- United States

- /

- Wireless Telecom

- /

- NYSE:AD

Array Digital Infrastructure Refocuses On Towers After Wireless And Spectrum Sales

- Array Digital Infrastructure (NYSE:AD) has sold its regional wireless operations to T-Mobile.

- The company has also announced agreements to sell most of its remaining spectrum licenses to Verizon and AT&T.

- These transactions represent a shift in NYSE:AD's asset base, with the company retaining only select spectrum assets.

Array Digital Infrastructure, traded as NYSE:AD, operates in the wireless and spectrum space, where carriers and infrastructure owners continue to reshape their asset portfolios. By exiting regional wireless operations and concentrating on a narrower pool of spectrum holdings, the company is adjusting its role within an industry in which scale, capital intensity, and spectrum quality are key considerations.

For you as an investor, this pivot raises questions about how NYSE:AD might generate revenue, manage capital, and position itself within the broader telecom ecosystem. The value of the remaining spectrum, the timing of transaction closings, and any plans for redeploying proceeds are all elements that could influence how the story develops from here.

Stay updated on the most important news stories for Array Digital Infrastructure by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Array Digital Infrastructure.

We've flagged 1 risk for Array Digital Infrastructure. See which could impact your investment.

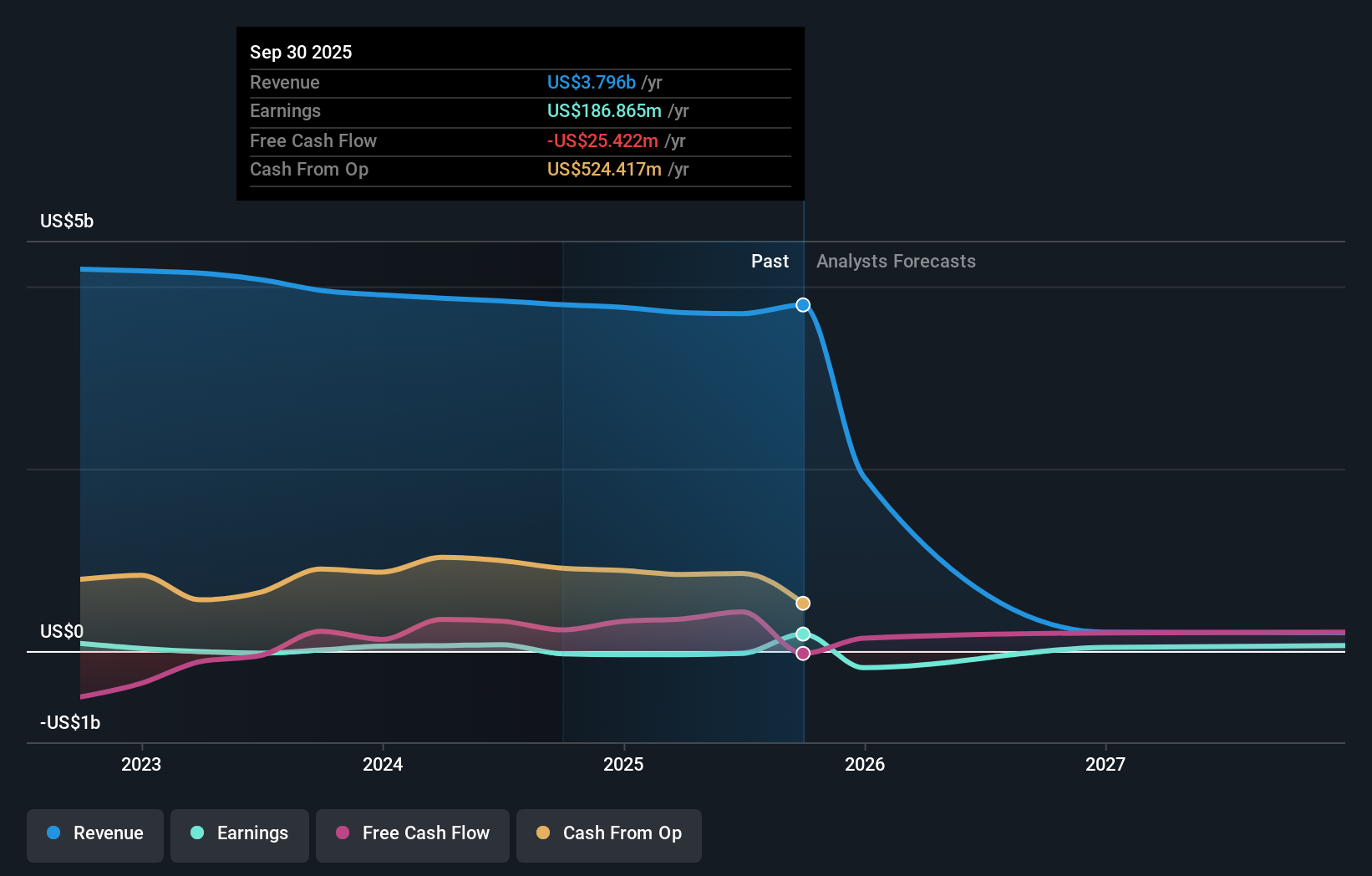

These asset sales mark a shift for Array Digital Infrastructure toward being more of a pure-play digital infrastructure owner, rather than a retail wireless operator. By transferring regional wireless operations serving about 4.4 million customers to T-Mobile and agreeing to sell most remaining spectrum licenses to Verizon and AT&T, the company is stepping away from customer-facing services and leaning into owning towers, partnerships and select retained spectrum. For you, the key questions are how the company intends to allocate incoming cash, what earnings base will remain once service revenues are gone, and how stable the future cash flows from infrastructure assets could be relative to its former wireless business.

How This Fits Into The Array Digital Infrastructure Narrative

- The shift to a tower and spectrum focused model aligns with the existing narrative that views digital infrastructure and debt reduction as important earnings drivers.

- Heavy reliance on large, transaction-specific proceeds could challenge earlier expectations that earnings growth would mainly come from gradual fiber expansion and tower revenue.

- The exact terms of the Verizon and AT&T spectrum sales, and how much recurring revenue versus one-off items they leave behind, may not be fully captured in the existing narrative assumptions.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Array Digital Infrastructure to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Execution risk around closing remaining spectrum deals with Verizon and AT&T, including timing and regulatory approvals, which could affect when cash actually arrives.

- ⚠️ A business mix that becomes more dependent on a smaller set of assets, such as 4,400 towers, which could leave Array more exposed if demand patterns or contract terms change versus peers such as American Tower or Crown Castle.

- 🎁 A simplified, infrastructure focused model that could produce more predictable, contract based revenues compared with consumer wireless operations from carriers such as T-Mobile or AT&T.

- 🎁 Cash proceeds from spectrum sales that increase financial flexibility, giving management options across debt reduction, potential shareholder returns and reinvestment in core infrastructure.

What To Watch Going Forward

From here, you will want to watch how quickly the Verizon and AT&T spectrum transactions close, how management outlines capital allocation plans, and what earnings mix is guided once wireless service revenues are largely out of the picture. Any new disclosure on tower tenancy, contract length and pricing, especially versus large tower peers, will help you judge how durable the new earnings base could be. Analysts have already adjusted expectations for Array Digital Infrastructure once, so further updates to research views and ratings could also signal how the market is digesting this shift.

To stay updated on how the latest news impacts the investment narrative for Array Digital Infrastructure, visit the community page for Array Digital Infrastructure to keep up with the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AD

Array Digital Infrastructure

Provides wireless telecommunications services in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

UnitedHealth Group's Future Revenue Grows by 3.59%: What Will It Mean?

Why EnSilica is Worth Possibly 13x its Current Price

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.