- United States

- /

- Airlines

- /

- NasdaqGS:AAL

American Airlines (AAL): Assessing Valuation After Spirit Airlines' Going Concern Warning Shakes Industry Dynamics

Reviewed by Simply Wall St

American Airlines (AAL) stock jumped after Spirit Airlines revealed concerns about its financial stability. With a key competitor under pressure, investors see this as a shift that could tighten industry capacity and increase American Airlines’ pricing power.

See our latest analysis for American Airlines Group.

The move comes shortly after a difficult year for American Airlines, with its share price falling 24.3% year-to-date and a total shareholder return of -10.5% over the past year. While the stock saw a quick 5.15% rebound today following the Spirit Airlines news, momentum overall has been fading. This reflects a sector facing both challenges and shifting dynamics.

If headlines like this have you thinking about the broader transportation sector, this could be your chance to explore See the full list for free.

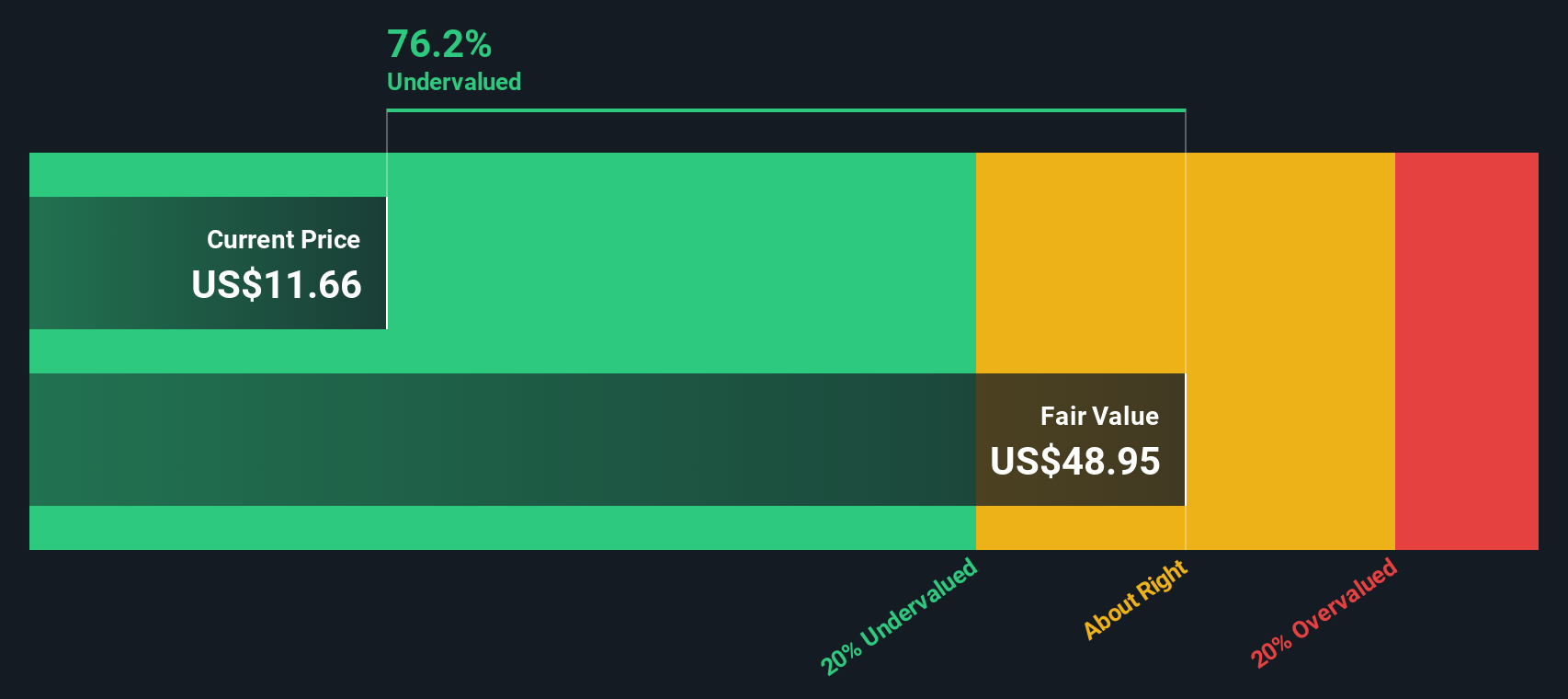

With such dramatic shifts in the sector, investors are left to weigh whether American Airlines’ current valuation underestimates its future prospects or if the market has already priced in any expected rebound. Is this a genuine buying opportunity, or has future growth been accounted for?

Most Popular Narrative: 21.3% Overvalued

Based on the most widely discussed narrative, American Airlines' fair value stands well below its current closing price, sparking debate over its upside from here. According to the latest perspective by PittTheYounger, the numbers just do not add up for a bullish thesis at these levels.

There is a single reason why American is the least attractive of US legacy carriers (in terms of investing, anyway): its balance sheet. If most airlines and certainly those in the US are loaded up to the hilt with debt, American goes so far as to boast negative equity. Any startup would go belly-up with a balance sheet such as this one. Now, you can survive and even generate decent returns with a precarious capital structure, but of course you are very sensitive to any shock on the demand side of your business, hitting both revenues and margins, and that is where the clouds gather on American.

Curious why this narrative projects American Airlines at a much lower fair value than its last trade? It all hinges on aggressive growth forecasts, razor-thin profit margins, and a bold bet on capital structure risks most investors overlook. Ready to uncover the assumptions driving this controversial valuation? Tap to see what's powering PittTheYounger's full calculation.

Result: Fair Value of $10.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lower interest rates or operational improvements such as expanding Premium Economy could help American Airlines outperform even cautious expectations.

Find out about the key risks to this American Airlines Group narrative.

Another View: Discounted Cash Flows Show Undervaluation

Taking a different angle, the SWS DCF model values American Airlines at $23.31 per share, which is 44.8% above the current price. This method suggests the stock could be significantly undervalued. Is the market overlooking long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Airlines Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Airlines Group Narrative

If these analyses do not reflect your perspective, or you want to see how your own research stacks up, you can build a custom narrative in just a few minutes. Do it your way

A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Set yourself up for smarter decisions with fresh ideas. Act now, or you might miss out on standout stocks already gaining momentum elsewhere.

- Capture high yields by reviewing these 17 dividend stocks with yields > 3%. This features companies rewarding shareholders with strong and consistent payouts above 3%.

- Ride the wave of future medicine by checking out these 30 healthcare AI stocks. This showcases firms revolutionizing healthcare with artificial intelligence breakthroughs.

- Accelerate your hunt for value by scanning these 918 undervalued stocks based on cash flows. This puts businesses overlooked by the market that could offer strong upside on your radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives