- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile (TMUS) Valuation in Focus Following Recent Share Price Weakness

Reviewed by Simply Wall St

See our latest analysis for T-Mobile US.

Shares have come under pressure as the recent selloff takes hold, with the 1-year total shareholder return now negative at nearly -12%. Momentum is clearly fading after several years of outperformance. While the company delivered strong multi-year returns of 38% and 63% for three- and five-year total shareholder return respectively, the current pullback suggests investors are reassessing T-Mobile’s valuation in light of cooling growth and shifting market sentiment.

If you’re looking to discover momentum elsewhere, this could be the perfect moment to check out fast growing stocks with high insider ownership

With shares down notably from their highs and a sizeable gap to analyst price targets, the key question becomes clear: is T-Mobile now attractively undervalued, or is the market simply factoring in all the company’s future growth?

Most Popular Narrative: 27% Undervalued

According to the most popular analyst narrative, T-Mobile US's fair value sits at $275 per share, which is well above its last closing price of $201. This valuation relies on optimistic assumptions about future growth and profit expansion and highlights what analysts see as T-Mobile’s main catalysts for outperformance.

Innovations such as the rollout of 5G Advanced and T-Satellite, along with enhancements in digital platforms like T-Life, point to operational improvements that could drive margin expansion and future earnings growth.

Want to know the secrets behind this bullish price target? Bold projections for growth, profitability, and margins form the core of this narrative. Which numbers do analysts believe will push T-Mobile to new highs? The details might surprise you, so uncover what’s driving these lofty assumptions.

Result: Fair Value of $275 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected tariffs on handsets or aggressive competitor promotions could quickly undermine the bullish outlook and put pressure on T-Mobile’s future growth trajectory.

Find out about the key risks to this T-Mobile US narrative.

Another View: Market Multiples Tell a Different Story

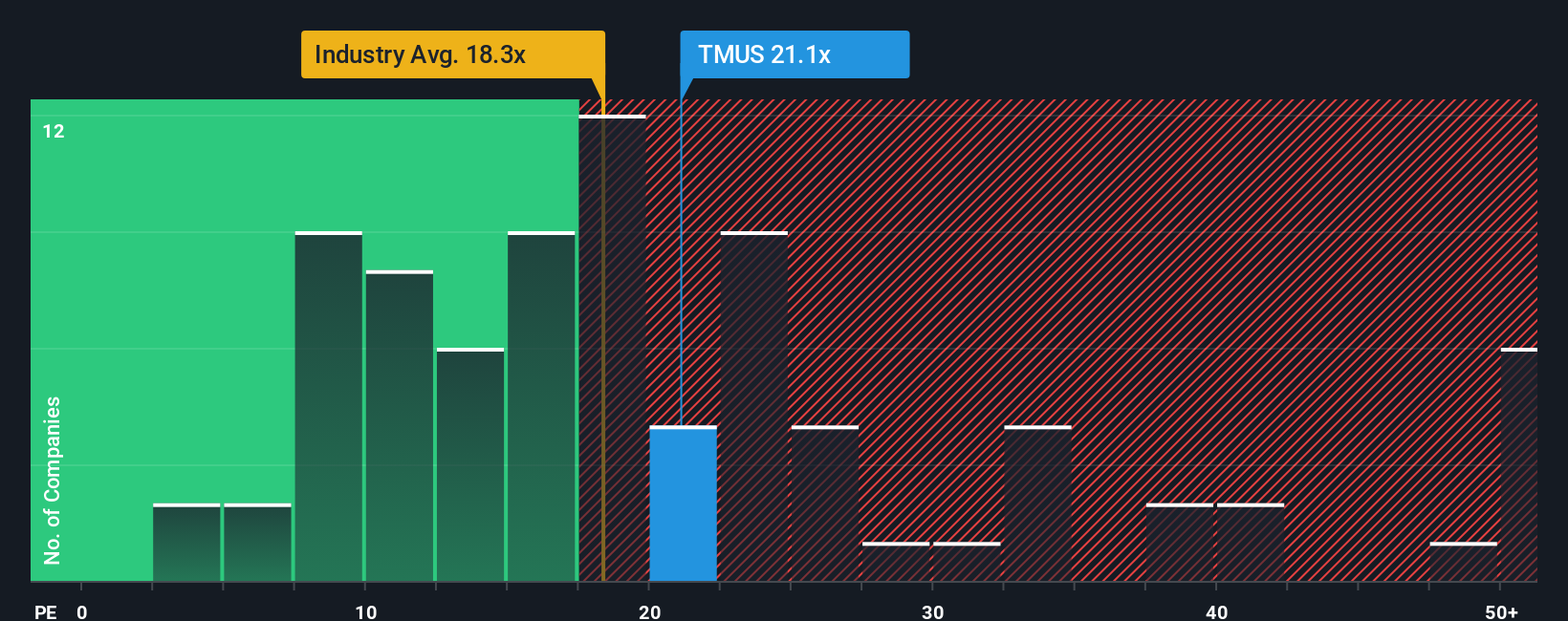

While the main narrative leans bullish, looking at the price-to-earnings ratio presents a more cautious view. T-Mobile is trading at 18.9 times earnings, which is higher than the industry average of 18.3 and the peer average of just 7.3. Compared to a fair ratio of 16.4, this suggests the stock may be on the expensive side. Could this be a sign that expectations are already baked in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T-Mobile US Narrative

Keep in mind, if you see things differently or want to build your case, it takes just a few minutes to put together your own perspective. Do it your way

A great starting point for your T-Mobile US research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Take charge of your portfolio and tap into exciting trends reshaping the market. The smartest investors don’t wait; they seize these opportunities before the crowd.

- Unlock the latest in AI innovation by checking out these 24 AI penny stocks, where companies are redefining industries with artificial intelligence breakthroughs and smart automation.

- Supercharge your passive income by reviewing these 17 dividend stocks with yields > 3%, featuring reliable stocks offering attractive yields and consistent dividend growth above 3%.

- Get ahead of the next market wave through these 860 undervalued stocks based on cash flows, highlighting stocks trading below their intrinsic value based on solid cash flows and strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives