to become profitable within three years. This pace outstrips average market growth. Revenue, meanwhile, is expected to rise 5.3% per year.

See our full analysis for Allegiant Travel.Next up, we’re putting these latest results side by side with the prevailing market narratives to see which themes get confirmed and which may need rethinking.

See what the community is saying about Allegiant Travel

Profit Margins Set to Swing From -11.1% to 8.7%

- Analysts expect Allegiant's net profit margin to rise from -11.1% today to 8.7% within three years, a dramatic turnaround that moves margins from deeply negative to healthy territory.

- Consensus narrative points out that, if Allegiant boosts margins at this pace, its focus on cost control, fleet modernization, and digital initiatives could help deliver sustained profitability, but there is still tension as past years saw no improvement in net profit margin.

- Strategic efficiency moves such as retiring older Airbus jets and increasing Boeing MAX usage to 20% of available seat miles by 2026 are highlighted as key to margin improvement.

- However, concerns remain that leisure travel demand is soft and any further shifts in consumer habits or macro headwinds could stall margin gains.

- This three-year margin swing would mark a notable break from Allegiant’s five-year trend of deepening losses, showing that analysts’ outlook relies on operational transformation.

See what is driving the balance between optimism and skepticism in the full consensus narrative. 📊 Read the full Allegiant Travel Consensus Narrative.

Fleet Overhaul Targets Cost Relief

- Allegiant aims for 20% of available seat miles to come from modern MAX aircraft by 2026, expected to lower fuel and maintenance costs and support higher utilization during peak periods.

- Consensus narrative argues the MAX ramp-up and retirement of older jets is central to lifting operating efficiency, but there are risks from elevated transition costs and possible fleet disruptions.

- If upgrades stay on schedule, the company could improve cost per seat mile and free up cash for debt repayment, potentially boosting earnings stability.

- However, ongoing industry-wide pilot shortages and labor cost headwinds could offset some of these savings, meaning operational wins may not fully translate to bottom-line growth.

Valuation Remains a Relative Bargain at 0.5x Sales

- Allegiant trades on a Price-to-Sales Ratio of 0.5x, notably below both direct peers and the broader US Airlines industry, suggesting shares are attractively valued despite persistent losses and financial risk.

- Consensus narrative cautions investors to weigh the cheap valuation against a shaky financial position and slower revenue growth, as analysts’ $68.75 price target sits below the current share price of $72.57.

- While bulls may be drawn to low relative multiples, the narrow gap between current price and analyst target implies much of the turnaround optimism is already reflected in today’s valuation.

- Improved margins and disciplined capital allocation are flagged as potential catalysts, but profitability must materialize to justify even these modest expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Allegiant Travel on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on Allegiant’s numbers? Share your perspective and shape the story in just a few minutes. Do it your way

A great starting point for your Allegiant Travel research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite bullish forecasts, Allegiant’s persistent losses, thin financial cushion, and narrow margin for error highlight ongoing concerns about its balance sheet strength.

If you’re seeking companies built on stronger financial foundations, explore solid balance sheet and fundamentals stocks screener (1979 results) to find those with robust balance sheets ready to withstand uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGT

Allegiant Travel

A leisure travel company, provides travel and leisure services and products to residents of under-served cities in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives