- United States

- /

- Wireless Telecom

- /

- NasdaqCM:VEON

VEON (VEON) Is Down 7.0% After Announcing Direct-to-Cell Partnership With Starlink – What's Changed

Reviewed by Sasha Jovanovic

- VEON Ltd. has announced a global framework agreement with Starlink to introduce direct-to-cell satellite connectivity, initially launching with Beeline Kazakhstan and Kyivstar in Ukraine, with additional service expansions anticipated in 2025 and 2026.

- This collaboration grants VEON access to over 150 million potential customers and marks the largest direct-to-cell partnership for Starlink to date, positioning VEON at the forefront of satellite-enabled mobile innovation across its markets.

- We'll explore how VEON's agreement with Starlink to deliver satellite connectivity may reshape its long-term growth and digital service prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

VEON Investment Narrative Recap

At a high level, VEON's investment appeal centers on its drive to capture digital growth across emerging markets through new services and infrastructure, while managing exposure to volatile currencies and ongoing market exits. The Starlink partnership introduces a headline-grabbing catalyst, potentially enhancing VEON's relevance in connectivity innovation; however, in the short term, the most important catalyst remains execution on digital service growth and retention, while the risk of currency depreciation and financial instability is not materially reduced by this news.

One recent announcement of particular relevance is VEON’s successful test and pending launch of Starlink Direct to Cell technology with Kyivstar, now evolving into a broader framework agreement. This move supports the catalyst of digital ecosystem expansion, but the company’s ability to translate access and new offerings into higher ARPU and margins remains in focus, especially as competition and operational costs could rise.

However, investors should be aware that despite technological partnerships, exposure to macroeconomic and currency volatility in core markets still leaves VEON’s reported growth vulnerable if...

Read the full narrative on VEON (it's free!)

VEON's narrative projects $5.1 billion revenue and $688.2 million earnings by 2028. This requires 7.0% yearly revenue growth and a $295.8 million earnings decrease from $984.0 million currently.

Uncover how VEON's forecasts yield a $69.64 fair value, a 56% upside to its current price.

Exploring Other Perspectives

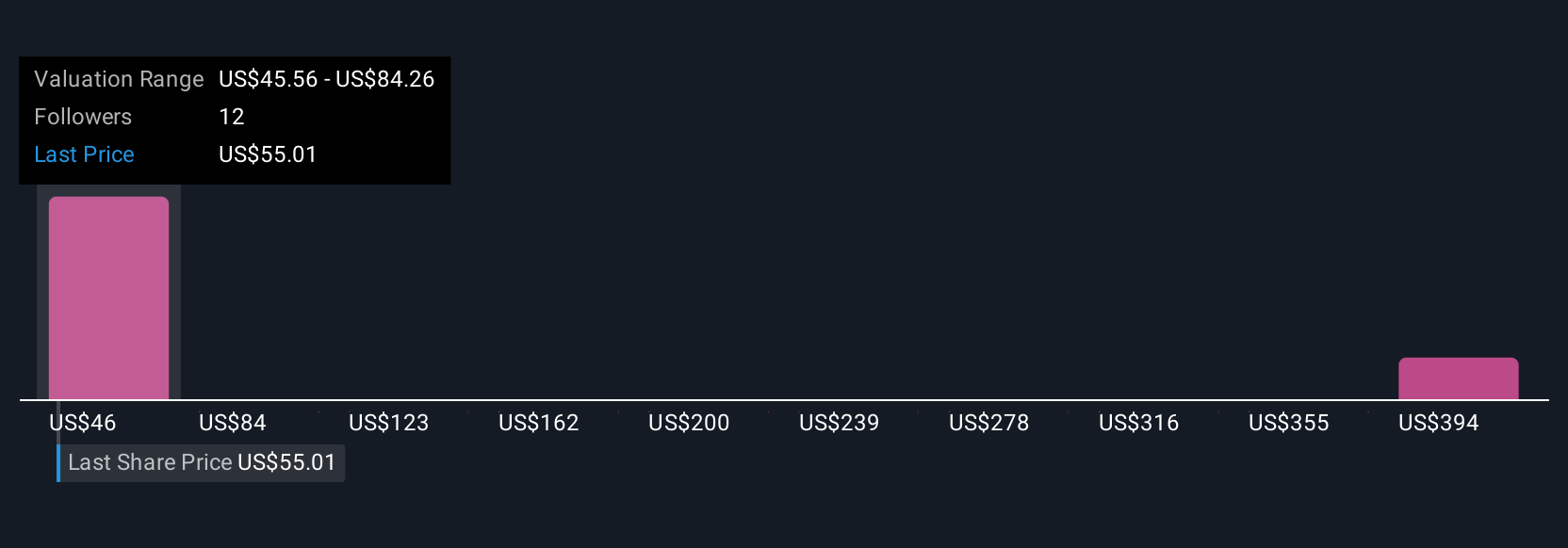

Four Simply Wall St Community fair value estimates for VEON range from US$45.56 up to US$495.71 per share. While market participants debate VEON’s future, uncertainty around currency risk and macro trends continues to shape outcomes for shareholders.

Explore 4 other fair value estimates on VEON - why the stock might be a potential multi-bagger!

Build Your Own VEON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VEON research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free VEON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VEON's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VEON

VEON

A digital operator, provides telecommunications and digital services to corporate and individual customers in Pakistan, Ukraine, Kazakhstan, Uzbekistan, and Bangladesh.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives