Stock Analysis

- United States

- /

- Telecom Services and Carriers

- /

- NasdaqCM:SIFY

Sify Technologies (NASDAQ:SIFY) earnings and shareholder returns have been trending downwards for the last three years, but the stock jumps 25% this past week

It's nice to see the Sify Technologies Limited (NASDAQ:SIFY) share price up 25% in a week. But only the myopic could ignore the astounding decline over three years. The share price has sunk like a leaky ship, down 86% in that time. So we're relieved for long term holders to see a bit of uplift. But the more important question is whether the underlying business can justify a higher price still. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the stock has risen 25% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Sify Technologies

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

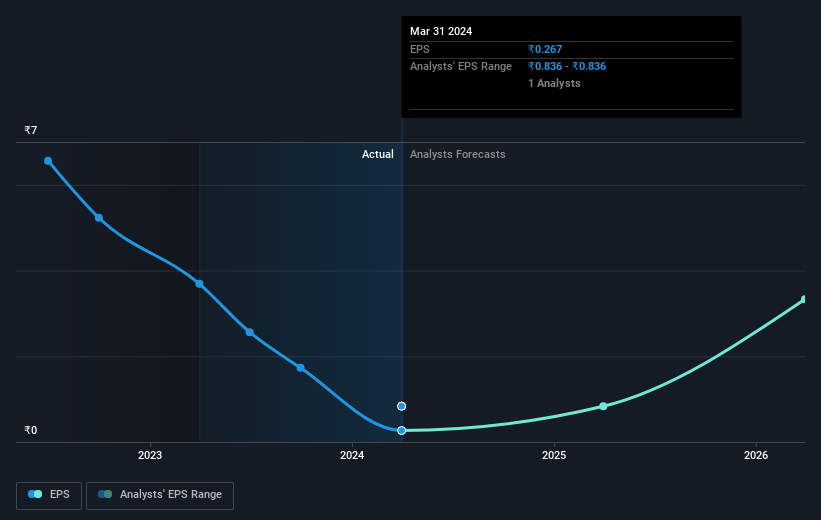

Sify Technologies saw its EPS decline at a compound rate of 68% per year, over the last three years. In comparison the 48% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in. With a P/E ratio of 148.22, it's fair to say the market sees a brighter future for the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Sify Technologies' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Sify Technologies had a tough year, with a total loss of 78%, against a market gain of about 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Sify Technologies is showing 4 warning signs in our investment analysis , and 2 of those can't be ignored...

But note: Sify Technologies may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Sify Technologies is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Sify Technologies is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SIFY

Sify Technologies

Offers ICT solutions and services in India and internationally.

High growth potential low.