- United States

- /

- Building

- /

- NasdaqGS:APOG

Undiscovered Gems And 2 Other Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

The United States market has experienced a notable uptick, climbing 1.2% in the last week and rising 32% over the past year, with earnings projected to grow by 16% annually in the coming years. In this environment, identifying small-cap stocks that are poised for growth can be an effective strategy to enhance a portfolio's potential and uncover hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| QDM International | 36.42% | 107.08% | 78.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Apogee Enterprises (NasdaqGS:APOG)

Simply Wall St Value Rating: ★★★★★★

Overview: Apogee Enterprises, Inc. is a company that offers architectural products and services focused on building enclosures, as well as glass and acrylic solutions for preservation and protection, operating primarily in the United States, Canada, and Brazil with a market cap of approximately $1.71 billion.

Operations: Apogee Enterprises generates revenue primarily from its Architectural Framing Systems and Architectural Services segments, contributing $553.30 million and $397.99 million respectively. The Large-Scale Optical segment adds $94.16 million to the total revenue, while the Architectural Glass segment accounts for $363.96 million.

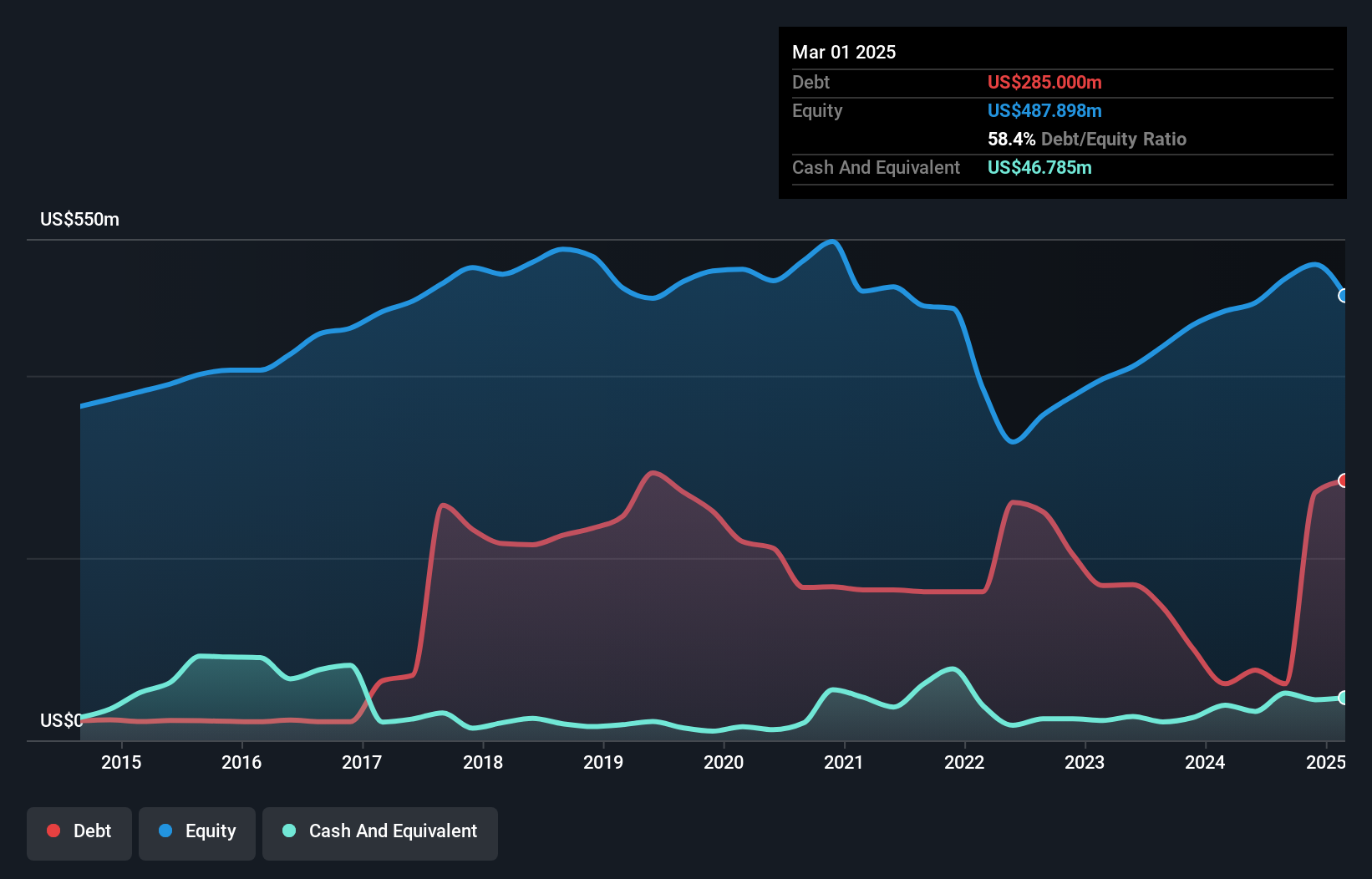

Apogee Enterprises, a promising player in the building industry, has seen its debt to equity ratio improve significantly from 54.2% to 12.2% over five years, reflecting strong financial management. The company boasts high-quality earnings and a price-to-earnings ratio of 16.2x, undercutting the US market average of 18.2x. Despite recent insider selling and modest earnings growth of 3.2%, Apogee's robust free cash flow and well-covered interest payments (39.5x EBIT) underscore its financial health and stability in navigating market challenges.

- Get an in-depth perspective on Apogee Enterprises' performance by reading our health report here.

Evaluate Apogee Enterprises' historical performance by accessing our past performance report.

IDT (NYSE:IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation offers communications and payment services across the United States, the United Kingdom, and globally, with a market capitalization of approximately $1.18 billion.

Operations: IDT Corporation's revenue primarily comes from its Traditional Communications segment, which generates $899.60 million, followed by Fintech at $120.70 million. The Net2phone and National Retail Solutions segments contribute $82.30 million and $103.10 million, respectively.

IDT, a nimble player in the telecom sector, showcases impressive financial health with no debt and a strong free cash flow of US$59.27 million as of October 2024. Its earnings surged by 59.2% over the past year, outpacing industry norms significantly. Trading at 72.7% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recent buybacks totaling US$48.52 million reflect confidence in its growth trajectory amidst robust net income improvements from US$40.49 million to US$64.45 million annually.

- Click to explore a detailed breakdown of our findings in IDT's health report.

Examine IDT's past performance report to understand how it has performed in the past.

Moove Lubricants Holdings (NYSE:MOOV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Moove Lubricants Holdings operates in the formulation, manufacturing, distribution, marketing, selling, and servicing of lubricant products across South America, North America, and Europe with a market capitalization of $1.78 billion.

Operations: Moove Lubricants Holdings generates revenue from its operations in Europe (R$2.97 billion), North America (R$2.36 billion), and South America (R$4.66 billion).

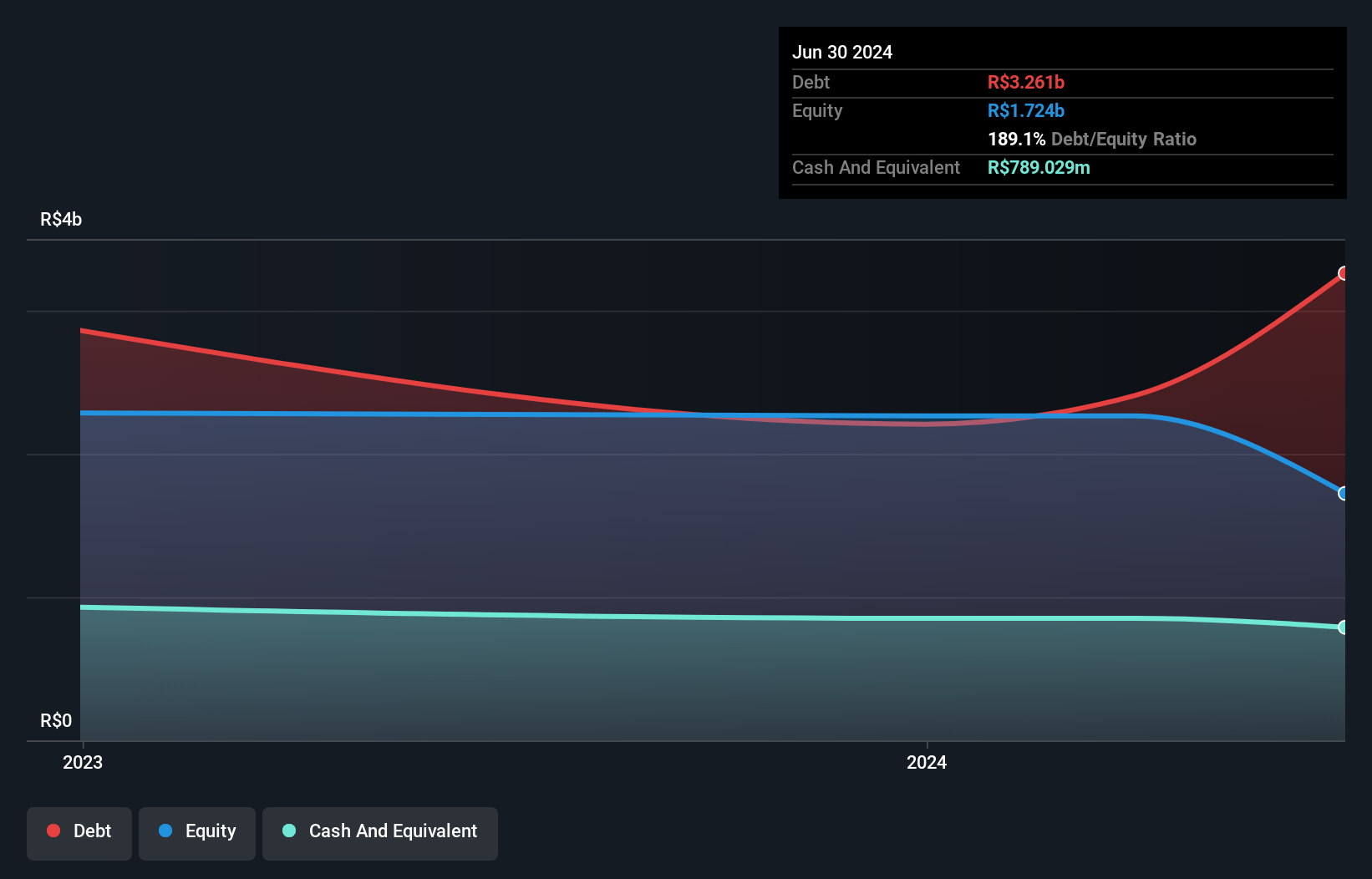

Moove Lubricants Holdings stands out with impressive earnings growth of 65% over the past year, surpassing the Chemicals industry's -4.8%. The company's net debt to equity ratio is high at 143.4%, yet interest payments are well covered by EBIT at 8.5x, indicating manageable debt servicing. With a recent IPO filing for $100 million, Moove seems poised for expansion despite its highly illiquid shares and a price-to-earnings ratio of 17.7x below the US market average of 18.2x.

- Click here and access our complete health analysis report to understand the dynamics of Moove Lubricants Holdings.

Assess Moove Lubricants Holdings' past performance with our detailed historical performance reports.

Where To Now?

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 221 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APOG

Apogee Enterprises

Provides architectural products and services for enclosing buildings, and glass and acrylic products used for preservation, protection, and enhanced viewing in the United States, Canada, and Brazil.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion