- United States

- /

- Airlines

- /

- NasdaqGS:AAL

American Airlines (AAL) Valuation Spotlight After Upbeat Q3 Earnings and Raised Guidance

Reviewed by Simply Wall St

American Airlines (AAL) shares saw renewed interest after the company reported third quarter earnings that matched revenue expectations and included a smaller loss than many anticipated. Investors are now watching upcoming trends with extra curiosity.

See our latest analysis for American Airlines Group.

With third quarter results providing a boost, American Airlines Group’s shares have enjoyed a solid rebound this month, climbing with a 13.7% one-month share price return. While the year-to-date share price is still down nearly 25%, investors are responding positively to recent earnings, improved commercial momentum, and a promising new leadership appointment. Even with some of the turbulence seen over the past year, the company’s one-year total shareholder return of -4.6% and five-year total return of 10.2% show the kind of resilience and long-term perspective that is top of mind for the market right now.

If American’s renewed momentum has you thinking about fresh investing possibilities, now is a great time to branch out and discover fast growing stocks with high insider ownership

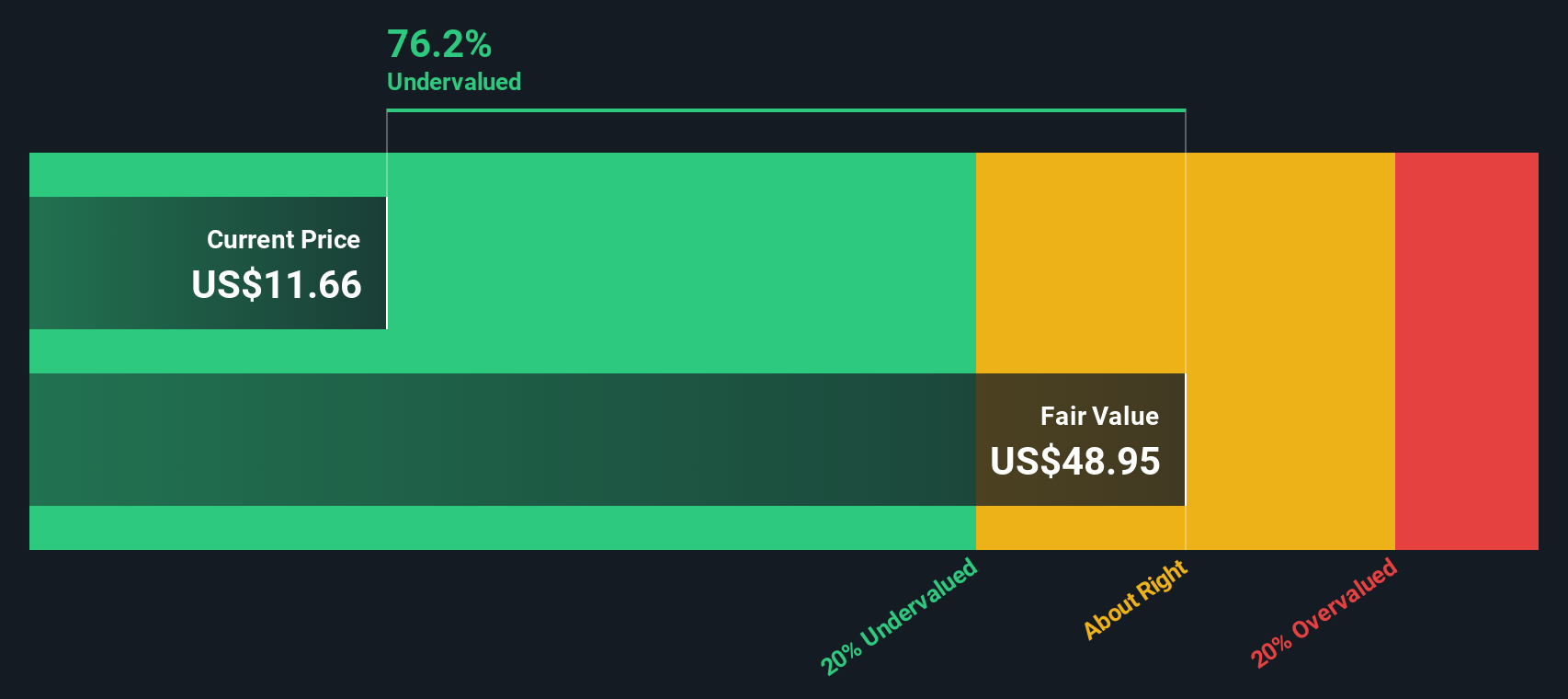

With shares on the rise after upbeat earnings and new leadership, the big question now is whether American Airlines remains undervalued or if the recent rally means investors have already accounted for future growth opportunities.

Most Popular Narrative: 20.5% Overvalued

The most-followed narrative on American Airlines, according to PittTheYounger, suggests the stock is trading well above its fair value estimate of $10.61, with the last close at $12.78. This gap highlights how the narrative drivers focus less on short-term news and more on fundamental structural concerns.

There’s a single reason why American is the least attractive of US legacy carriers (in terms of investing, anyway): its balance sheet. If most airlines and certainly those in the US are loaded up to the hilt with debt, American goes so far as to boast negative equity. Any startup would go belly-up with a balance sheet such as this one.

Curious about why this valuation stands out? The key to this narrative is not just debt; a carefully modeled mix of segment growth, margin assumptions, and ambitious future profit multiples holds the answer. Ready to see which numbers could turn this perceived “ugly duckling” into a contrarian bet? Only the full narrative reveals the math behind the fair value calculation.

Result: Fair Value of $10.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if premium offerings succeed or economic optimism returns, these factors could rapidly strengthen American Airlines’ position and challenge the prevailing overvaluation story.

Find out about the key risks to this American Airlines Group narrative.

Another View: Discounted Cash Flow Model

Looking through a different lens, the SWS DCF model points to a markedly divergent story. It calculates American Airlines’ fair value at $19.54, meaning shares are trading around 34.6% below this estimate. This implies the stock may be undervalued, standing in direct contrast to the overvaluation flagged by the previous method. Which perspective holds more weight for investors as the market digests new data?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Airlines Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 850 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Airlines Group Narrative

If you see things differently or want to dive into the details yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't stick to the beaten path; expand your opportunities by checking out top-performing themes and market trends before these stocks break out. If you want to level up your investing, these screens are your shortcut to opportunities others might miss.

- Uncover companies generating stable, consistent income by reviewing these 24 dividend stocks with yields > 3% with attractive yields above 3%.

- Tap into fast-evolving markets by checking these 26 AI penny stocks that are at the forefront of transformative technologies and AI breakthroughs.

- Boost your search for value by targeting these 850 undervalued stocks based on cash flows with strong cash flows that the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives