- United States

- /

- Airlines

- /

- NasdaqGS:AAL

The Bull Case for American Airlines (AAL) Could Change Following Flight Cuts Linked to Government Shutdown

Reviewed by Sasha Jovanovic

- American Airlines CEO Robert Isom recently confirmed that, amid the longest U.S. government shutdown to date, the airline canceled more than 220 scheduled flights due to worsening air traffic controller shortages and incremental FAA-mandated traffic reductions of up to 10% by November 14.

- The disruption highlights how extended government shutdowns can compound operational risks for airlines by deepening staff shortages and forcing major service reductions.

- We'll explore how these government shutdown-driven flight cancellations intensify operational risks and fit with American Airlines' broader investment picture.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

American Airlines Group Investment Narrative Recap

To be a shareholder in American Airlines Group, you need to believe that a recovery in domestic travel demand, enhanced customer experience offerings, and growth in high-margin loyalty programs can offset ongoing cost and operational pressures. While the recent wave of government shutdown-driven flight cancellations adds to short-term disruptions, they do not appear to materially shift the company’s biggest risk right now: persistently high labor costs and margin pressure relative to peers.

Of American’s recent announcements, the appointment of Nat Pieper as Chief Commercial Officer on November 3, 2025, stands out given the fresh operational challenges posed by extended government disruptions. Leadership changes in such critical commercial roles can be impactful amid shifts in market demand and scheduling constraints, especially as the company’s ability to adapt remains central to near-term catalysts and longer-term performance.

But it’s worth noting that even as leadership evolves, the operational impacts from external disruptions may linger and investors should be mindful of…

Read the full narrative on American Airlines Group (it's free!)

American Airlines Group's narrative projects $61.8 billion revenue and $1.8 billion earnings by 2028. This requires 4.5% yearly revenue growth and a $1.2 billion earnings increase from $567.0 million.

Uncover how American Airlines Group's forecasts yield a $15.02 fair value, a 16% upside to its current price.

Exploring Other Perspectives

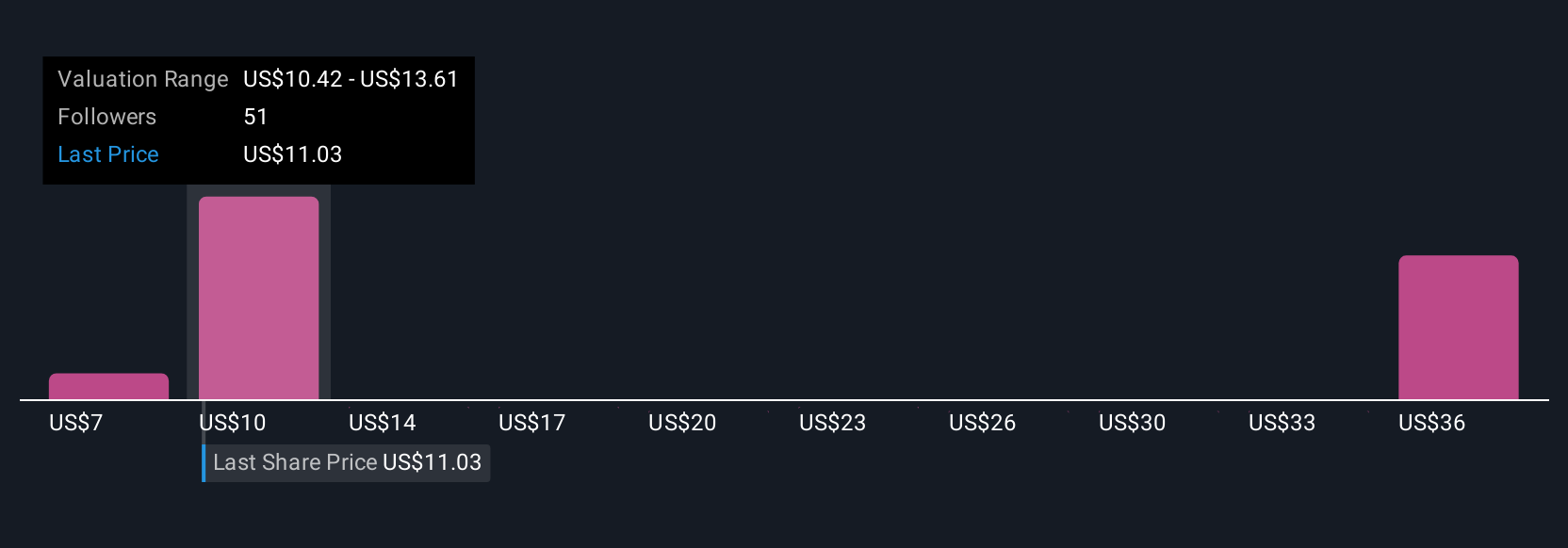

The Simply Wall St Community’s 12 fair value estimates for American Airlines span US$9 to US$23.15 per share, revealing sharply varied outlooks. With operational reliability still facing elevated risks from government-related disruptions, explore how others view the company’s future and compare your perspective.

Explore 12 other fair value estimates on American Airlines Group - why the stock might be worth 31% less than the current price!

Build Your Own American Airlines Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Airlines Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Airlines Group's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives