Verizon's Accelerated Fiber and 5G Partnerships Could Be a Game Changer for VZ

Reviewed by Sasha Jovanovic

- In recent days, Verizon Business announced new enterprise partnerships, including equipping KPMG’s U.S. headquarters with a multi-carrier 5G network and collaborating with Amazon Web Services to deliver high-capacity fiber for AI workloads, while also moving to expand residential fiber reach through an exclusive agreement with Eaton Fiber LLC and progressing its pending Frontier acquisition.

- An interesting aspect of these developments is Verizon’s increasing reliance on third-party network funding and infrastructure sharing, which may accelerate fiber rollout while managing capital intensity and operational risks.

- We'll explore how Verizon’s expanded fiber and 5G initiatives, especially its Eaton Fiber and KPMG partnerships, reshape its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Verizon Communications Investment Narrative Recap

For investors, Verizon presents an opportunity centered on the belief that expanding fiber and enterprise 5G partnerships can drive new sources of revenue growth and operational efficiency, key to offsetting mature wireless markets and heavy capital requirements. Recent news, highlighting fresh alliances with KPMG and AWS and expanded fiber builds, reinforces this focus on next-gen connectivity but does not materially change the most important short-term catalyst, which remains subscriber retention and broadband net adds; the biggest ongoing risk continues to be elevated capital intensity and margin pressure from network buildouts and integrations. Among the updates, the multi-carrier 5G deployment at KPMG’s new U.S. headquarters stands out as especially relevant, underlining Verizon’s push into enterprise connectivity and diversification away from dependence on the consumer wireless segment, supporting efforts to stabilize earnings in the face of competitive churn and shifting market opportunities. Yet investors should remain alert to an additional consideration: while new partnerships offer growth avenues, they come as Verizon continues to juggle high debt loads and aggressive network investment commitments, so if technology adoption lags or execution stumbles, ...

Read the full narrative on Verizon Communications (it's free!)

Verizon Communications' outlook anticipates $144.5 billion in revenue and $22.1 billion in earnings by 2028. This hinges on a 1.8% annual revenue growth rate and a $3.9 billion earnings increase from the current $18.2 billion.

Uncover how Verizon Communications' forecasts yield a $47.52 fair value, a 19% upside to its current price.

Exploring Other Perspectives

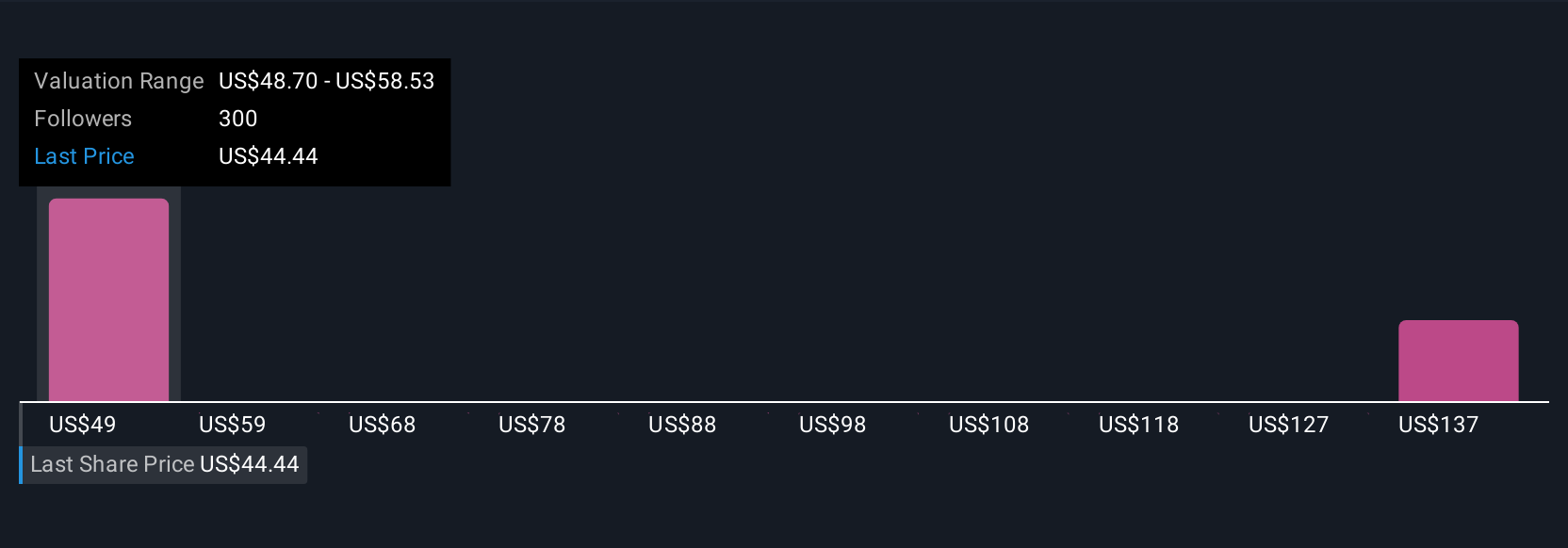

Sixteen members of the Simply Wall St Community estimate Verizon’s fair value from US$42.83 to US$105.48 per share. With new broadband and enterprise initiatives boosting the growth story, opinions still differ widely on the long-term effects of high capital spending requirements.

Explore 16 other fair value estimates on Verizon Communications - why the stock might be worth just $42.83!

Build Your Own Verizon Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verizon Communications research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verizon Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verizon Communications' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives