- United States

- /

- Wireless Telecom

- /

- NYSE:AD

Array Digital Infrastructure (NYSE:AD): Exploring Valuation After Recent Share Price Swings

Array Digital Infrastructure (NYSE:AD) is suddenly on many investors’ radar, thanks to a recent turn in its share price performance. While there has been no headline-grabbing event or big announcement, the latest price moves might have some investors wondering if this is a signal worth taking seriously. Sometimes, it is the quieter shifts that prompt the most questions, especially when the company’s fundamentals seem out of step with how the stock is behaving.

Over the past year, Array Digital Infrastructure posted a striking 36% total return, even as momentum has faded in recent months. The stock lost ground over the past month and three months, giving up some of those gains. Notably, annual revenue growth is down sharply, but net income has shifted positively over the past year. This unusual mix complicates the outlook. Without a single event to point to, these crosscurrents make it tricky to pinpoint what the market is really pricing in right now.

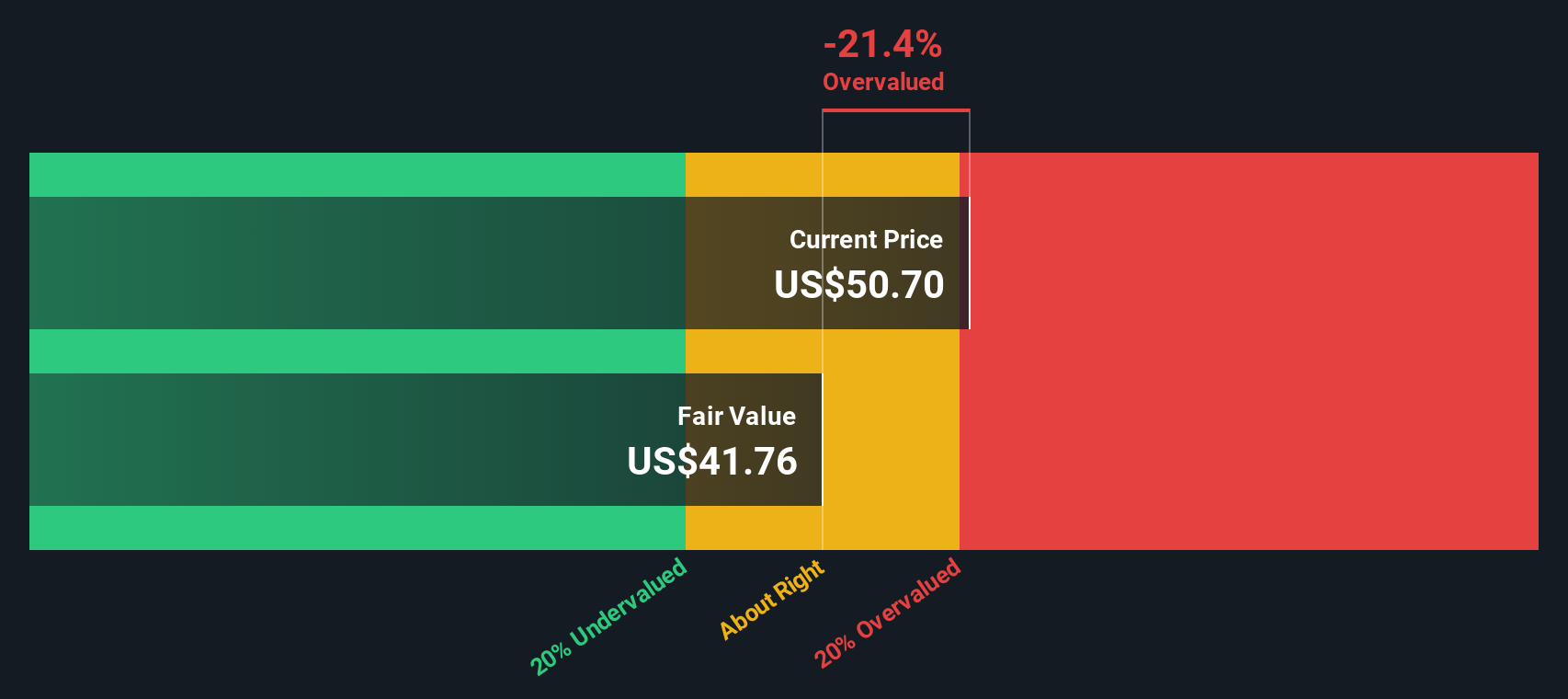

So, after a year of dramatic swings and mixed signals from the company’s financials, are shares of Array Digital Infrastructure undervalued, or is the market already factoring in every possible scenario?

Most Popular Narrative: 32.1% Undervalued

According to the most widely followed narrative, Array Digital Infrastructure shares are considered significantly undervalued relative to their calculated fair value. The analysis suggests that the market is not yet fully recognizing the company's predicted turnaround.

The anticipated mid-2025 closing of the transaction with T-Mobile, subject to regulatory approval, is expected to provide UScellular with significant proceeds. This could impact earnings positively by paying down debt and potentially declaring special dividends.

Wondering how one transaction could reshape the whole story? The foundation of this valuation is built on a few aggressive forecasts about future profitability, revenue shifts, and a higher profit multiple than the industry norm. Explore the crucial projections that set this price apart and see which financial levers the consensus expects to move most dramatically in the next few years.

Result: Fair Value of $75.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant hurdles remain, including regulatory delays for the T-Mobile transaction and ongoing tough competition from larger telecom carriers.

Find out about the key risks to this Array Digital Infrastructure narrative.Another View: Our DCF Model Weighs In

Looking at Array Digital Infrastructure through the lens of our DCF model presents a different story and suggests the market may have already priced in much of the future optimism. Could this method challenge the bullish narrative, or is the real value simply hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Array Digital Infrastructure Narrative

If you want to take a different approach or dig into the numbers for yourself, it's easy to craft an alternative perspective on Array Digital Infrastructure in just a few minutes using our tools. Do it your way

A great starting point for your Array Digital Infrastructure research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your horizons and give yourself an edge by uncovering fresh stocks tailor-made for today’s fast-moving market. Don’t miss these standout themes; your next big opportunity could be waiting.

- Take charge of your portfolio by spotting companies with robust financials and high potential in the penny stocks with strong financials universe.

- Maximize your returns with companies boasting healthy yields by checking out dividend stocks with yields > 3% and see which stocks could boost your income.

- Stay ahead of the curve by tapping into the hottest breakthroughs with a handpicked selection of AI penny stocks paving the way in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:AD

Array Digital Infrastructure

Provides wireless telecommunications services in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

The Grid Modernizer: Leidos and the $2.4 Billion Bet on Sovereign AI and Energy

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.