- United States

- /

- Telecom Services and Carriers

- /

- NasdaqCM:SIFY

Sify Technologies (NasdaqCM:SIFY): Assessing Valuation Following a Sharp Upward Move in Share Price

See our latest analysis for Sify Technologies.

After a stellar run so far this year, with a year-to-date share price return of 331.05%, Sify Technologies has shown remarkable momentum. While the total shareholder return over the past year stands at 239.95%, the recent sharp upswing in the share price suggests renewed optimism about the company’s prospects. At the same time, short-term swings remind us that volatility can be part of growth stories like this.

If you’re looking to capture more of this kind of momentum, now’s the perfect opportunity to expand your search and discover fast growing stocks with high insider ownership

With Sify's meteoric rise so far, investors may wonder if the stock remains undervalued or if the market has already priced in future growth, leaving little room for further upside. Is there still a buying opportunity here?

Most Popular Narrative: 40% Undervalued

With the fair value pegged at $22 and Sify Technologies last closing at $13.19, the narrative points to significant potential upside ahead. The future valuation is built on bold growth assumptions and confidence in Sify's expansion strategy, raising big questions about what could fuel this premium.

The expansion of data center capacity, including two 26-megawatt facilities set to go live, will boost Sify's ability to cater to increased customer demand, impacting future revenue streams from data center services.

Want to see what makes this narrative tick? There’s a hidden set of bullish projections about revenue, margins, and a future profit multiple that rivals tech giants. Don’t miss the assumptions behind this aggressive price target. Find out how the numbers actually stack up.

Result: Fair Value of $22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high SG&A expenses and uncertainty in AI market growth could challenge Sify’s profitability outlook and put the bullish narrative at risk.

Find out about the key risks to this Sify Technologies narrative.

Another View: Is Momentum Masking Premium Valuation?

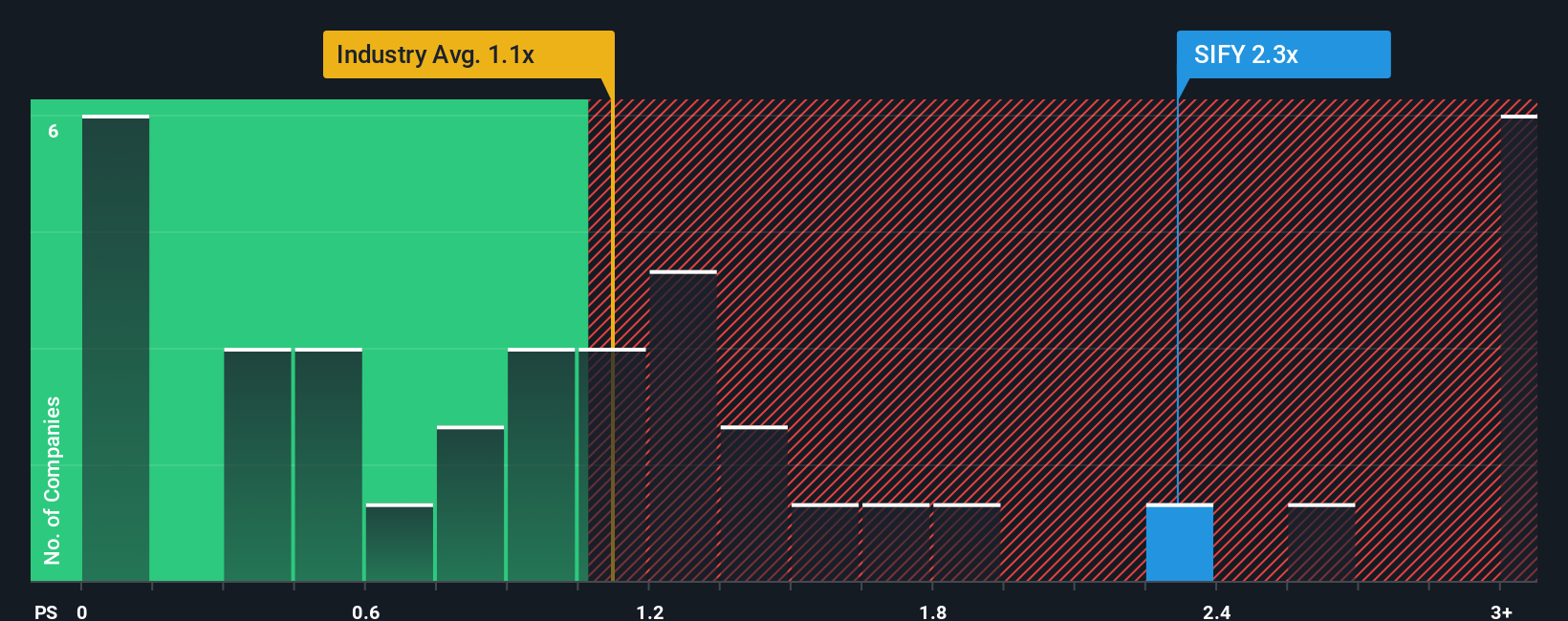

While the bullish narrative paints Sify Technologies as significantly undervalued, a look at its price-to-sales ratio tells a different story. At 2x, the ratio is steep compared to both industry (1.3x) and peer averages (1.6x), and it is well above the fair ratio of 1.1x. This premium could mean investors are already pricing in much of that future growth. Could this signal more risk than opportunity for those jumping in now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sify Technologies Narrative

If you see things differently or enjoy digging into the details, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your Sify Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let opportunity slip by. Power up your portfolio by tapping into unique stock themes that go beyond the obvious and stay ahead of market trends.

- Start building wealth with these 18 dividend stocks with yields > 3%, which offers reliable yields that can boost your returns and bring extra income to your strategy.

- Target high-growth sectors early by checking out these 24 AI penny stocks, which are transforming industries with machine learning, automation, and artificial intelligence breakthroughs.

- Position yourself for tomorrow’s innovations as you track these 26 quantum computing stocks, with the potential to disrupt the tech landscape and create new winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SIFY

Sify Technologies

Offers information and communication technology solutions and services in India and internationally.

High growth potential with worrying balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.