- United States

- /

- Wireless Telecom

- /

- NYSE:TDS

How a $500 Million Buyback and Fiber Milestone Could Shape TDS’s Transformation Plan

Reviewed by Sasha Jovanovic

- In early November 2025, Telephone and Data Systems, Inc. announced a US$500 million boost to its share repurchase authorization and reported improved net income for the third quarter, following the completed sale of its wireless operations to T-Mobile and continued execution of its fiber and tower growth strategy.

- This move coincides with the company surpassing 1 million marketable fiber service addresses and a substantial increase in site rental revenues at its Array Digital Infrastructure business, indicating meaningful progress in its transformation plan.

- We will now consider how this substantial share buyback authorization shapes the investment narrative for Telephone and Data Systems.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Telephone and Data Systems Investment Narrative Recap

To own Telephone and Data Systems stock today, investors need to believe in the company’s pivot from a legacy telecom provider to a focused fiber and tower business, capitalizing on infrastructure expansion. The recent US$500 million share buyback announcement points to management’s confidence, but it doesn’t materially alter the main short-term catalyst: execution on fiber growth and site rentals. The key risk remains the pressure from declining legacy revenues, which could outpace fiber’s contribution if adoption slows or costs rise.

Among the recent company actions, the US$500 million boost in share repurchase authorization stands out, showing a continued commitment to return capital to shareholders even as the company invests deeply in fiber and digital infrastructure. This aligns with the current catalyst, rapid broadband network expansion, by suggesting internal confidence in TDS’s ability to generate long-term value from these investments while managing financial flexibility.

Yet, while the buyback headlines are positive, investors should not overlook the mounting strain from legacy business declines if fiber initiatives take longer to ramp up...

Read the full narrative on Telephone and Data Systems (it's free!)

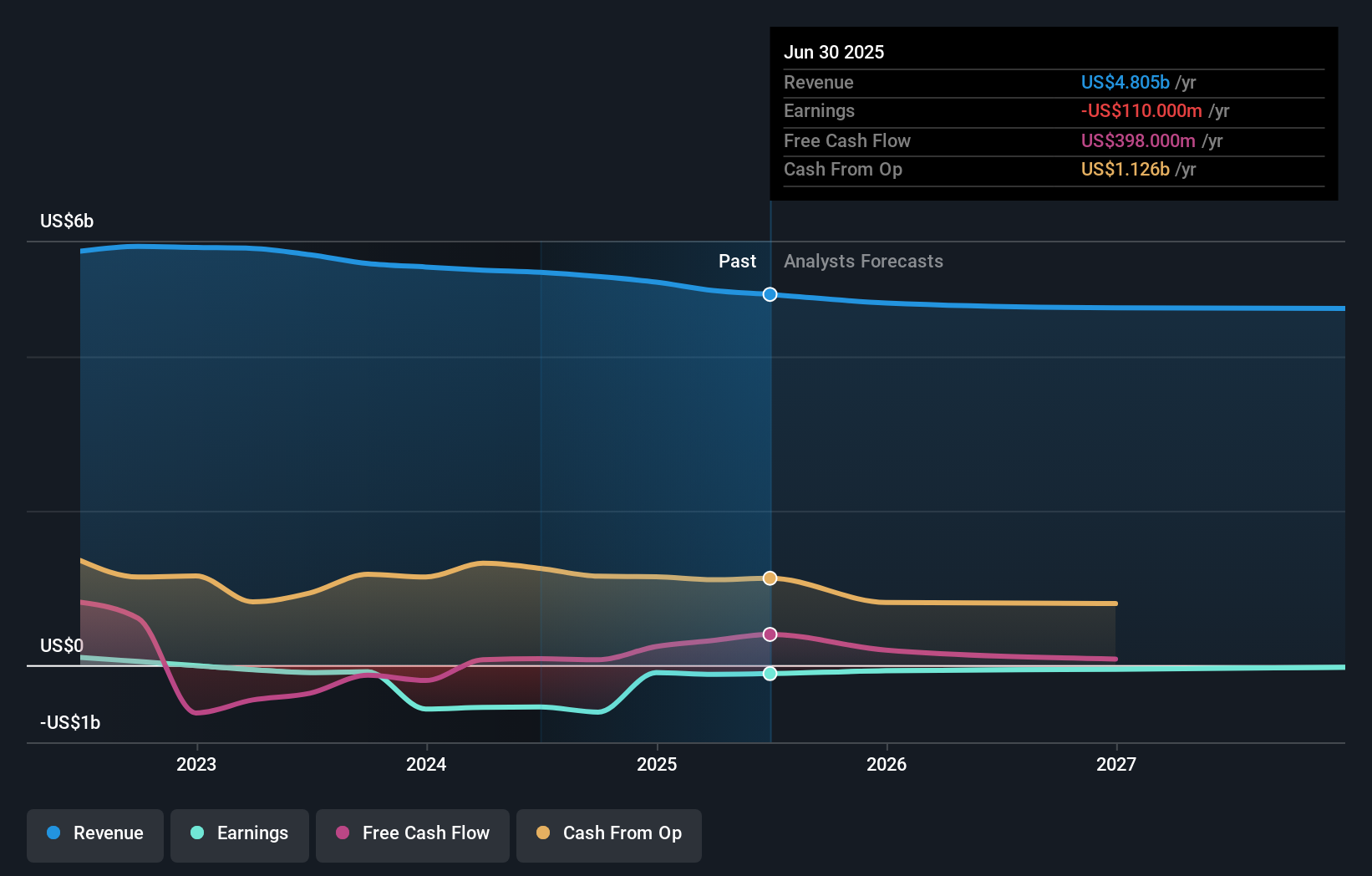

Telephone and Data Systems' outlook anticipates $4.6 billion in revenue and $577.2 million in earnings by 2028. This scenario requires a 1.7% annual decline in revenue and a $687.2 million increase in earnings from current earnings of -$110.0 million.

Uncover how Telephone and Data Systems' forecasts yield a $52.00 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Two retail investor fair value estimates from the Simply Wall St Community range widely, from US$6.24 up to US$52 per share. While opinions differ, fiber execution remains a major performance driver that could shape future valuations, compare these perspectives to your own view on the company's ability to expand its broadband base.

Explore 2 other fair value estimates on Telephone and Data Systems - why the stock might be worth less than half the current price!

Build Your Own Telephone and Data Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telephone and Data Systems research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Telephone and Data Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telephone and Data Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telephone and Data Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDS

Telephone and Data Systems

A telecommunications company, provides communications services to consumer, business, and government in the United States.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives